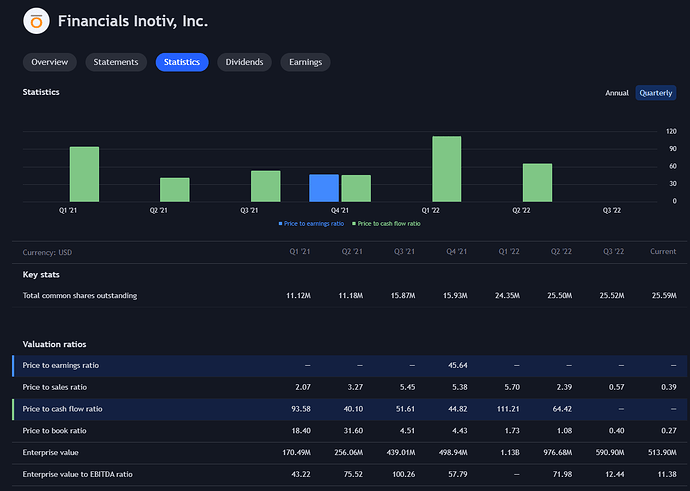

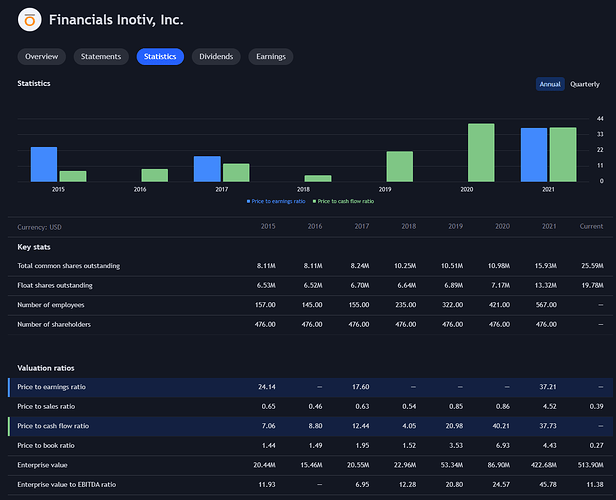

Could somebody take a look at this ticker? P/B of 0.27 in hot biotech sector looks really low, especially with such a stable growth rate.

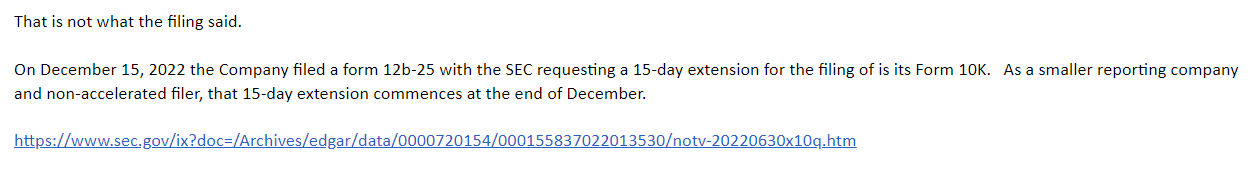

Earnings were postponed until 28th, which resulted into bigger dip last week - probably daytraders selling off their positions at once on the “news”.

Currently it is showing strong support at 3.9$ so I sold the shares and bought 5c expiring at January for 0.3$.

Inotiv currently generate revenue equivalent to its whole market cap every 2 months and ask side is quite thin.

Unless we get completely fucked up earnings I expect atleast recovery to 6-7$ which would result in 300-700% gain.

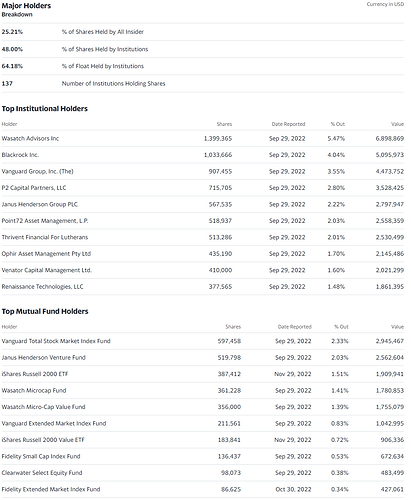

NOTV 100% unrealized profit so far, still time to consider jumping in on low volume before earnings next friday. Looks like somebody is steadily buying in / averaging down (64% of float is owned by institutions) Below 15% daily move at the end of the day to avoid getting on big mover lists, I wonder if its gonna end up at 5.25$ today…

Apparently the new ER date might be later. They filed at 15th december, but the official deadline was probably on december 31th and 15 day period starts at that date, not at the date of the filing. -.-

Finally - earnings next tuesday - even tho they had time until friday. Hovering around 5 at low volume for now. I am still holding the calls at current 120%… Hopefully wont regret it… ![]()

Just reminder that NOTV earnings are today after market close. It probably does not show on the brokers as they postponed.

nice call! sold at the peak for 500% return

Also sold, 580% gain. Might jump in later as it will probably go double digits next month. Insiders blackout period is over this friday.

What do you think a good price to jump in?

Really no Idea, technicals would say around 6.3$

And probably longer term options as next earnings is close on 9th January. But it might not drop at all. Might buy just into stock as it will def go up.

Bought back in again.

11x 5c february 17 calls at 1.85$. Earnings should be between 9-13 February.

Did you get back in? CEO just bought 60k shares right after blackout period ended.

I will hehehe! I think it’s a good price

Couple of thoughts as requested:

-

Their two business models, Discovery and Safety Assessment (DSA) and Research Models and Services (RMS) are high in demand but i believe at the same time it is a competitive space.

-

In their annusal report they share the following in terms of competition:

“For DSA, we have many competitors, including three public companies in the U.S. and one public company in China.”

"For RMS, there are five main competitors, including one public company in the U.S., two privately-held companies in the U.S., one government-funded, not-for-profit entity in the U.S., and one privately-held company in Europe.”

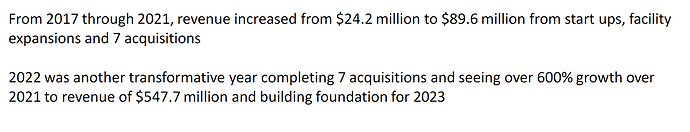

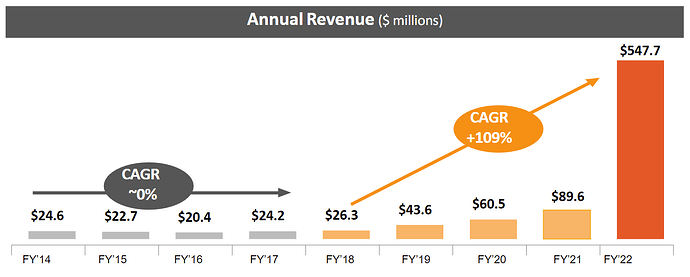

The Company delivered an extraordneity reveneau growth, from $70m in 2021 to $550m in 2022. The following is mention regarding the growth in their annual report:

Revenue grew to $547.7 million during the fiscal year ended September 30, 2022 (“FY 2022”) from $89.6 million during the fiscal year ended September 30, 2021 (“FY 2021”), driven by a $75.7 million rise in DSA revenue and $382.4 million of incremental revenue from our RMS business. Growth resulted primarily from acquisitions and growing customer demands along with favorable pricing.

But this growth comes with a high cost of revenue:

- Part of it was the one time cost regarding recent acquisitions:

RMS operating loss was $189.3 million in the fiscal year 2022. The loss includes non-cash charges for goodwill impairment of $236.0 million, $24.7 million intangible amortization related to intangible assets acquired through the acquisitions of Envigo, RSI, and OBRC, $11.1 million of depreciation expense and $10.2 million amortization of inventory step-up related to inventory acquired through the acquisitions of Envigo and OBRC.

- Consistent Operational losses in the last years, data point of 2022:

RMS operating loss was $189.3 million in fiscal year 2022. The loss includes non-cash charges for goodwill impairment of $236.0 million

- Lower supply over the next year as a result of the time it’ll take to audit facilities in Cambodia.

We continue to work with external and internal resources to review our current NHP inventory from Cambodia and we’ll begin shipments of these NHPs only after such time that we can reasonably determine the NHPs in our possession are purpose-bred and not wild caught. While we are not currently aware of any outside constraints on importing NHPs from Cambodia, Inotiv will not import from Cambodia until we can complete satisfactory on-site audits of our suppliers. We are in communication with our Cambodian suppliers and we expect that we will be able to be on-site in Cambodia to complete these audits during this quarter. We do understand Cambodian officials have stated that they will be shipping NHPs.

So the big question mark is about profitability as the company is still not profitable. I believe a sustainable plan in terms of the profitability mid to long term will drive the stock price in the future. You can argue the company is undervalued, at the same time there is a reason why its undervalued (see above). If you believe they can address the profitable and the supply chain I can see it as good long-term investment, for the next ER i am not sure how much they are ready to share yet.

Solid dip this week. Very high dark pool volume, usually around 30-50% pre day.

Earnings next monday AH.

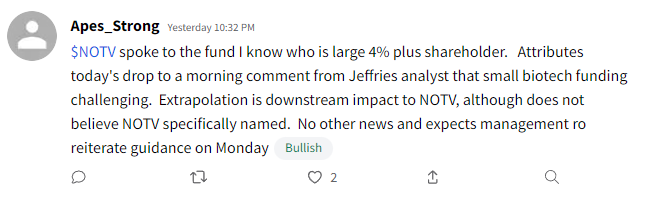

Yesterday even more so, with whole biotech as cunts at Jefferies went full gay bear.

The article (Biotech Stock Outlook: Layoffs, Cuts As Funding Tumbles, Jefferies Says):

Investor presentation made this february(https://ir.inotivco.com/events-and-presentations/default.aspx):

Highlights:

$NOTV - ER today at 16:30.

Sold all for 57% gain.

Lower than I could have as I was 95% up at one point, but was expecting better news on ER, so held till now.

I assume it is going to be manipulated until lawsuits are over and held up NHP stock is being sold at full pace. Also did not want to hold through OPEX.

Possibly gonna swing for that again through APR calls, unless it goes immediately nuts. PT on these issues resolved is around 10-12 atleast, as current book value is 14.