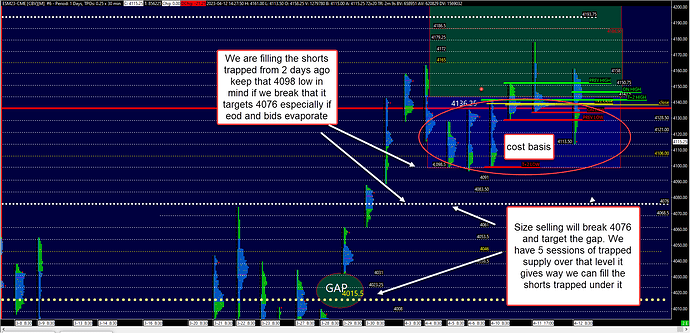

Those poor shorts. Maybe they can exit with some dignity. ![]()

Will you look at that, it’s like shorting in the hole doesn’t work.

POC is a profile term for cost basis. (purple letter area)

Look for short covering in globex. If market cannot get down there, then you know the drill.

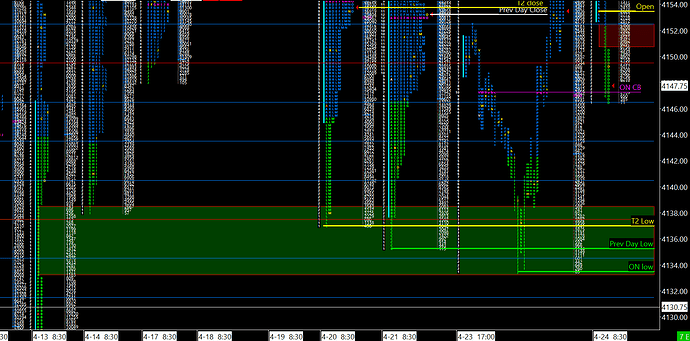

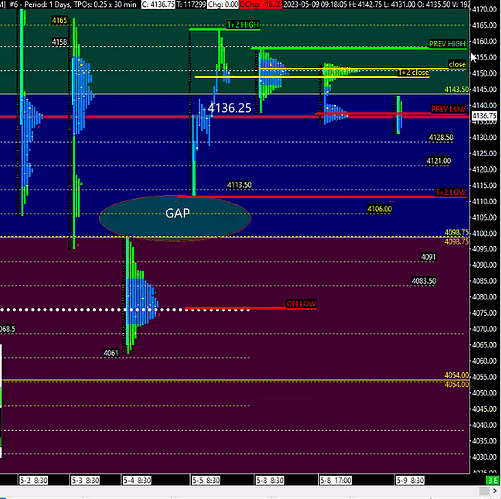

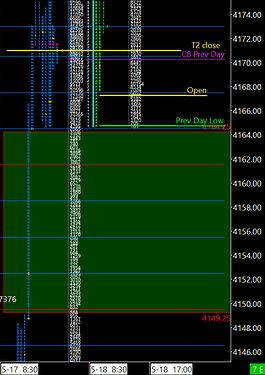

Back down to the overnight cost basis trapping all the longs from this morning. We have single prints on the downside, red box (4150.75-4152.50), meaning there is supply in that area. This acts as an area of resistance.

Would be nice to test those lows in the ON and fill those single prints from 4/13, green box (4133.25-4138.50), from the trapped shorts. Singles on the upside is a lack of supply acting as support.

Reminder there is a lack of outside participation from big money institutions until there is more concrete data on the market thus giving confidence to the participants. And it being month end, fund managers can continue their holiday in the Hamptons.

Hopefully earnings season gives us just that and takes us away from this awful price action and ranging for the past month. Till then expect more of the same.

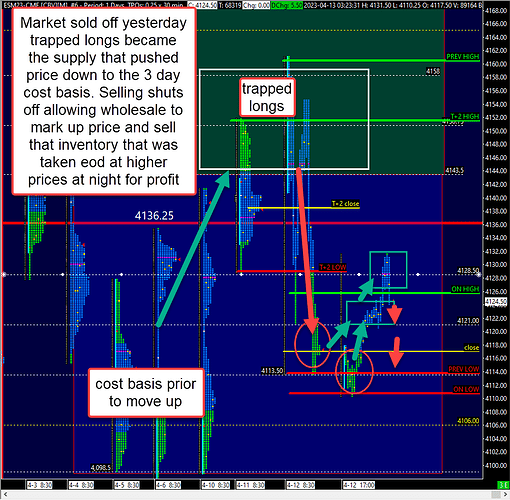

![]()

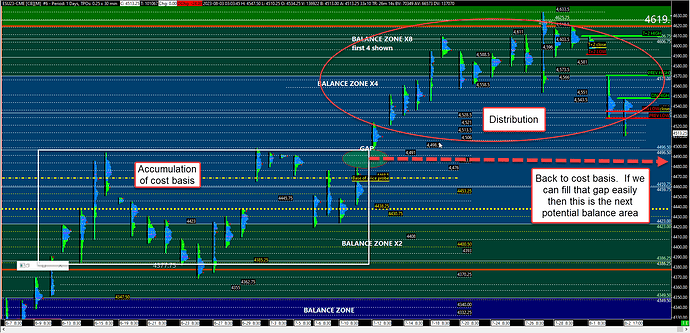

We tapped that M period low from 3-30-23 which is coincidentally within that day’s cost basis. That’s last month’s quarter and month end mark up. If we catch no bid look for the lowers stops.

It’s month end again so big size funds are eating strip club sushi i.e., sitting on their hands, so we should as well and preserve our capital; no need to trade every day.

No size trader is buying at these lows besides trapped shorts on the gaps leading to March’s month end. ![]()

Shorts are always the first to buy so be wary of the buying as it’s unsustainable.

And as I type this we break that 3-30-23 M low. ![]()

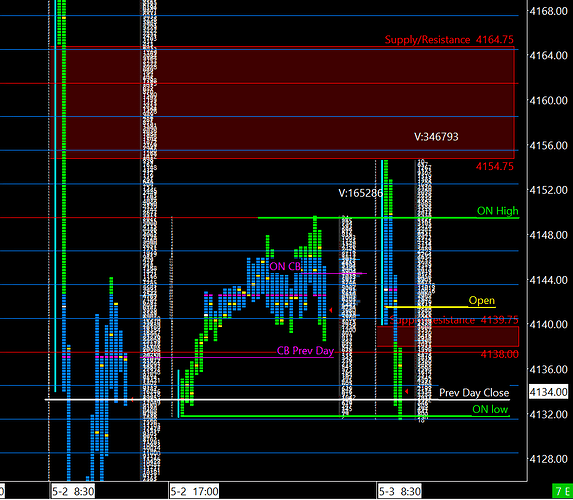

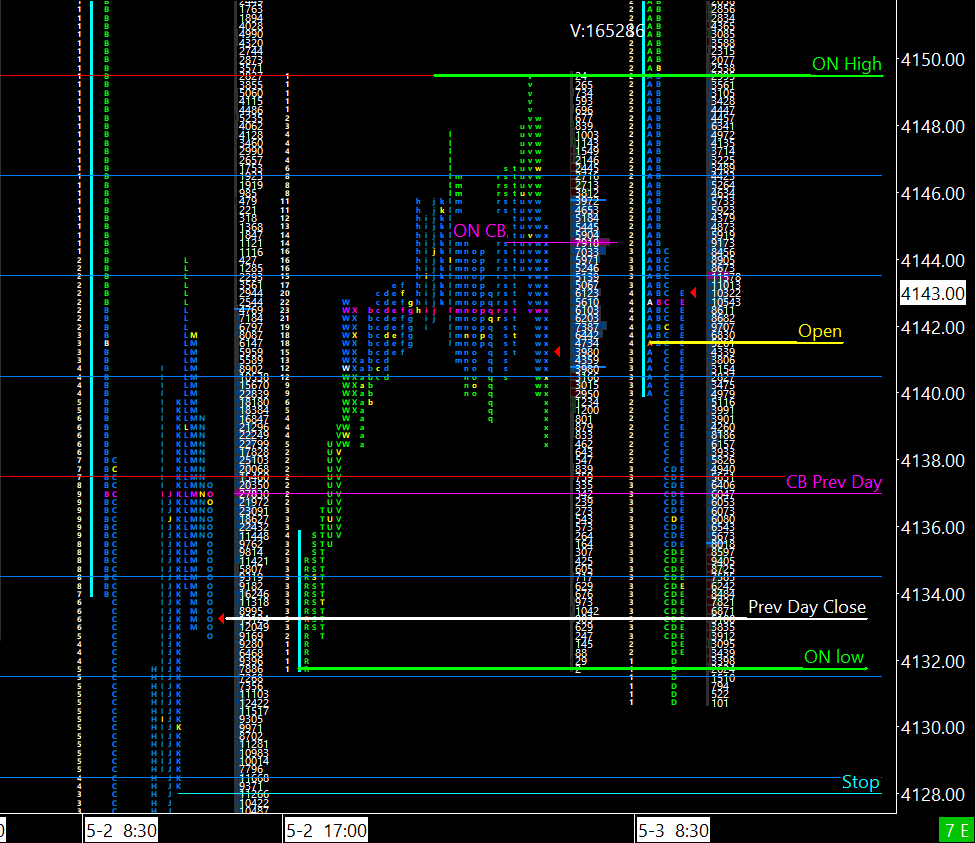

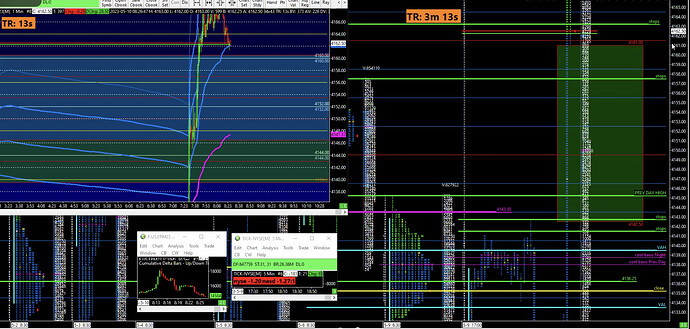

We are still in ON’s range. Went up looking for supply and came back down to yesterday’s close, could not break that ON low; coincidentally that’s also around yesterday’s cost basis.

We just opened D period (11-11:30am) under single prints on the downside meaning there is resistance at 4138.

Failed continuation on the ON low break meant rotation back up. And now sitting on the Open.

Let’s see what FOMC brings.

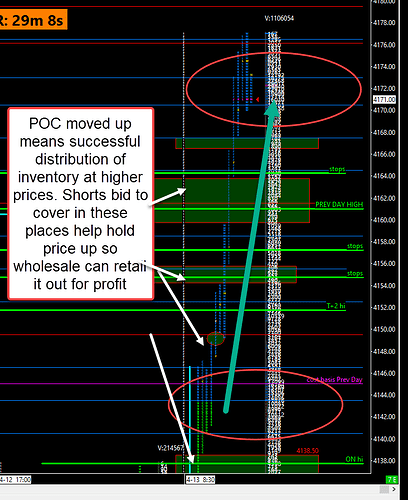

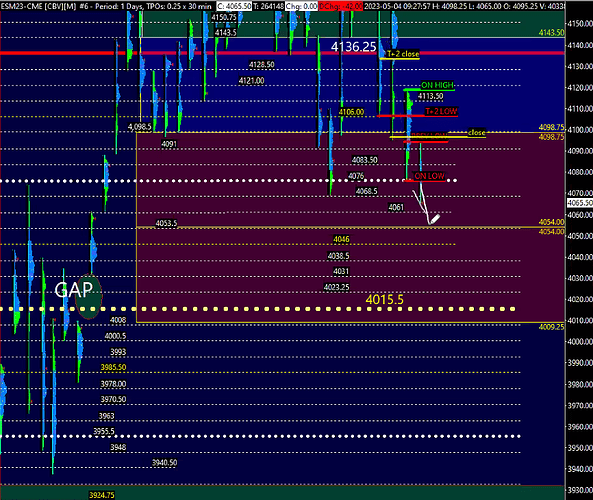

On a larger timeframe, we broke that 4098.75 balance zone. Market is trading a bit below it, around the low of April 4/26. The market is holding that 4061 level which corresponds with March’s EOM low; if it continues to hold look for it to rotate back up.

If it keeps moving down and breaks half of the red zone, 4054, look for the target of 4009.25, the bottom of the zone. And essentially filling the gap from trapped shorts at the end of March.

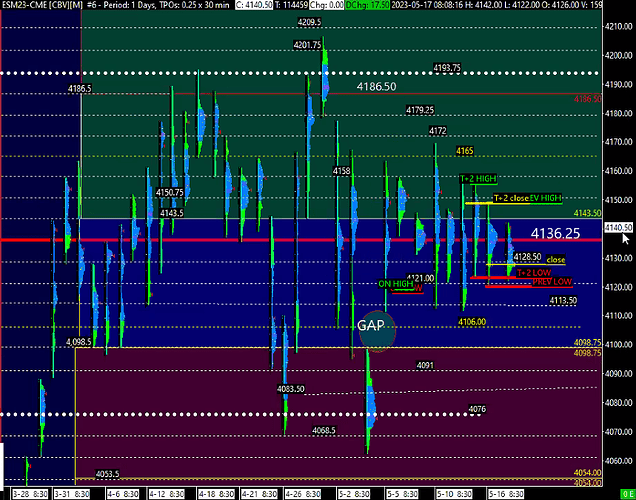

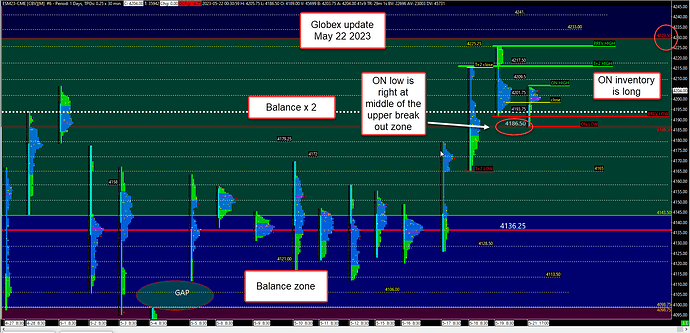

Market did not break 4061 last week therefore we rotated up. Even gapped up due to lack of supply, more trapped shorts. Yay. Means more chop and subpar price action; just look at today’s morning. Trading around the cost basis of Friday, 5-5, ~4134.

Look for the market to trade in the blue balance area, 4098.75 - 4143.50.

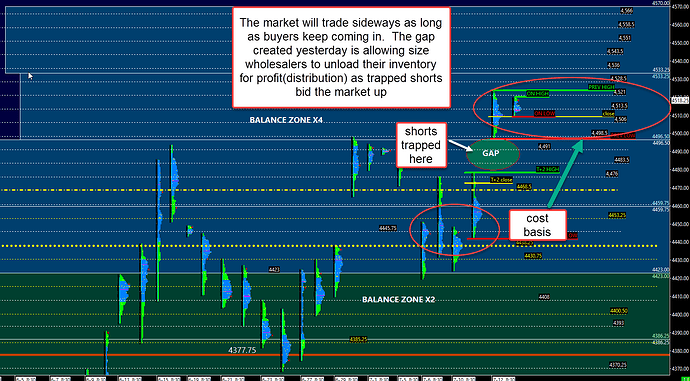

CPI was released and now shorts are trapped under ~4145 at yesterday’s cost basis. Market is selling (distributing) their product above it.

And as I typed this it literally went back down to yesterday’s cost basis. ![]()

This is what a rotational market looks like. Not much has changed; we area till trading in the blue balance area (range), 4098.75 - 4143.50.

Let’s see if we get some selling when we get to 4143.

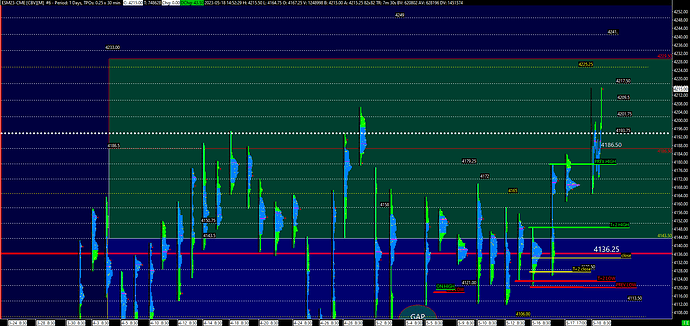

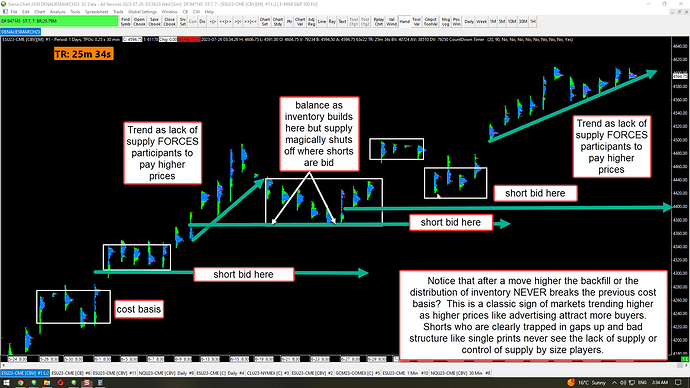

Market did not sell at 4143 and instead broke out to the upside, well into the highs of 4/28. That move up got more shorts trapped. Shorts provide the bid giving longs an opportunity to accumulate and take the market higher to distribute (sell).

Let’s take a closer look:

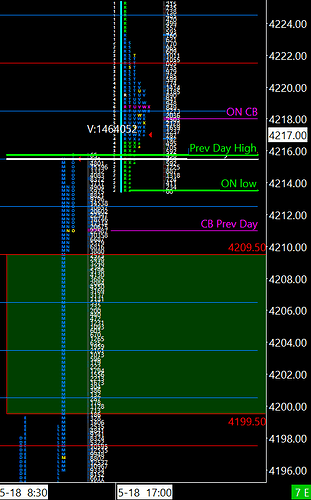

Today’s open, 5/18, stopped to the tick of the L & M low of 5/17, it could not break 4164. Market couldn’t even get lower to test that area the remainder of the day and so we rotated up to look for supply.

Furthermore, traders look for M period (2:30pm) liquidation and typically short it alongside sellers which was not the case again today.

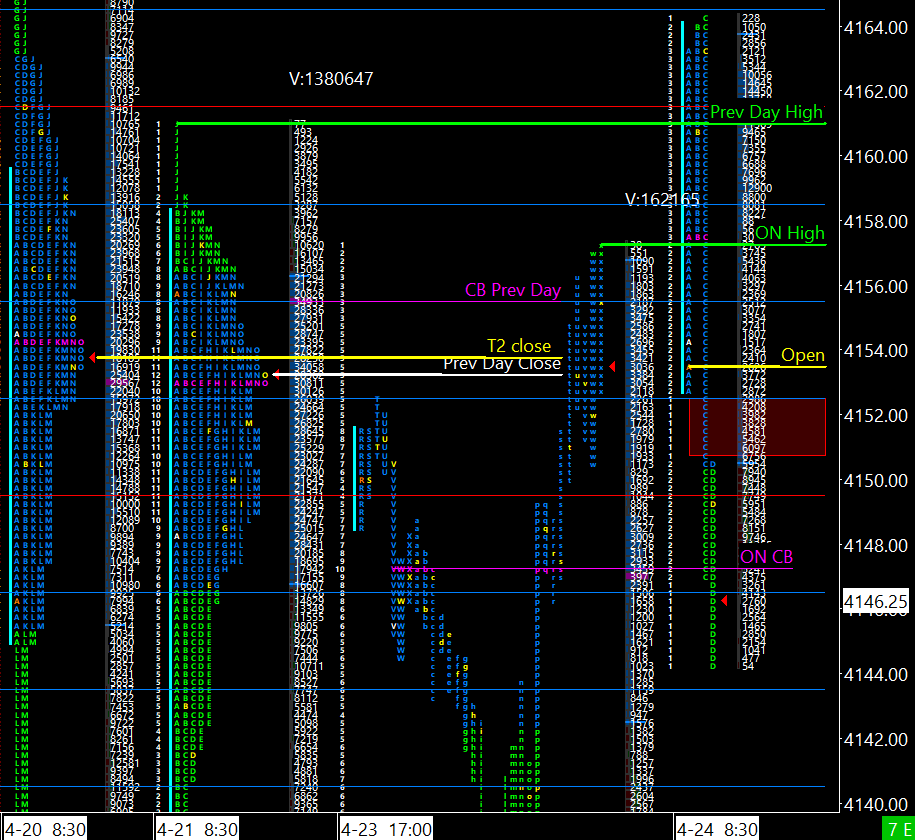

Let’s take a look at EOD and the ON:

Currently in the ON, market has not tested the CB of 5/18’s close. Shorts, again, are the bid propping the market up. If we cannot break 4209 tomorrow in RTH (regular trading hours) look for the market to continue up. Be cautious as any size selling can make this thing unravel like Weezer’s cheap sweater.

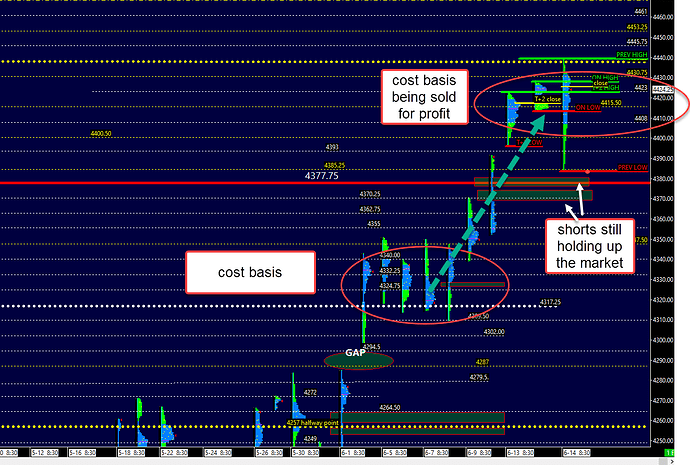

Shorts remain bid to cover. It has been this way since the gap up from end of March. Market has not had any decent liquidation; any pullbacks are basically eaten up by trapped shorts. This market remains propped up by multiple short positions. That said, this market has weak structure meaning these short positions act as support for the time being, but are not strong enough to hold size sellers since the shorts will simply lower their bid if they see supply come in.

Look at today’s FOMC: market liquidated all the way to the top of those single prints (green box) and finished the day right above the Open, ~4420. Prints were not filled and the aggressive buying from the shorts rotated it up.

How long will these short covering rallies last? As long as there are buyers.

To end the day: some humor and an homage to my SPY puts.