@PolyP , @Shadowstars has done a great job documenting that RSX has been liquidating the shares they could through their holdings that weren’t halted. See the linked comment.

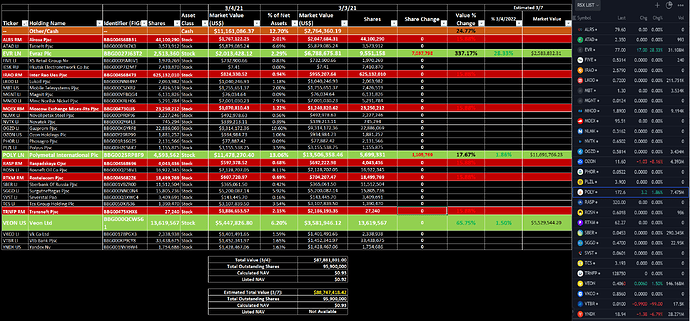

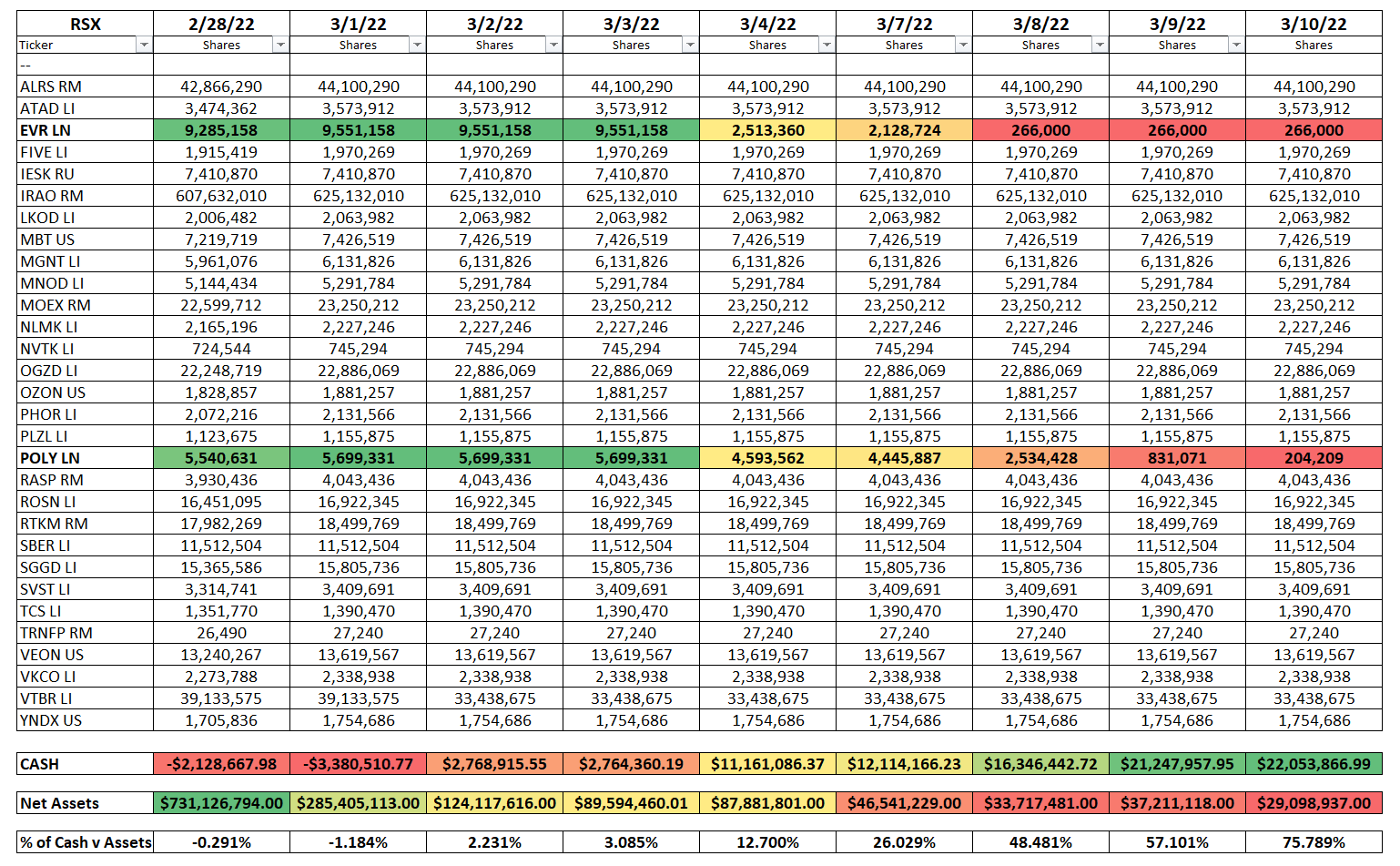

@BBarna and @Shadowstars have been on it, look at the dates along with line items for cash position, and here’s a quick screen grab of todays

notice cash is increasing along with the cash % of portfolio

Thanks! Good to know

Noob question here, so feel free to ignore if its stupid; but does there come a point where they legally have to announce liquidation if they carry on selling stock and converting to cash?

Presumably you can’t have an ETF that’s 100% cash? Or maybe you can?

I’m just thinking if we’re seeing the % of cash rising significantly every day, we might be able to workout the date when a hypothetical threshold is hit.

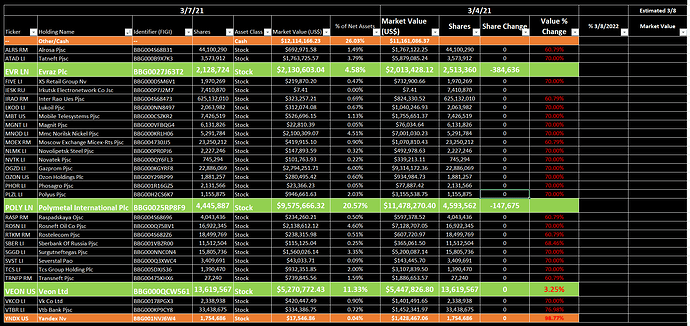

It’s not just converting to cash. Look at their holdings. 27 of the 30 stocks are now valued at one penny per share. They aren’t liquidating. They already liquidated.

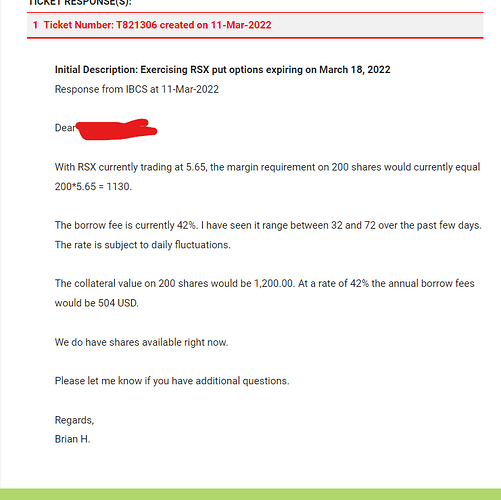

Is 100% margin req the strike of the contract x 100 x # of contracts?

Margin requirements are based on the underlying value, shouldn’t have anything to do with the option strike price.

With IBKR you have the ability to show margin impact before you make a trade, so prep an order to short 100 shares of RSX (you can do this even though its halted) and then right-click “check margin impact” and you will see the effect on initial and maint margin before you exercise

As your note from Brian H shows, they are valuing RSX at $6 per share in terms of margin ($1200 for 200 shares), I guess they round up from $5.65 ?

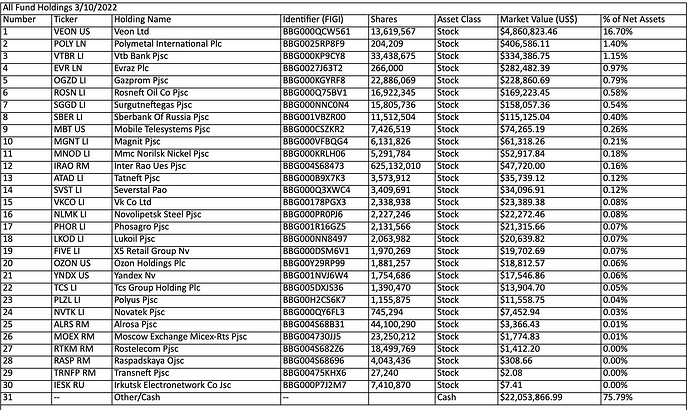

RSX holdings table 2/28 - 3/10.

Showing share movement of all holdings and the cash holdings.

Clearly from 3/4 onwards we see them selling off their positions in EVR/POLY on a daily basis…

Sent an email to the OCC earlier:

Good afternoon,

As I’m sure you’re aware at this point, a great deal of options will be expiring worthless today for RSX. Brokerages and investors alike are practically begging your organization to step in and set these things to cash settlement. Share borrow availability is extremely low and brokerages are now quoting 500% margin requirement and as high as a 39% DAILY fee in order to exercise options that were purchased and are in the money. So in order to exercise these contracts, people are having to agree to lock up 500% of the trade value and pay an additional 39% fee daily on a stock that we have no clue when it’ll be unhalted. Absolute insanity.

You are allowing VanEck to impeach the credibility of options contracts by refusing to step in and do what’s right in this situation. The RSX fund is currently 76% cash as of today. They have been liquidating the entire length of the halt and have simply refused to admit that is what they’re doing at the cost of 10’s of millions of dollars from innocent investors who were right .

The facts at this moment are as follows:

VanEck is liquidating this ETF while its halted

There is not enough share availability for investors to reasonably exercise the contacts they purchased

Even if the shares can be found, the fees being charged are completely prohibitive to any “average investor”, meaning exercising is not possible for most options holders.

In this situation cash settlement is necessary to preserve the integrity of options contracts as an investment .

What message does this send? Buy options contracts but don’t be too right or we’ll shut you down? Infuriating.

Please, someone, anyone, speak to whoever needs to be spoken to and help these people. You guys have the ability to do it.

Their reply:

Thank you for contacting us at OCC. Though we are closely monitoring the situation with RSX options, we do not have the ability to arbitrarily assign a cash settlement on options in which the underlying shares still exist. However, should the situation change, updates will be posted on our public website.

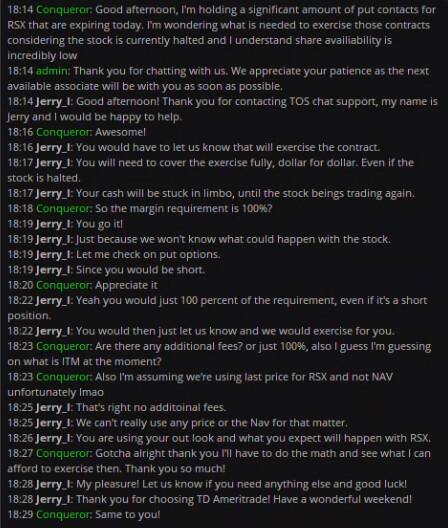

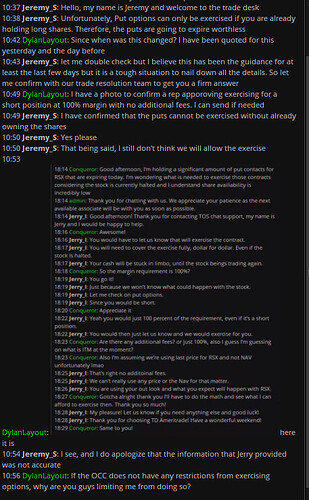

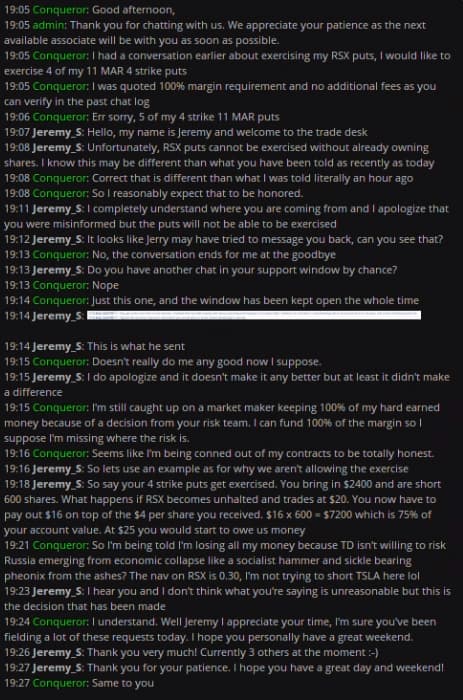

This is what TD told me on Tuesday:

------- Tuesday, March 8, 2022 -------

10:16 Anonymous so far: What do I need to do to be able to excercise my RSX puts by 3/18 and be able to be short RSX shares?

10:16 admin: Thank you for chatting with us. We appreciate your patience as the next available associate will be with you as soon as possible.

10:18 Jeremy_S : Good morning, my name is Jeremy and welcome to the trade desk today

10:18 Jeremy_S : RSX puts can only be exercised if you are already holding long shares

10:23 Anonymous so far: Is this just because my account is cash?

10:24 Jeremy_S : No it is due to the options and security itself being halted

10:38 Anonymous so far: Why would I not be able to open a short position?

10:39 Jeremy_S : Because no trades are currently being accepted

10:53 Jeremy_S : What other questions can I answer for you today?

11:19 Jeremy_S : I hope you have a great rest of your day. Feel free to reach out to us with any further questions that you might have, either here or the trade desk via phone at 800-672-2098

I am asking again now.

i had to phone in to Scotiabank, a Canadian bank, to ask about RSX as i have a few in my investment account. they said their derivatives department is getting flooded with calls right now due to these halted securities

I think I forgot to post the email response from Webull that was back on Mar-6. Here it is just for the record:

Thanks! I sent an email to all 3 of my Congressmen.

I know you are a lawyer, and it’s very helpful as you can pursue, however I have been in a lot of situations in my life, with arbitration clauses and firms that have means to drag things out, I am not a lawyer however my take is I am going to be screwed , and they are going to say it’s the federal governments fault for the halts and unfortunately I can not sue my self since the federal government is the rule maker. Therefore I would happily join a class action suit but my gut feeling is president pelosi gets options excercised and I get the shaft.