<@151954037544189952> amd <@363741563072937984> thanks for pointing that out to me. I will do some more research tomorrow on them and see - I have always liked HPE equipment as far as quality and reliability, going back to the old Compaq days.

Have any of you all heard of or paid any attention to HPE’s acquisition of Pachyderm? I read this - https://www.hpe.com/us/en/newsroom/press-release/2023/01/hewlett-packard-enterprise-acquires-pachyderm-to-expand-ai-at-scale-capabilities-with-reproducible-ai.html

and it was interesting but not a lot of detail - I noted the open source reference and noted AI-at-scale which I am not sure of the meaning of but its a nice buzz word.

Importantly parterning with Lockheed mean defense applications and big money.

Anyone head of this, they acquired them in January/Febuary of 22. Might be really bullish. If there is a military application here of this particular approach to AI.

Found this also and its from May 22nd - sounds like a massive hardware setup at least https://aibusiness.com/verticals/intel-hpe-to-develop-generative-ai-models-

So calls or puts?

So far what I have been able to find, along with what’s been posted here - says Calls to me.

But an ER is all about what you did last quarter, coupled with your press confrence and guidance.

The thread title is HPE ER - which is short term. And I am finding a lot of stuff that says long term AI bullish - assuming it works as described. We also have the added effect of a possible debt selloff, which can drag everyone along to some extent.

So I guess there are really two questions to decide

- short term ER and what happens

- long term and is now the time to get in here or would it be wise to see what happens market wise and then get in.

But yeah all I can find as far as my opinion says long term bullish and goverment and military usage of their AI.

HPE also acquired Determined AI in 2021. I say Calls as well, but the debt ceiling might move the entire market as well.

Thank the lord.

Apologize this isn’t my normal quality. But it’s something

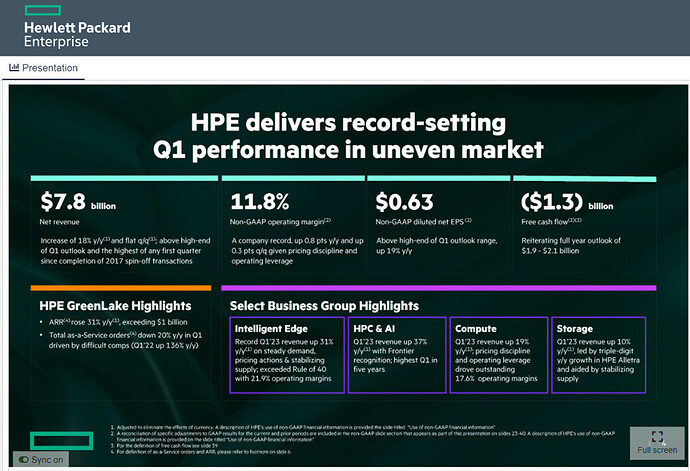

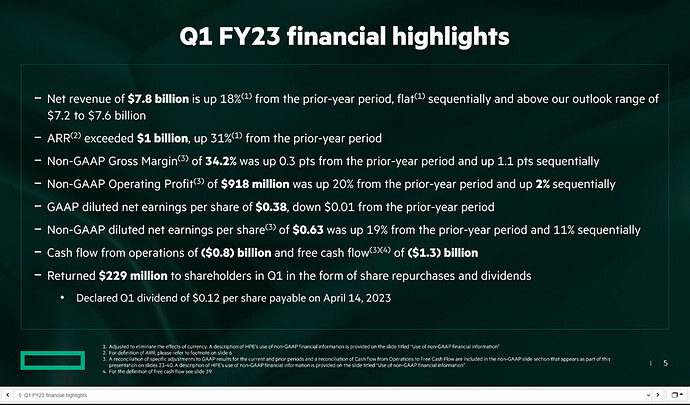

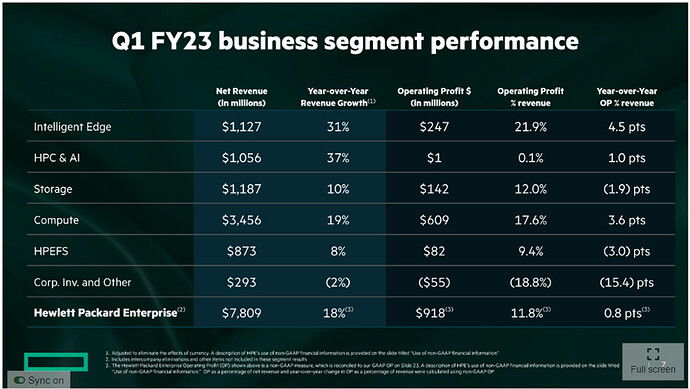

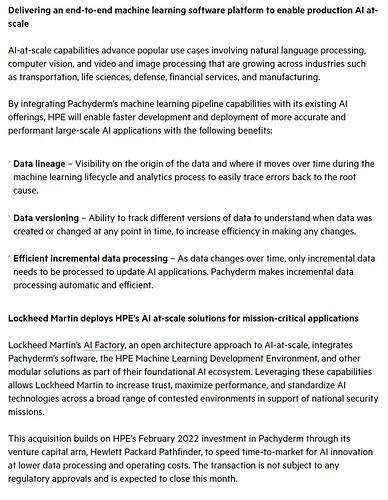

HPE Q1 FY 23 March 2, 2023

*In this section they said that Chat GPT and Bard are running on their systems? So that would imply that MSFT is running HPE hardware for their AI which brings in hardware build out and recurring costs as well more than likely. Their Supercomputers are apparently pretty fucking good. More on that later.

Q&A Section (highlights only)

Q: You guys and many others talking about AI, Chat GPT and saying you’re well positioned for it. You said you’re well positioned for this. Are you participating in some of the infrastructure for the cloud opportunities or how do you see yourself participating in the AI build outs?

A: Ai is front and center in the IT community. We cannot talk about what specific cloud. But we have a bigger opportunity than that. Large AI language models require super computing capacity. With what we did with Frontier you see how we make that accessible to every enterprise of every size. Apparently they acquired Craig and that positions them well for these buildouts? (https://www.hpe.com/us/en/newsroom/press-release/2019/09/hpe-completes-acquisition-of-supercomputing-leader-cray-inc.html)

Another question, but apparently their contract for recurring software services essentially doubled.

Q: Help us understand about this big Qtr is it sustainable? Any activities that aren’t likely to repeat? Your guidance suggests it accelerates from here. Help us model the growth moving forward.

A: Nope, just the momentum we’ve been building over the last quarters. We have a cloud native offer for all aspect of connectivity. Announced 2 acquisitions as well. Big pipeline to fucking deliver these profits you dumb analyst. We’re winning shares even in the largest customer segments. The market is dumb and not recognizing how much share we’ve won (he pretty much exactly said that).

Q: Why do your views sound more optimistic than your other IT exposed peers whether its around the compute side of the business or the storage? I get Intelligent edge, so not pushing there, but help us understand your compute side.

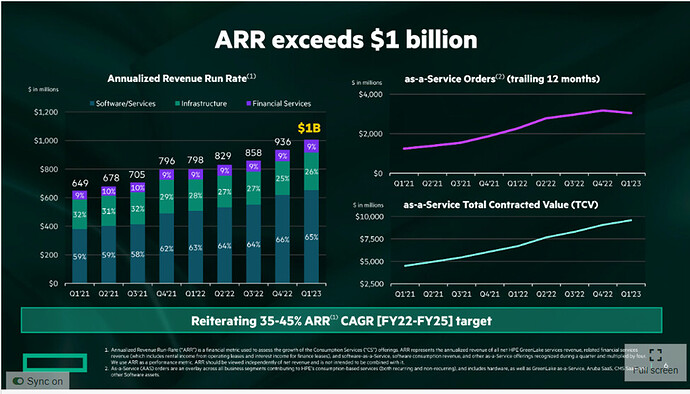

A: We have a unique strategy with a deep portfolio. Some are just playing in one area. But we’re playing in all. 1/3rd of our revenues come from recurring services which is unique in our space. We brought our unique portfolio to a unified and unique experience with Greenlake. We leverage everything through there (all their products). They can consume all their data in one experience rather than having 3 different products/services. 3 different areas addressed with their new version 11? DDR5 allowing for more content in their servers (higher throughput).

Q: Whats the timing of the H3C sale? Where will you use the proceeds?

A: Continue on returning value to SE’s (60% of free cash flow is the goal apparently) etc etc

Q: You’re midpoint guide seems to suggest the 2nd part of your FY is going to be less than you initially guided (I think this means they guided for a lot of spending in this QTR they’re about to report, due to the big flow of spending, which is probably what we saw with Nvidia as well but they reported huge guidance upswing of course).

A: Double the revenue guidance for the midpoint (so basically with this quarter they’re going to report). Their EPS guide they beat the midpoint of their guide by 0.09 and 0.03 of that beat was from Foreign exchange gains that were non-operational. In their guidance they had baked in FX volatility. Want to remain prudent with rates and macro environment being uncertain.

Q: How much incremental orders in your backlog were you able to satisfy? Considering supply chain improvements in the 1st QTR? On FX as well for headwinds?

A: Simply put not enough. We have a good pipeline in front of us and we continue to improve on the supply side. But simply not enough. At SAM we flagged a 0.30 FX headwind and we even had headwind above that this QTR and still posted the numbers we did today. 30%+ FX impact on EPS is factored in and we’re still raising our guide with this accounted for which is just outright impressive considering FX got worse this QTR as well.

Q: Questions on AI and its impact on High compute, storage, networking etc

A: Networking, or inter-connect fabric, to connect 40k GPU’s at scale requires a unique differentiated fabric. That’s what the Frontier is all about. Next gen we can easily connect 80k GPU’s because our software and silicon can scale to those levels. So that’s a unique value proposition that you won’t get in the public cloud environment. The other unique is the Cray programming environment which allows you develop and deploy these AI models at that scale. In order to leverage all these capabilities you have to prepare the data and the data pipeline requires a lot of work upfront to maintain compliance. With our acquisitions of Pachyderm and another one it automates that process by training the model and deploying them easily. We’re at a unique point in the market where we are prepared to capitalize on all levels. You’ll hear about these new opportunities in the next QTR’s and we’re excited to announce them. Customers are approaching us left and right.

Mainly tossing this section in here to show that there is some similarity in NVDA’s general charting and ER numbers as HPE’s. It’s loosely following similar trends but Nvidia does have substantially more significant EPS #’s albeit more volatile in the difference and range of their reported numbers.

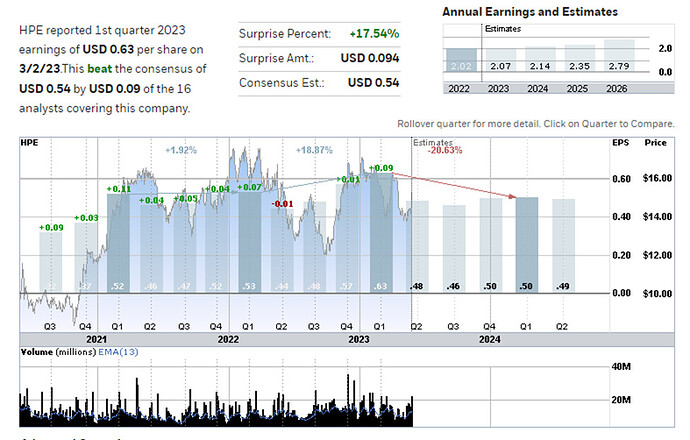

Institutional Ownership is nice and hefty with lil flows

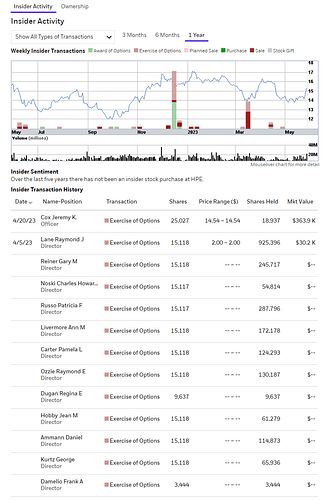

Kinda funny that the CTO sold going into a surprise ER beat. Also lots of options exercised in April. Not too surprising. Went back and looked for the year I had and guessing its around their performance review cycle when they allocate RSU’s or options for the employees so it’s use it or lose it stuff.

<@768562231964860426> this actually transfers from Discourse really well. Kinda impressed. Was expecting it to be all jumbled and not good. The formating is off a bit

Just cause the Discord thread isn’t super easy to read this extended post:

TL;DR

Seems that they’ve intentionally guided up this QTR they are about to report and gave quite a few interesting allusions that they’re basically better positioned than anyone else for the AI opportunity at large. Rather bold claims to make but considering they actually have the accreditations to make those claims will likely be an interesting ER.

Thank you <@151954037544189952> for the work you put in here. They do seem to be positioned well for AI growth. my one concern about them is the 17.xx price wall they have had historically, they closed at 15 and some change on Friday, so upside may be limited if they beat, and maybe this is the time they break to a new ATH. Have to decide how I feel about that as it is going to be some sentiment driving this. As far as over the next couple weeks its going to depend some (unless they can pull off an NVDA) going to be some market pressure too.

I mean in the world of AI ATH’s aren’t real they can’t hurt you.

But seriously, yeah makes me want to go light for call and be ready for the after call movement.

I’m leaning toward shares in HPE, AI, MRVL, and CRWD this week, and maybe some calls, but with the jacked IV, not sure if it makes sense or not.

It will never makes sense! You gotta be lucky in the market and avoid stupidity

Very well done DD, thanks <@151954037544189952>!! Might take small call position for ER ![]() Yahoo Finance says that their earnings are tomorrow tho?

Yahoo Finance says that their earnings are tomorrow tho?

Yeah I stumbled on this being possibly something Friday after close. So at least we got something <:pepepray:930324508018106448>

Yes, after market close tomorrow

Alright, we ride at dawn tomorrow <:pepesalute:937785778698862633>

I do think they might beat and maybe have bullish guidance, but I also think staying very close ITM is probably the smart move as if you soom out and look at them, hgh 17 has been a brick wall for HPE. I do not think I would bet too much on them breaking that right at the moment. And hey if they do ITM calls are gonn make money too.

yup I was literally max getting like 2 atm or itm contracts and just chilling.Mainly did the DD to see if there were patterns to be seen on this AI services stuff honestly