This is why you always at least take some profit on large candles:

Above is the price ladder for my WEAT 18 MAR 11 strike call options. The red arrow is pointing towards a sell I made earlier after the stock unhalted and we got some large green candles with volume. I cut 1 option for a fill price of 2.20. Now that some time has passed, the stock has returned to the same price point, but the bid (green arrow) is only sitting at 1.90. A lot of times, you’re going to get really inflated prices during momentum and it makes sense to at least capture some profit in them just in case they don’t hold. By selling in that one candle, I captured a fill price that has been unmatched for the majority of the rest of the day. You can see below the candle I sold on (red arrow) compared to the current pricing (green arrow):

While it’s always fun to wait for moon, over time, its a lot more profitable to just take what you’re given and be happy with it.

69 Likes

Small update, I noticed today that the challenge account is currently under GFV restrictions and as such is no longer advanced money when I sell positions that were held overnight. Going to try to get TD to remove this restriction, if unsuccessful, it’ll probably slow things down a small amount.

Will update when I know more, priority right now is trying to get more info on RSX & OZON, keeping my smaller amount of trades going for the time being.

20 Likes

Alas all good things must come to an end  , today ends my streak of green days since 02/25.

, today ends my streak of green days since 02/25.

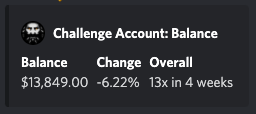

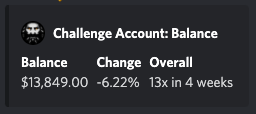

Closing balance is $13,849.00, -6.22% on the day. I think we might’ve gotten some deals though today so we’ll have to see what tomorrow has in store.

Going to be a little bit more active again soon, been busy with bot development and RSX related stuff. Have a good night

37 Likes

Taking a bit of a breather today to work on the notifications bot. Its missing orders still and I want it to be reliable

4 Likes

Going to be running a couple test buys/sells on the re-built TF notifications, don’t follow.

8 Likes

Currently just focusing on unwinding the WEAT trade that I’m over leveraged in. Once out I’ll re-focus and trade a little more actively.

7 Likes

No stream this AM as the challenge account only has halted positions at the moment and I’m making some changes to the setup cause that shit got mad laggy lately. Moving to an RTX5000, whatever the hell that is.

7 Likes

The reports of my death are greatly exaggerated.

After my break for the last week or so, I’ll be back to actively trading the challenge account tomorrow morning.

27 Likes

I’m now at my full position for AMC, not going to put anymore into this trade.

I haven’t really been obeying my normal rules and the trading is showing it. Going to focus more on my entries and exits, I’m just making a decision on direction and taking longer strikes that would probably be right eventually but I’m spending way too much time down where as if I were paying more attention I’d probably be green the whole time.

16 Likes

AMC is 1:1 SPY correlation at the moment. Gotta get my head in the game ffs.

3 Likes

SPY plays are always super risky, I’d advise that if you don’t have the capital in your account to reasonably play them with me to sit them out.

1 Like

Bringing cost basis down on AMC puts

3 Likes

At 10 contracts for AMC, I’m good here. Betting on a SPY reversal knocking AMC/GME back into correlation (AMC is seemingly following GME’s earnings run-up at the moment).

7 Likes

Family emergency (nothing too serious I’m fine), stream is ending for the day. Remaining positions will be held through close most likely, if it changes the alert will trigger.

8 Likes