Putting DAC back on a watchlist, to potentially short. As the title of the page notes, DAC is like ZIM in that it deals with containerships, but different because it charters out its ships to folks like ZIM.

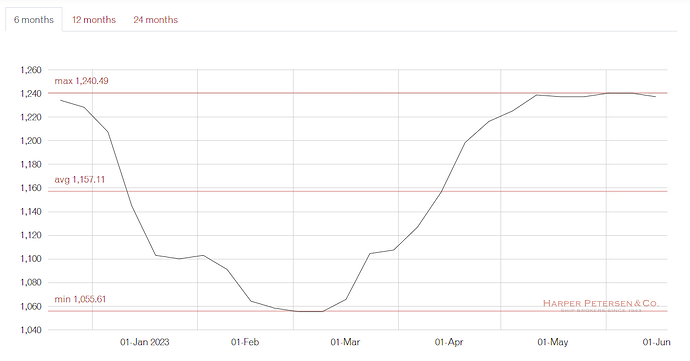

We have seen a very clear divergence over the last few months, because leasing rates have stabilized somewhat, while container shipping rates have gone down.

And DAC is long term contracts in place that make it somewhat immune to the immediate vagaries of the containership world.

Here is a nice article from Freightwaves that goes into this in more detail:

Even MIntzmeyer is adding to the bullish voices, citing it as one his favorite three shipping tickers:

https://seekingalpha.com/article/4612463-top-picks-in-maritime-shipping

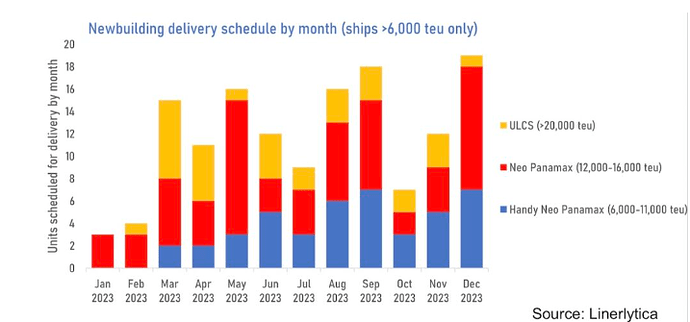

What gives me reason for pause though is the amount of capacity hitting the water over the next two years:

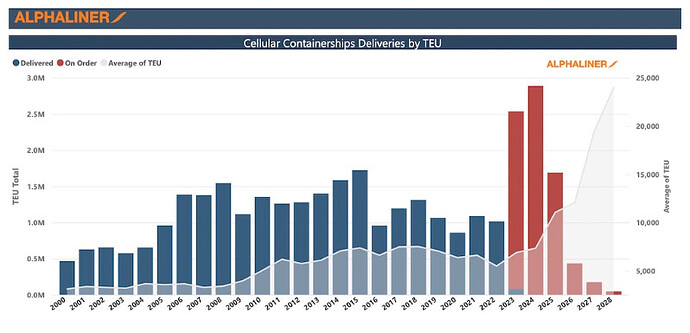

The record container order book, which sees ships contracted at yards in Asia through to 2027, now totals 7.692m teu according to Alphaliner, a figure which is larger than the combined extant fleets of Maersk and CMA CGM, the world’s second and third largest container lines. By July last year, the boxship orderbook had become larger than both the tanker and bulker orderbooks in dwt for the first time, according to Clarksons Research.

…

The orderbook as a percentage of the current fleet stands at 29.5% according to Alphaliner, with a heavy skew towards larger-sized ships.

(Source)

Ships can be scrapped though to keep supply in balance, so will keep an eye on rates for now.