If I had to take a guess, RSX will either adopt a clear SPY correlation or just trade sideways until we see the holdings unhalt. The unhalts could very possibly not be until tomorrow.

I’m up to 7x RSX 11 MAR 12 PUTS, cost basis is at 2.00 right now. Watching this pump, might collect a couple more.

Stream is up - YouTube

Cut 6 of my 12 strike march 11th RSX puts, holding 4, bought 3x RSX 18 MAR 9 PUTS @ 1.55 avg

up to 7 of the 18 mar 9 strikes now

Sold 1x of my 11 MAR 12 PUTS for RSX @ 3.60 (no the 9 puts, the 12)

Sold 1 more @ same price.

Totally out of my 11 MAR 12 PUTS, still holding my 12 18 MAR 9 PUTS

Stream is down for the rest of the day, had to run out of the house for a bit. See you guys tomorrow!

Stream up is https://www.youtube.com/watch?v=ix2xWSoPTcE

Slowly trimming out of RSX

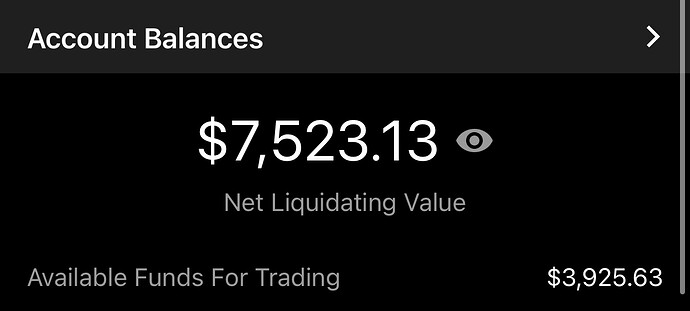

I accidentally used the challenge account to pay rent so its missing $2K atm that I’m going to transfer back, however, the balance at open right now (would’ve been) 10,125.65, meaning we’ve hit 10x and 910% gain in the challenge overall.

Holding 8 of the 14 RSX 18 MAR 9 PUTS (sold 6 this AM for an avg sell price of 2.80), I also snagged 1x RSX 18 MAR 7 PUT before the halt at 1.60. I’ll be holding the 9 strike puts and looking to cut for a little more profit as this comes down later in the day and using the 7 strike puts to take advantage of this upward price movement and using this momentum to my advantage for cheap fills.

Sitting on 5x 18 MAR 7 PUTS @ basis of 1.60

Took 1x RSX 18 MAR 5 PUTS @ .70

Got 3x more 5 PUTS, cost basis is now .75

Those 5ps are 11 MAR apparently. ![]()

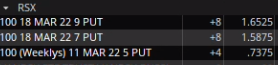

Current RSX positions:

8x 18 MAR 9 PUTS @ 1.65

8x 18 MAR 7 PUTS @ 1.58

4x 11 MAR 5 PUTS @ .73

Current RSX positions:

8x 18 MAR 9 PUTS @ 1.65

8x 18 MAR 7 PUTS @ 1.58

12x 11 MAR 5 PUTS @ .70

Probably maxed out on this for now