Potential Downtrend Weakening/Reversal Point on 30m Timeframe for OXY. This may be a good spot to start scaling into calls.

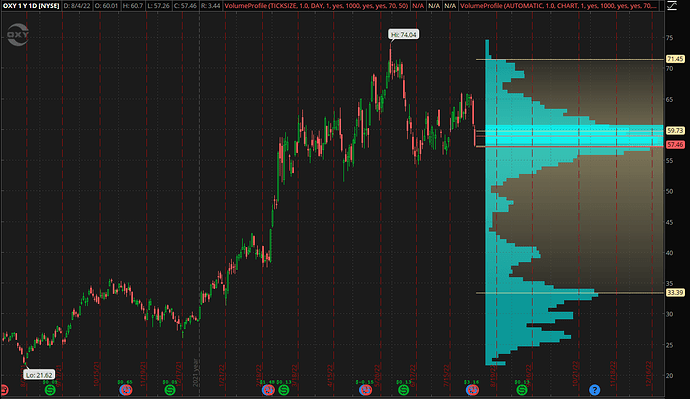

Ok this one I am a bit stumped. On one hand, it is near the support of 56/57 area. Most price targets are above where it is currently trading in the 70’s range. Some just came out and gave price target of 59…If we try a few calls if it touches near 56 then average down would be needed if it drops to 54. The oil market also grabs a hold of this stock (of course) and SPY sometimes leashes onto this one too. So it can be difficult to trade with all these factors. It has been in a downtrend the last 4 days and is near our support buy. They beat EPS on 8-2 $3.47 to $3.02 estimate. Berkshire owns more than 80 mill warrants with strike price at 59.62 that kicks in after preferred shares are redeemed. I think the oil market uncertainty (Pricing/Supply) and guidance that said this is the main concern shows why it has dropped. Also it ran from 56 to 66 starting 7-14 to last week. Maybe I just start with 1 contract 2-3 weeks out around 60 strike price. Thoughts?

Very interesting, also because the pattern since they resumed dividends is a drift up between earnings and dividends, and then a fall.

Now… there is this “little” bit in the earnings:

While we expect future dividend increases to be gradual and meaningful, we do not anticipate the dividend returning to its prior peak

They just had record cashflows of 10B on 26B of revenue. What are they smoking!? This could indeed be what markets are punishing them for.

Having said that… there’s this bit near that quote:

Once we have completed the $3 billion share repurchase program and reduced our debt to the high teens, we intend to continue returning capital to shareholders in 2023 through a common dividend that is sustainable at $40 WTI, as well as through an active share repurchase program.

If I were to guess - and this is a very lightly researched guess - they are probably shifting majorly to buybacks. Buffet loves that stuff. They have repurchased $1.1B worth out of the $3B allocated for this year, which isn’t bad for a $57B company.

Unfortunately, share repurchases play out over looooong time periods.

For the here and now… decent volume in this area though, and we are approaching a trendline. Perhaps consider going long if $57 support holds on repeated test?

I am listening to the call now and they did say a lot of their focus is destroying their debt and focusing on share buyback etc. More mentioning about how they can’t predict the oil prices and supply. I wonder if @The_Ni pointing out the pattern that is drifting up was actually because Buffer started buying in and with them killing earnings it kept going up vs the typical down movement you would see on dividend. If I do calls it will be hard for me not to cut if it goes below 54 ish area. Wonder if this will be a reset to the mid 40’s range.

Morning Update

The last AH signal for OXY was a STRONG SELL on the 30m Timeframe

The last signal can occasionally be indicative of a sustained trend, however opening volatility can quickly change the situation so be sure to be mindful and take profit if you see it.

Confirmed Buy Alert on 30m Timeframe for OXY.

Potential Uptrend Weakening/Reversal Point on 15m Timeframe for OXY. This may be a good spot to start scaling out of calls.

A Normal Buy Signal has Turned Strong on 30m Timeframe for OXY. Consider Dropping Puts.

Morning Update

The last AH signal for OXY was a WEAKENING SELL on the 30m Timeframe

The last signal can occasionally be indicative of a sustained trend, however opening volatility can quickly change the situation so be sure to be mindful and take profit if you see it.

Strong Confirmed Buy Alert on 30m Timeframe for OXY.

Potential Uptrend Weakening/Reversal Point on 15m Timeframe for OXY. This may be a good spot to start scaling out of calls.

Morning Update

The last AH signal for OXY was a WEAKENING BUY on the 30m Timeframe

The last signal can occasionally be indicative of a sustained trend, however opening volatility can quickly change the situation so be sure to be mindful and take profit if you see it.

Potential Uptrend Weakening/Reversal Point on 15m Timeframe for OXY. This may be a good spot to start scaling out of calls.

Potential Uptrend Weakening/Reversal Point on 30m Timeframe for OXY. This may be a good spot to start scaling out of calls.

Confirmed Sell Alert on 30m Timeframe for OXY.

Potential Downtrend Weakening/Reversal Point on 15m Timeframe for OXY. This may be a good spot to start scaling into calls.

Morning Update

The last AH signal for OXY was a STRONG BUY on the 30m Timeframe

The last signal can occasionally be indicative of a sustained trend, however opening volatility can quickly change the situation so be sure to be mindful and take profit if you see it.

Confirmed Sell Alert on 30m Timeframe for OXY.

Positioning before 10AM is generally not reccomended due to increased volatility

Strong Confirmed Buy Alert on 30m Timeframe for OXY.

Potential Uptrend Weakening/Reversal Point on 15m Timeframe for OXY. This may be a good spot to start scaling out of calls.