Perhaps someone smarter than me can make use of this, but FATH filed their S-1 yesterday I think. Found here: Altimar Acquisition Corp. II - S-1 - Registration Statement - January 14, 2022

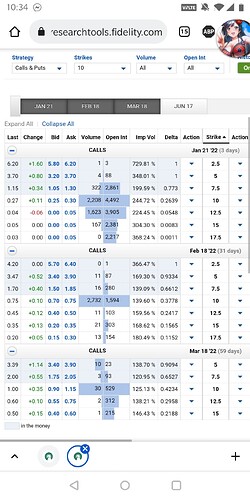

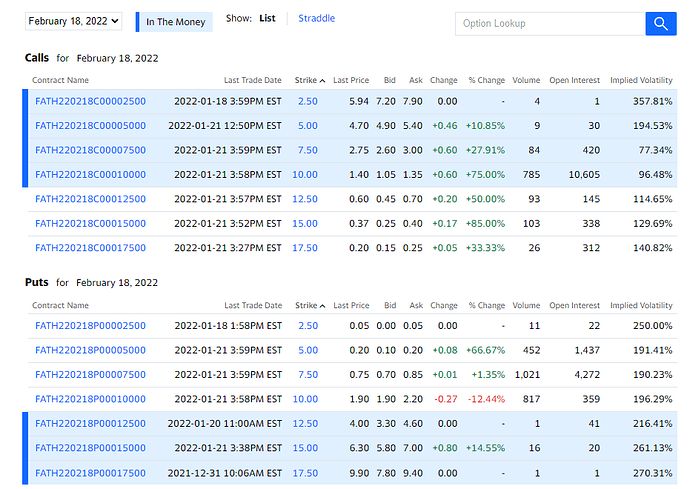

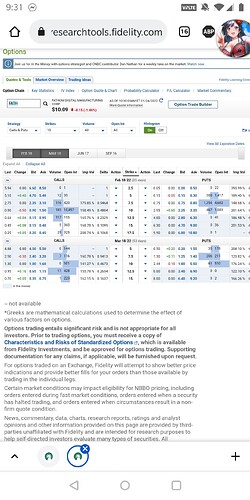

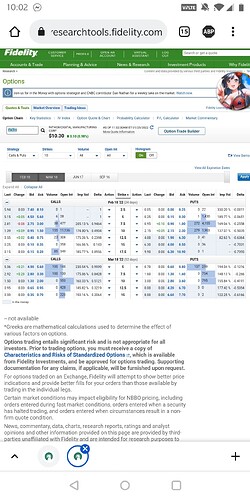

I was given permission to double post so I’ve been following this one much closer. The $7.50 strikes for 1/21 are ITM right now. It does seem like OI has moved up the chain though and is still split between $10 and $12.50 strikes now:

FATH is trading at about $8.40 as of me writing this post, so I’ll see where it is. It’s pretty flat and I guess if it breaks $10 by tomorrow or the day after, we might have a fast play. Unfortunately, with expiration of 1/21 in about 3 days, we might not see a meaningful play until after opex. I will continue looking at this, but if the OI remains, we might be looking at a February play.

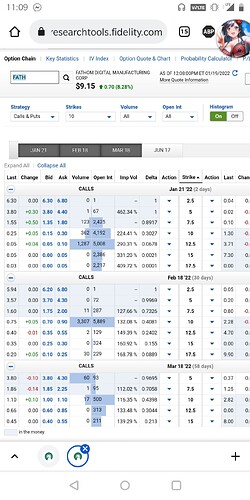

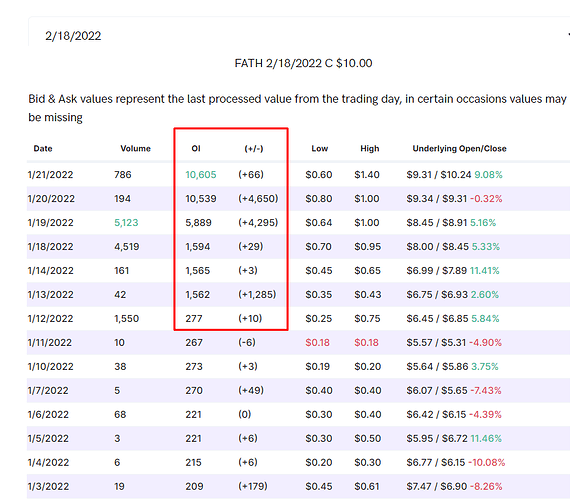

Updated OI today:

Slight increase to the $12.5 for 1/21. FATH is trading at just short of $9 right now, I don’t think this will get to the $10 strike in time for this play to be on the table for 1/21, but interesting.

Will keep watching.

Leaving a message so HypnoDoge can reply again. Capped at 3 in a row apparently

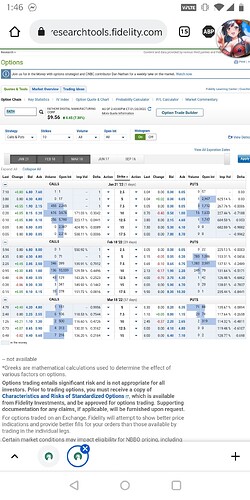

Slight decrease to $10c with expiry of 1/21/22, increase to OI on $12.5c with same expiry. However, there seems to be a good increase in the OI on the $10c with 2/18/22 expiry. The play for 1/21/22 is probably off at this point, however seeing as FATH still hasn’t crashed back down to or below $7.50, we’re looking good. I will probably be waiting until after the 1/21/22 option expiry to see where we are on OI as well as checking to see if the price has crashed back down to or below $7.50. if not, then we may have something on the table.

More soon.

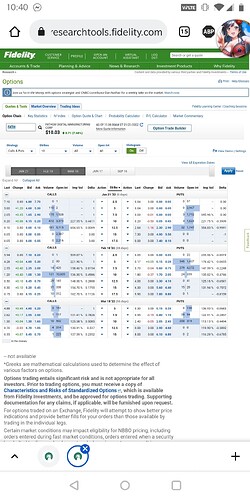

Here is the updated OI for today:

As of me writing this, FATH has broken above $10, I don’t know if it’ll hold, but we’ll probably want to wait a few days after today’s OPEX to see where we are. There may be a play on the table for February. Exciting, but I am still closely watching this one.

More soon.

The Feb chain has about 10.6k on the OI for the 10c but barely anything for any of the ITMs.

Will add this to my watchlist just to see how it develops.

Pure speculation, but with BBIG dying and this having low float and high OI and currently in an uptrend could see some more interest from retail. Gonna keep an eye on social over the the next week, see if it’s gaining traction.

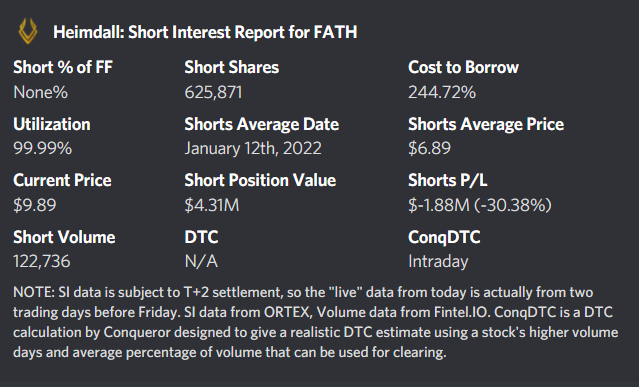

Shorts are currently 30% underwater and around 20% SI. Average daily volume is around 600k so could provide a bit of upward pressure if they start to close their positions.

any thoughts from all the smart people on when this starts going down? this is crazy price action

lol when you asked

These are some big jumps in OI on the Feb 10c… 10,605 10c weighs about 46% of the float…

Now that it’s at $10 I can see people loading the 12.5c next

Other strikes don’t have any OI.

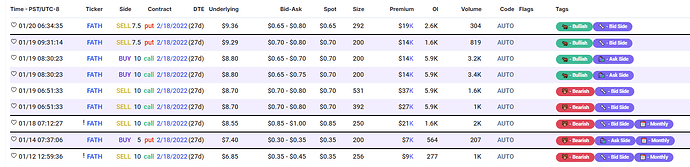

Taking a look back at flows since Jan 12 when the Feb 10c started building, UW only shows what they deem as significant transactions. That being said, based on these sizes not being particularly large, it looks like the OI build up is coming from many smaller orders, maybe indication of retail interest or it’s whales breaking up their orders.

Copy of the Feb chain here for record keeping:

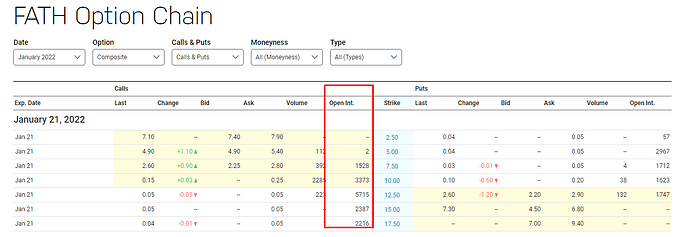

Copy of the Jan chain on Jan 21 OpEx. Had potential.

On October 21, 2021, Fathom entered into a commercializaton partnership: https://investors.fathommfg.com/news/news-details/2021/Fathom--Evolve-Additive-Solutions-Enter-into-First-of-itsKind-Commercialization-Partnership/default.aspx

I wonder how much potential Fathom has to popping out more press releases between now and Feb 18 for sentiment boosts.

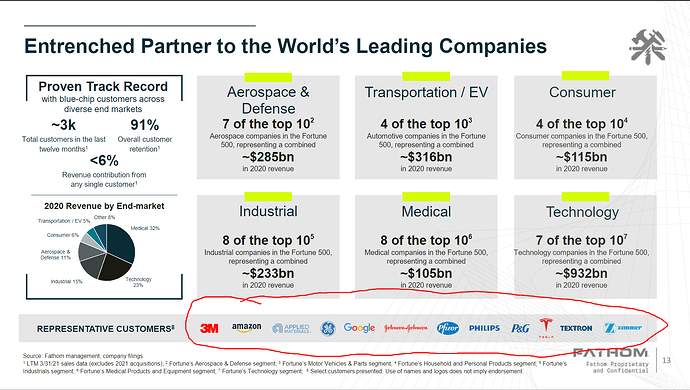

According to their latest presentation they worked with a Fortune 10 tech company

And these are some big names wtf Amazon, Google, Johnson and Johnson, Pfizer, Tesla…

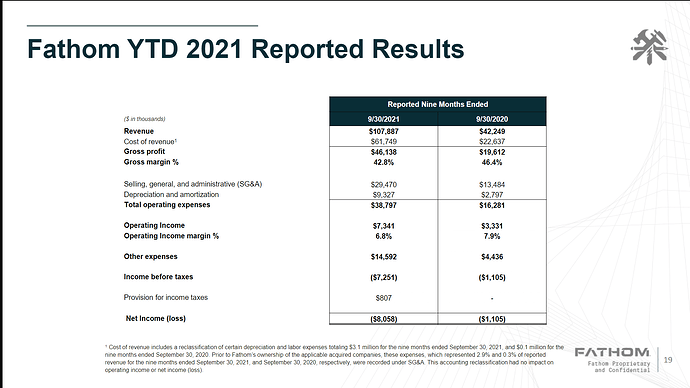

A de-SPAC that is already profitable, with notable YoY growth?

View more here: https://s29.q4cdn.com/435091200/files/doc_presentations/2022/01/01-07-22-FATH-Needham-Conference-Presentation-Final-rev.pdf

Not sure why there were over 90% redemptions.

Starting a new comment here because this is particularly important.

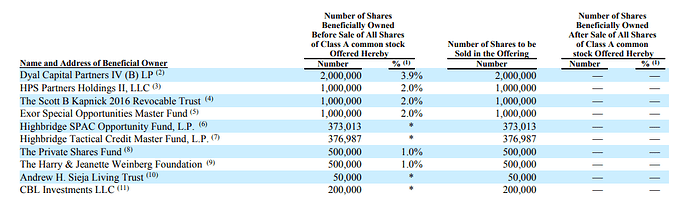

On January 14, 2022, FATH filed two S-1s. They seem to suggest a massive share dilution. Any SEC filings experts able to figure out the conditions of the sales and explain in English?

This one is a registration of 154,518,484 shares of Class A common stock for possible resale by the Selling Stockholders from time to time and up to 18,525,000 shares of Class A common stock that are issuable upon the exercise of the Warrants.

This one is a 7M share sale from 10 different shareholders

What’s puzzling me is that these dilution announcements were made public on the 14th, but the major influx on 10c OI occurred AFTER that.

Did the news just fly under the radar of everyone purchasing these 10c? Or is there something I’m completely missing here? To me, dilution means the underlying should be going down. So to me there is a much stronger bear case now. 10p?

I did a quick look over but I don’t have much experience in SEC documents. Do we know when the dilution would occur?

Could it be those contracts were actually STO and someone is playing theta gang on a despac expecting it to go down?

The way I’m reading this from PDF pages 129 and 130 as well as the opinion letter from PDF pages 328 and 329, these shares are for warrants being exercised? So the shares aren’t necessarily going directly into the market adding dilution? Yes these shares add to the float, but they are all going to Altimar? If so, not sure what this implies with Altimar dumping these shares or not but that would be my next question if my understanding from the above holds up…

Ok, after reading the 8K and recent stock dilution filings, most is going institutions already invested with Fathom/allowing them to sell via tranches without restrictions.

A few things I do want to note:

on the 8K filing: A Pipe investor defaulted 1M share purchase and Fathom is pursuing said investor of those funds based on the contract. Technically Fathom doesnt have to have these shares locked up so they can dump them or already dumped them on the open market to get funds.

Note Below:

- An institutional investor that had committed to purchase an aggregate of 1,000,000 shares of Altimar II’s Class A Common Stock for $10.00 per share to be included as part of the PIPE Investment defaulted under its subscription agreement, and failed to fund its respective portion of the PIPE Investment. The Company plans to aggressively pursue its available remedies with respect to such investor.

The Shares Dilution doesnt have a date but they can allow investors to sell in tranches without any restrictions. In addition, I noticed a ton of pages where Fathom owes a ‘Term Loan’ due to the SPAC due April 29th 2022. This date is put on the filings several times (7+) on the forms. I would expect a tranch sale prior or in April.

Personally there are too many things that show this deal was completed on rocky grounds. I do not see anything that would be consider as bullish. Conqueror says this is a pump and dump and I agree. There are too many chances of a rug pull to happen.

Updated OI for today:

It looks like everything is now on 10c, but barely anything on the chain. However as @Castle pointed out, there is a strong bear case with share dilution on this one.

Updated OI:

Sight increase to 10c. FATH still essentially trading sideways at $10. Not too much to see here.

So it seems that a winning strategy for short-sellers has been to short de-SPACs down bigly right after merger. Hence why these are dropping down to $5 a month or so after de-SPAC (i.e. FATH).

Now, at the bottom of this is when we should start piling in as a discord after buying options. How to tell? Short utilization at 100%.

These mini-squeezes that we’re seeing on FATH and other recent de-SPACs are shorts covering their position (at big profits) hence the run-ups. I don’t think FATH has much more steam and will probably start trending down again once there are available shares to borrow but we can find other de-SPACs that have trended down bigly and pile in to achieve mini squeezes.