So to summarize the play, you see shares being unlocked as soon as MAR 4 (2 weeks from today) or maybe MAR 14, and from there a continued downtrend in the underlying due to profit taking? Do you have any intel on the upcoming earnings call? Consensus seems to be -.08 from EW, but I wonder if there are any environmental factors that would affect them? I’m not that familiar with them except that they make coffee?

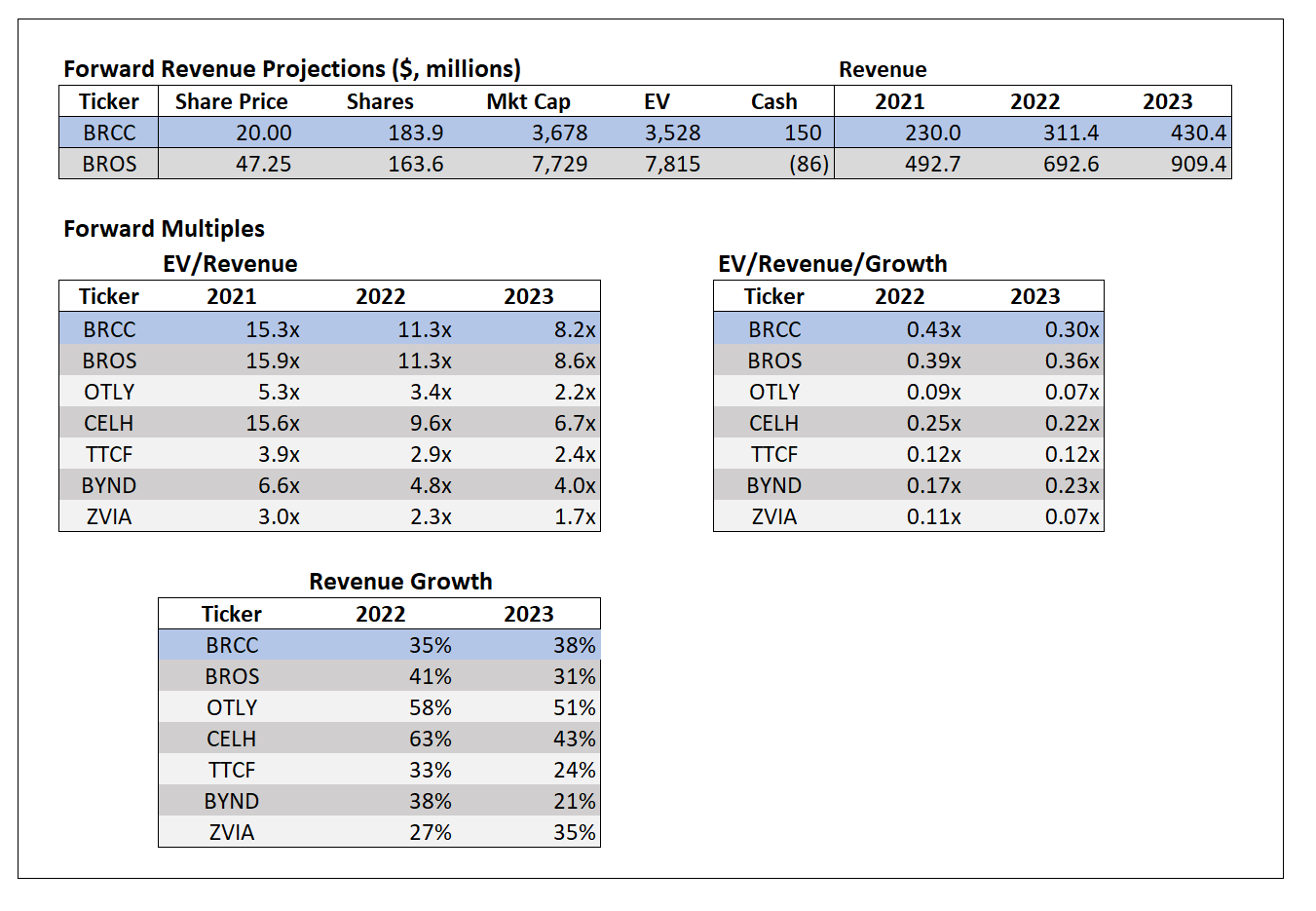

Yes, essentially lockup expires as soon as 4 Mar and profit taking is expected as my thesis is BROS is too richly valued. However, BROS has been a downtrend in the last few days and I would be more comfortable entering into puts closer to $50 than at current levels.

On earnings, BROS gave some prelim results guidance in Jan. However, the market does appear to have mostly priced this in already with the average consensus estimate for FY21 Revenue at $493m vs. the previous 9M21 + 4Q21 guidance from the company of $358m + $128m = $486m. Even if we assume 10% above guidance for 4Q, it should still be at $141m and bring FY21 to $499m

“Across all of our markets, we experienced strong same shop sales momentum in the fourth quarter, growing 10.1% and totaling 8.4% for the year. We therefore expect fourth quarter revenue to exceed the upper end of the previously provided guidance, with mature shop level margins in line with expectations. We have great confidence in our new unit development pipeline and are increasing our systemwide new shop development expectations to 125 shops in 2022, up from our prior guidance of 112 shops.”

I posted the preliminary report in the original body of the thread.

Thanks for all the DD, entered a position for the 45P. Spreads were pretty big here, only got filled as this stock moved up along with the overall market.

I figured with the possible rocky future ahead with the overall market and the diligence done here this will be a decent play.

Started a small position (1 BROS APR22 50P) and will increase the position in case it will go up after todays ER.

Yup, I have a small starter position of Apr 50/55c credit spreads here. Still better to be a little cautious around earnings which is an unknown and can always scale in later. In fact, a small pop may be just what TSG is looking for to sell a block of their stake

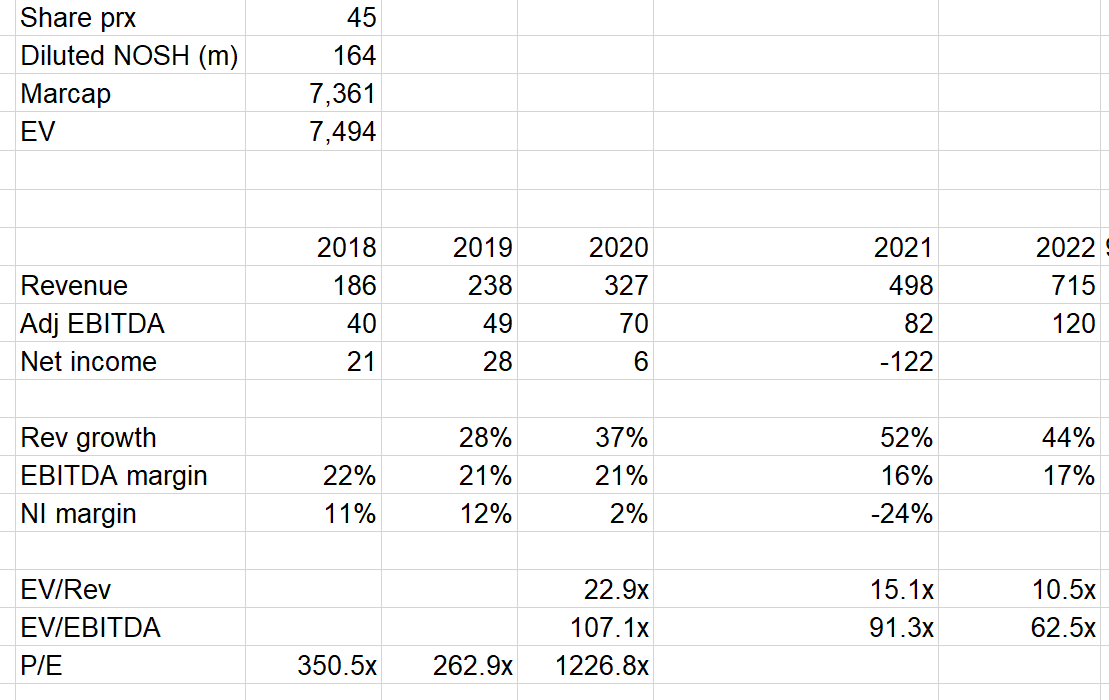

4Q21 earnings and guidance look mostly priced in to me. 4Q revenues came out at 140m which was slightly above consensus and close to the 10% above guidance estimate.

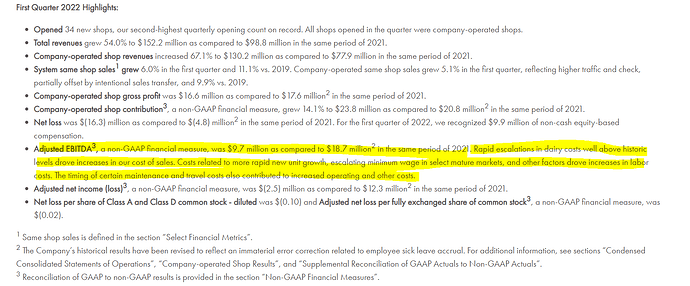

For 2022, they are guiding revenues slightly above consensus which was at 693m but EBITDA is coming below consensus which was at 139m.

All in all, no material change to the BROS thesis in my view.

For full year 2022 , Dutch Bros is providing the following outlook:

- Total system shop openings are expected to be at least 125, of which at least 105 shops will be company-operated.

- Total revenues are projected to be in the range of $700 million to $715 million.

- Same shop sales growth5 is estimated in the mid-single digits.

- Adjusted EBITDA6 is estimated to be in the range of $115 million to $120 million.

- Capital expenditures are estimated to be in the range of $175 million to $200 million.

Appreciate the write-up on this one, will be looking to enter some 4/14 45p this week.

Updated based on actual 4Q numbers and FY22 guidance from company. Didn’t change very much but BROS is now trading at around 10.5x '22 Revs

Implied share prices if it trades down to an EV/'22 Rev of …

9x → 38.50

8x → 34.15

7x → 29.78

6x → 25.41

5x → 21.03

Comps table of some FMCG peers done by Platypus for reference (though I haven’t independently verified these numbers)

BROS having a big day today up c.10% and hanging around $50 at the moment. May provide some opportunities for a potential entry if you believe in the unlock thesis which was supposed to take effect from today. Am still holding my position, added 40p and 45p Apr puts over the last few days and considering adding more.

Searched for what may be prompting the big counter trend move and found this. Did notice a large candle mid day yesterday after someone on CNBC promoted the stock… although I can’t really understand why anyone would want to scale in before the unlock dip.

https://twitter.com/ThweisSXFX/status/1499440906142949376

I remember LCID having similar upwards movement prior to their lockup, only to dump towards $30 shortly after their lockup. Kind of seems like the same setup with CPI numbers and Fed meeting approaching as well. In for 04/14 $45 Puts ![]()

Closed my puts this afternoon. It likely falls more, but 35% was enough for me. With OZON/RSX still halted, I wanted to free up some BP and lock in some profits, given how some of my other positions are looking.

Thanks for all the research into this one!

I took a start position again on PUTs on todays run up for april , depending on Fridays price action I might add more.

Covered my cost basis on todays drop.

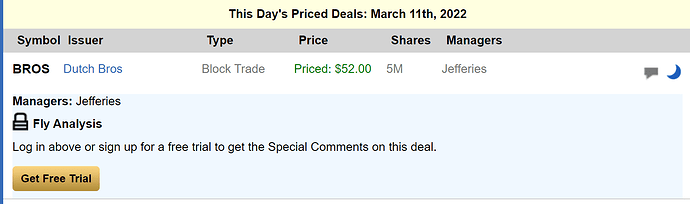

Looks like 5m of the 10m class A shares that got unlocked got placed out yesterday at $52 after market close. May explain some of the after market activity we saw yesterday.

Form 4 filed today confirming the placement of 5m shares at $51.47. This selldown of class A shares was done solely by TSG and included the conversion of some of their Class A common units (confirming that these shares are indeed freely convertible and sellable). They still hold a further 59m shares which they will probably exit in stages

https://www.sec.gov/Archives/edgar/data/0001866581/000089924322010976/xslF345X03/doc4.xml

https://www.sec.gov/Archives/edgar/data/0001866581/000186658122000030/xslF345X03/wf-form4_164874137766527.xml

https://www.sec.gov/Archives/edgar/data/0001866581/000186658122000026/xslF345X03/wf-form4_164747239819037.xml

More (smallish) insider sales today by the COO and earlier in the month by the CFO.

This has been a tough trade as the stock surged over last couple of weeks (the stock seems to have some exuberant retail tailwind) and only started to fall more today. I am less confident in calling where it’s headed from here, but if the broader market continues to underperform we hopefully have a decent chance of a continued downtrend. FWIW still holding my Apr puts which are down quite a bit

Earnings is this Wednesday AH. Poots?

This got absolutely wrecked post 1Q earnings… we were just too early to the party the last time ![]()

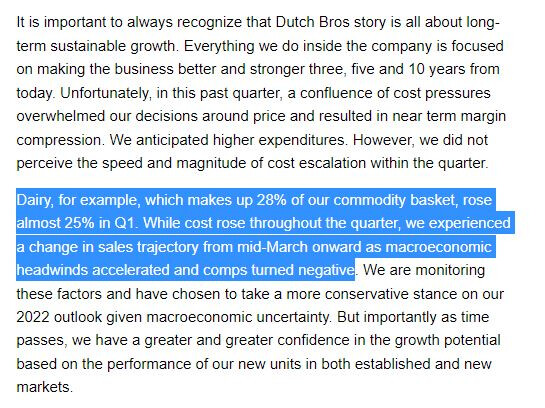

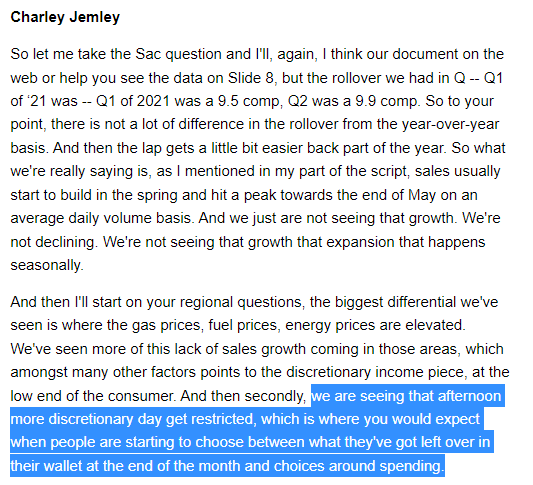

Will take a closer look at the numbers and see if there is room for further downside but here are some quick takes from fintweet below:

https://twitter.com/LSValue/status/1524481665116037123/photo/1

https://twitter.com/bluff_capital/status/1524691449522049026/photo/1