Took 1x XOM 11 MAR 78 CALL @ 2.12

Trimmed some more XOM at .76

Been continuing to scale out some XOM calls I used to avg down.

Bought 1 LMT 25 FEB 395 @ 2.60

Going to do the account update over the weekend for today. It’ll essentially be a breakdown of the numerous mistakes I made throughout the day not the least of which was not cutting when green earlier as I’ve been doing pretty religiously.

Had some personal stuff on my mind today and felt pretty off as a result. Will be more clear headed by next week.

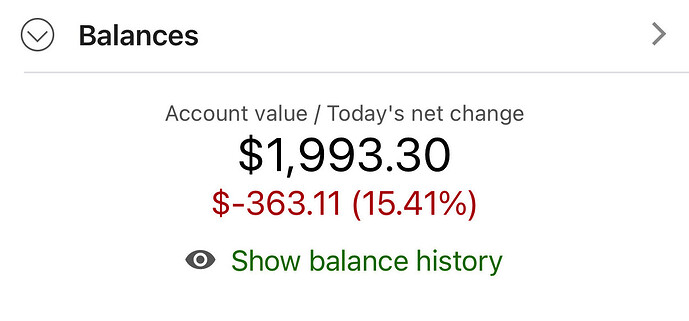

Finishing balance for the week, $1,993.30, -15% on the day, +66% on the week and +99% on the challenge overall.

See you guys next week, enjoy your three day weekend.

It was a tough day. Thanks for keeping the stream going. As much as it’s nice seeing how you trade on good days, in some ways it’s almost better to see how you handle red days.

You mitigated losses as much as you could, you tested fills, and you developed plans that you stuck to.

Hope the personal stuff is okay, much love my friend.

Out of LMT, sold all of my XOM except for the March call.

Took one more XOM 11 MAR 78 CALL. cost avg is 2.23

May end up just scalping this though.

Just holding the XOM calls at the moment, still feeling a little sick (caught the flu over the weekend) so I’m probably going to lay down for a little longer and probably reassess in a bit. Should be 100% again by tomorrow. +20% on the day at the moment.

XOM is currently following SPY 1:1. We know the stock itself reacts to Russia news, so its probably just waiting for the next bit of news to come out which would hint towards:

- An actual invasion

- Potentially more sanctions

Took two USO 11 MAR 66.5 CALLS, cost average 2.42. USO is holding better than XOM, might switch to it but we’ll see.

Entered 1 RSX 11 MAR 20 PUT @ 1.45

Took an L on RSX puts, its pumping with SPY.

Took profit on one of my avg down XOM calls. Just reducing risk.

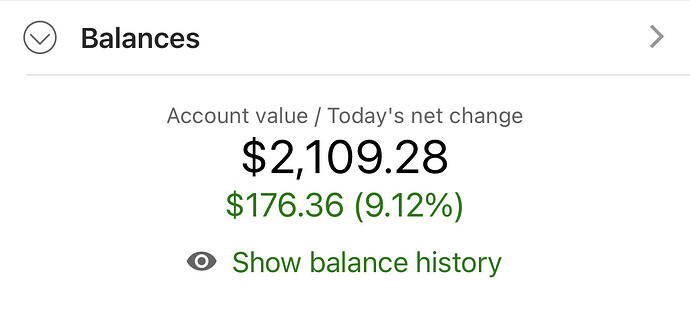

Doing a cheater update again, should be back to full updates and trading tomorrow. Finished the day +9%, Balance at 2,104.28. Didn’t anticipate the selloff on XOM so ended up spending some cash fixing my cost average on the reentry.

I saw a lot of people talking about how the trade was killing their portfolio and that shouldn’t have been the case. In these challenges you have to be mindful that you’re not acquiring your whole position at once. You see me “taking one here” and most everyone should be doing the same. If you’re blowing your load at one cost basis, you’re very often going to be wrong.

Tried RSX puts but didn’t like how it was following the US market. Took some USO calls trying to gauge if they’re most stable and profitable than XOM.

Overall not a bad day, made mistakes being too dedicated to a play and reentering too quickly. But I think it’ll work out.

Still green on the day, can’t complain. Cya tomorrow.

Trimmed one more XOM, holding 3 now.

Sold one USO @ 2.45, holding 2 now.

Opened two UNG 4 MAR 16 CALLS @ .65

Cut one more USO @ 2.73, holding 1 now.