RSX has further reduced the number of shares they hold between 3 March and 4 March. They sold 1.1M shares of POLY, reducing their holdings by 19% and sold 7M shares of EVR, reducing their holdings by 74%. They now hold 12.7% cash, compared to 3.2% the prior day. This also means that currently trading stocks move the NAV less.

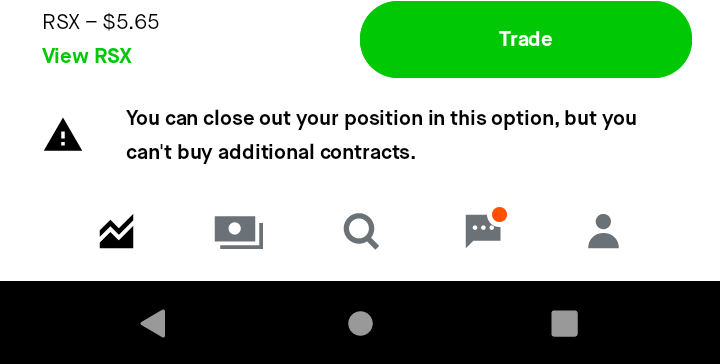

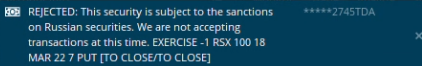

Error message received when attempting to exercise one of my ITM RSX puts via ThinkOrSwim this morning.

Not concerned just seeing if it’d work.

Tweet from Bloomberg ETF Analyst

https://twitter.com/EricBalchunas/status/1500861413555908609?s=20&t=Vf8g5dmYAPXM03jnLECx-w

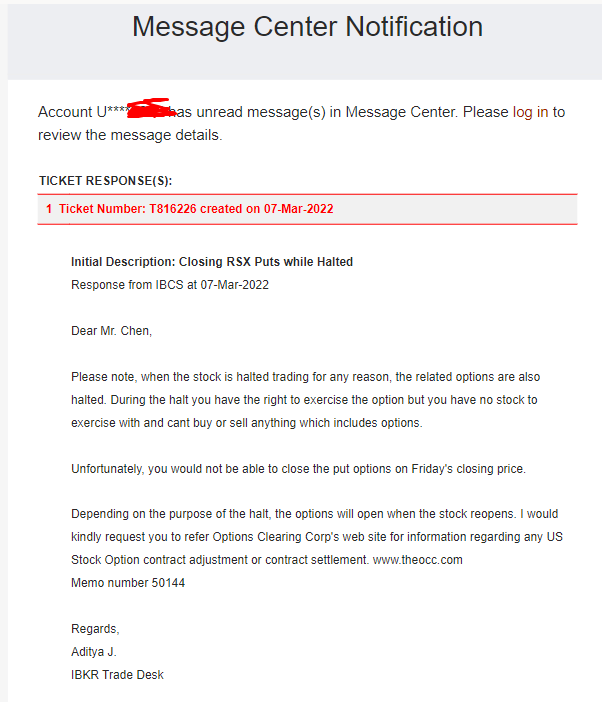

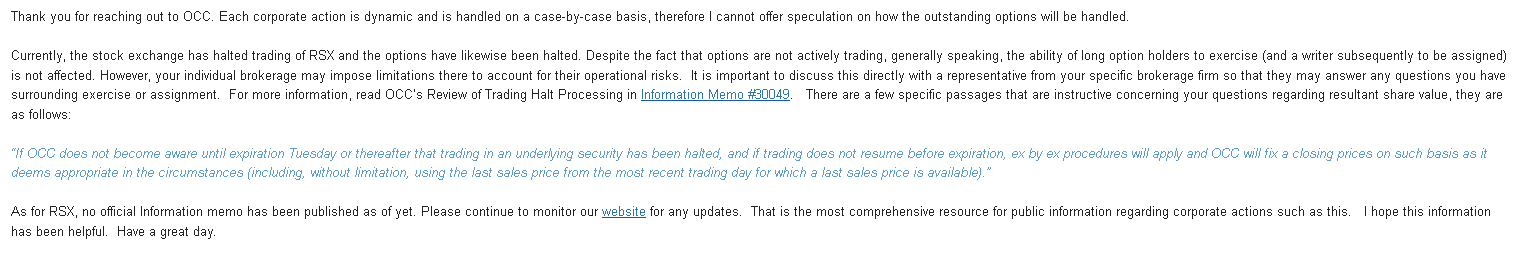

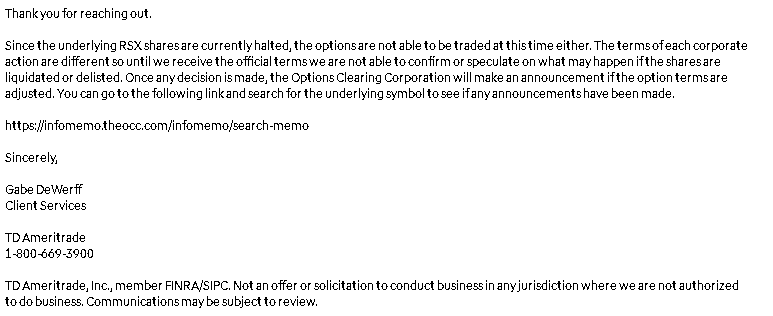

i sent an email to the OCC as well as my broker. i received a reply from the OCC but not from TD as of yet, i will update when i do.

From the OCC;

Memo 30049

30049.pdf (35.7 KB)

So the OCC says you should be able to exercise, but brokers can restrict that (and have from several members’ experience). And that if they don’t get word about the halt before expiration, the OCC can set a price to settle options at, which may be the last traded price of RSX (or another price). As far as I know, last traded price was $5.65.

Thanks for sharing that email. Still not worried yet, we have time for this to get settled.

I agree completely with his assessment. To me, the decision is pretty clear cut, either they stocks are sanctioned and untradeable, or they’re not. If they’re not, it’s a $0 and cash settlement is required. If its not the case, then there is no reason for the stocks to be halted. I’m thinking we get resolution on this sooner rather than later.

Chat with TDA today and was told that due to the difficulty in locating RSX, I would be restricted from exercising–I wouldn’t be allowed to hold it short.

However, regarding a conversion to cash-settled or something else, they don’t know yet. Was recommended to inquire again tomorrow or later in the week.

The main reason right now that I think this is the case as well, is the fact that there is a specific halt code on NASDAQ (T8 = Halt - Exchange-Traded-Fund (ETF)) for ETFs and it was not used for RSX, instead H11 = Halt - Regulatory Concern was used. T8 would be reasonable halt as well, since almost none of the holdings are trading and that is a reason given in the description. So it’s not a giant leap from here to reach your conclusion

Fidelity said they expect to hear from the OCC tomorrow on further instructions.

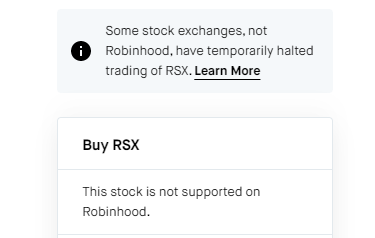

Spoke with RH. Same story as every other broker. They will wait to hear from the OCC but according The person that I spoke with said that if RSX remains halted through expiration date (I have some 3/11s) that those contracts will most likely expire worthless. Just figured I’d update for RH users

Sounds like the person you spoke to at RH might not know what they’re talking about. I’m waiting on word from OCC and VanEck.

I don’t think they had a clue what they were talking about as well

RSX oi 2022-03-07 - Trade Alert.xlsx (45.3 KB)

Just as an FYI for everyone, I have attached the OI for RSX. There is roughly 42K OI in 3/11 PUTS and 185K OI in 3/18 PUTS. Total OI Puts and Calls for RSX is close to 1 million. There have to be a lot of institutions holding positions, i don’t believe retail can hold that much volume. I believe that they have to come to a solution at least before the 3/11 expiry and definitively befor ethe 3/18 since there is a lot of OI on that date.

I’m a fan of this take. The sheer amount of OI on these means institutions are waiting on an answer too. Wouldn’t be surprised if this is resolved by Wed.

Just an update. From TD;

The link in the picture for the OCC memos

https://infomemo.theocc.com/infomemo/search-memo