this is great stuff and can’t wait to hear how they kicked-ass for thanksgiving! up here in Canada my extended family and i go to Costco about 2-3 times a week if you include gas and it is always busy. like Tedro was saying, from the eye-test doesn’t appear to have any supply issues in terms of empty or unavailable stock.

Nov. sales came out AH and across the board good improvements: Costco Wholesale Corporation Reports November Sales

too bad the market as a whole just got pummeled

Those are some good numbers, hopefully market calms down and COST can rebound… but here’s to hoping.

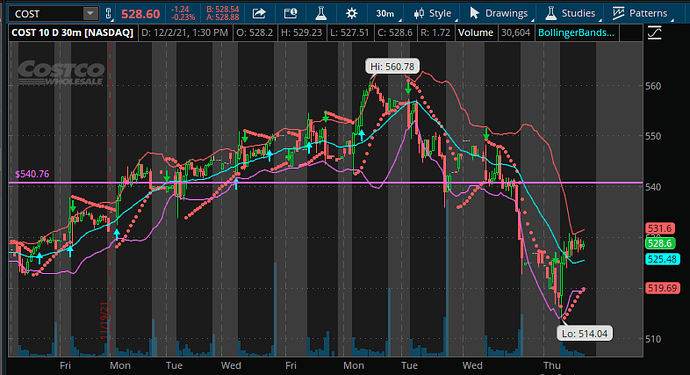

i’m trying to wrap my brain around the last 2 days of trading for COST and the divergence from SPY is confusing me. recent positive news from the November sales report (unless they missed targets - which i can’t find any information on).

this just feels like profit-taking when SPY took the massive dive over the past few days. maybe someone can shed some light on this. i’m still holding onto 2 calls but if SPY recovers and COST continues to be in the red intra-day i might look to just cut.

hopefully we see a massive push up soon!

Only thing I can think of would be that the market was worried the new coronavirus variant would disproportionally affect retail. I wouldn’t look too far into it and would expect COST to recover somewhat quickly.

Now this observation may be a bit retarded, but looking at the way COST climbs, there’s a clear pattern of an early day jump which levels off into the later day. Today, thus far, seems to be in line with its uptrend days. Provided SPY doesn’t shit the bed tonight, I think we might see a green day tomorrow. This price point may not be a bad are to start a position if you’re playing the earnings run, I personally took calls at open.

Joined you and took a small position here with very tight stop losses for 560c dec 17. I would go for the 540c but the premium is too high for me. lets see how this plays out.

EDIT: took a note from JB and sold for ~20% profit. May or may not re enter depending on price action and spy being down hard

I spoke to my friend who works at the 3rd largest Costco in the US in Commack, NY.

He said that the store did 160 million two years ago and the manager said this past week they did 220million. He said the store is busier this year compared to last year. They’ve had multiple days over 1.3 million. That’s about all I could get numbers wise.

The east coast union is attempting to negotiate for a $3/hr wage increase for all employees. They will likely achieve this. But that’s only for unionized employees in the northeast. Not all locations are unionized.

Here’s an article that says COST missed Nov. sales expectations. The gist of it is that COST has been killing is to much that these expected sales numbers are almost unrealistic - a victim of its own success

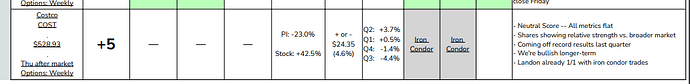

I want to point out that the 5 days leading into earnings since 2016 are usually flat or down. You can check the chart for yourself if you don’t trust my Google-Sheeting.

TLDR I’m not buying calls.

This makes sense to me. It’s doing well but the price is out pacing how well it’s doing

Cramer pumping COST

Yo. I can try to dig. I live close to this one. However BJs has a big presence in the area with a BJs within 5 miles of the COSTCO commack location. BJs is also building a new center in commack 5 miles the other direction. BJ earnings in Nov beat expectations in sales and earnings and I believe it jumped significantly. However like everyone has said these are different times. I am indecisive on this one, but will see how Monday is maybe jump in one way or other. Thanks and good job

Here is market watch as other mentioned from yesterday

https://www.marketwatch.com/story/costco-saw-inflation-easing-as-november-sales-rose-11638395454

Twitter sentiment neutral… Likefolio guys doing Iron Condor… Seems unadvisable since the MMM is usually small

As COST wobbles into ER tonight, currently at $527, I wanted to bless this thread with some positive sentiment. Oppenheimer has raised its PT from $550 to $580!

i hope everyone was able to exit their COST plays with some profit. the run up this morning with SPY/CPI playing nice has been quite a relief.

volatility has been the name of the game: see AAPL, MSFT the last couple of weeks. the range for COST has been between 525 and 555 and the volatility has been a great learning experience for me. one of the key takeaways for me on ER was that internet sales was up 14%. COST online sales have been lagging in comparison to competitors but 14% is nothing to sneeze at. Also, in Canada, they are launching a new MasterCard with one of our major banks with double points for online purchases.

great long-term play for me still. good luck to all!

This positive ER and recovery have been a nice surprise, in the past even positive ERs were followed by a drop then onto new ATHs. Picked up a 540 12/17 at close yesterday for a nice gain. Will be looking to see if we get another drop at days end or monday morning.

Costco’s online sales are lagging compared to the competition but we have to remember it’s a relatively new space for them at this scale, considering that, it is pretty impressive. Even at this heightened evaluation I think Costco is a great long term stock.

Probably going to archive this. It was a great play but I was too cocky and bought in too early. Got busy day of run and sold for a loss vs holding and watching cost run all day long lol. This one hurt a bit and completely played wrong. Will look for the next few and likely sell on the run up or way down before earnings then just buy the trend after earnings comes out.