I think this coming quarters reporting will be similar to the previous as AN LAD and PAG all carry new cars and have a back log of New car retail orders. Most of the OEM manufacturers have consistently built sold order units. Which many have been ordered for over a year. These have started to come into dealers and these are very profitable. This is mostly why the belief there will be a delay in the affect on the mega dealer groups. Used car demand has slid and that will affect them as well because they sell both but for most part my store in particular was still setting records leading into September which was the first month we noticed any type of demand destruction.

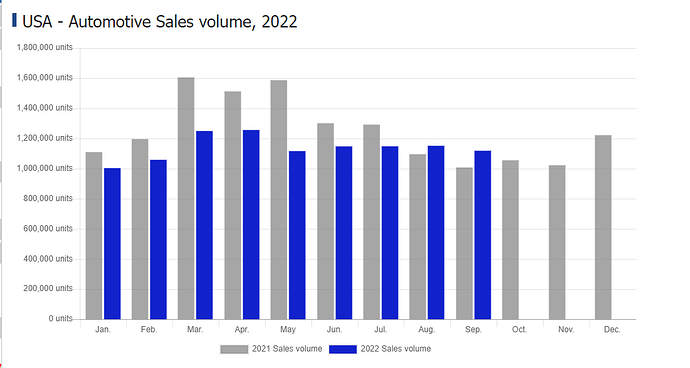

That actually lines up with a chart I just happened to be looking at for a school assignment (which is why I ended up on this thread, accidental synergy). This shows that while sales are largely down YoY between 2021 and 2022, August and September were the first months this year that actually exceeded last year’s sales. Does this seem like it jives with your experience so far this year - started slow but then picked right up?

This is definitely accurate. 2021 was a huge year in automotive. However when I am setting my targets for my store or my goals for my sales guys. I try to avoid comparing 21-22 to any other years. It’s been complete craziness and can’t be comparable to previous times.

I try to look at previous years or as I call a lot of the time normality. As we return to normal economic times I want to focus on improving from where we were then. Which for the most part we have. Maybe it’s because I’m really good at my job. But I don’t think that’s it.

I think there has been relatively little demand destruction that we have all expected in the retail industry. The auto sector is if often the biggest retail segment that consumers spend expandable income on.

Inflation hasn’t skipped auto. New cars have increased MSRPs by 5-10 percent largely in line with inflation rate. However the other aspect of this is dealers used to discount a 60k dollar pickup truck all their markup as well. So when I’d set my advertising up I’d basically net whatever I was advertising out to my dead cost. So you have a 5-10 percent increase in MSRP and coupled with dealers not discounting anything. This leads to double essentially.

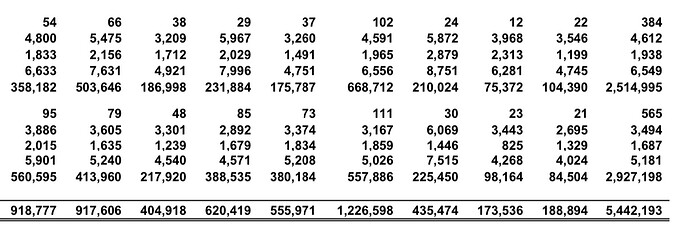

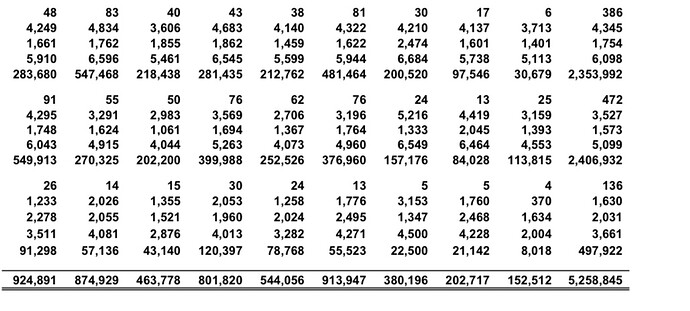

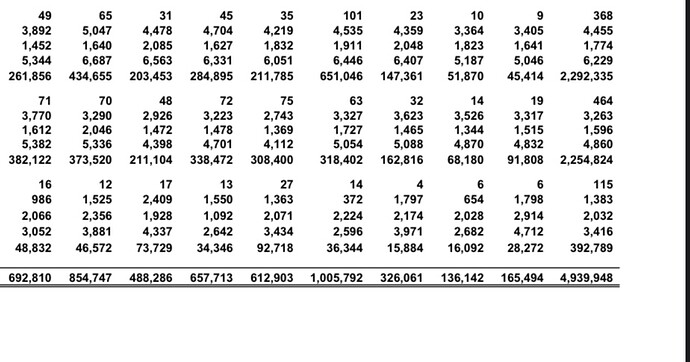

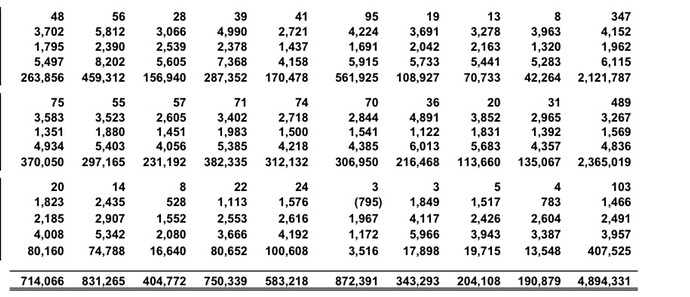

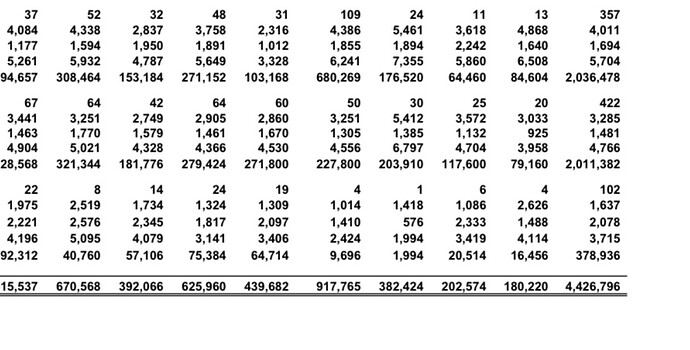

But the demand hasn’t squashed like I’d have expected. Until we reached September going to share some charts below that shows last quarter in comparison to this quarter that just ended. So April-June and July-august this is actually numbers from my group.

These are in order of date.

This is this quarter below

As noted here the total revenue in the previous quarter is 15 million this quarter is at 14 million. That’s a decline however the majority was in September.

Posting this here interesting read @macromicrodick shared on TF

Tying into regular automotive industry, looks like Ford just got hit with price cuts due to “demand destruction”.

UBS downgraded them to a SELL with a $10 PT, RBC from $15 to $13.

One of the reasons for the “stickiness” of elevated car prices is supply chain challenges. There have been people wanting to buy cars for 2 years being told “we can take your order, but you won’t have the car for 6-8 months”. These people that would be buying new are then going to the used car market in higher numbers than previous.

Played in a golf outing with the senior automotive managers for my largest local credit union we write about 40 percent of our loans with them this includes lenders such as JPM PNC and pretty much every other one you can think of.

They judge their business or months by applications. August of this year was their record month as in their history. This is not a mom and pop credit union. It was started as a credit union of a Fortune 500 company. And are a top 250 CU in the US.

September showed a decline. Now this coupled with a bit of a decline from the retail automotive standpoint in September as well would signal some demand destruction taking fold and maybe some decline in inflationary segments. It’s a bit concerning to me that August was their best month ever however many a times I see CUs slower to raise rates because profits are paid in dividends back to members anyways.

Essentially this means they are basically not for profit they pay expenses salaries etc but not reliant on borrowing money most loans are written with members money.

Not sure how to take this info. I take it as a positive to CPI PPI if demand is starting to take hold. But also bad if the long term this hurts businesses.

As a reminder for me and everyone else who has been following these plays, LAD reports earnings tomorrow morning. It may give us the opportunity to pressure test some of these thoughts.

I’ll be watching this one for sure. As it’s obviously something I follow closely. I’d expect LAD to struggle to beat their EPS it’s about flat with Q2 and as I showed spreadsheets above September was soft across the board. However they are primarily a New car conglomerate and that is still pounding with volume from a year out wait on sold units and higher than in my life time gross per unit.

But if I was their CEO I’d projecting slowing guidance as I do to my employees to try to front run any slowing in their bonuses. There is definitely a slowing of demand however October is currently outpacing September and back to summer levels for my store.

AutoNation has caught my eye, I believe they are still scheduled to report earnings on 10/27. I know that there has been headwinds in the automotive space, and am curious to see if AutoNation will be feeling those affects. In looking at the AN chart, I can’t help but see that this stock is what seems to be quite inflated since the covid drop in 2020.

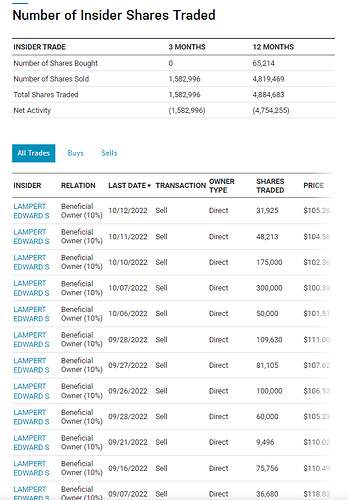

I also noticed that Eddie has been selling his shares left and right over the past several weeks:

Updating here on some recent segment news. ALLY and LAD reported this past week.

LAD missed but still hit over 11 dollars per share EPS. ALLY missed bad. Reported more significant credit losses they are one of the top subprime auto lenders in the world.

Coming up we have GM and F this week. This will be telling to outcome for AN or Penske for this quarter. New car volume is the key to dealer groups profits in current times with used cars gross per unit falling.

From real world my groups stores currently pacing better than September and back to july august levels.

ALLY’s bad earnings really kicked CVNA’s share price in the balls. From this, I expect even worse things to come out of CVNA’s earnings report on 11/03.

I will also add that CVNA’s lowest PT target recently is $15 which is the lowest target it has been given. Other targets are around the $30 - $45 range. Last time I checked, short interest on CVNA was around 38% with average short price around $35. So depending on earnings, there could be some upwards movement from the report, or simply just from shorts taking profit after earnings.

This topic was automatically closed 14 days after the last reply. New replies are no longer allowed.