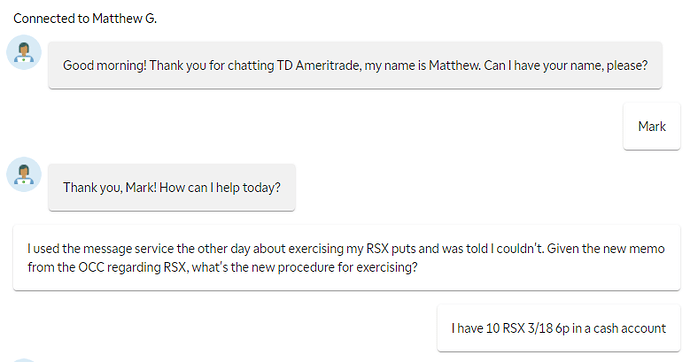

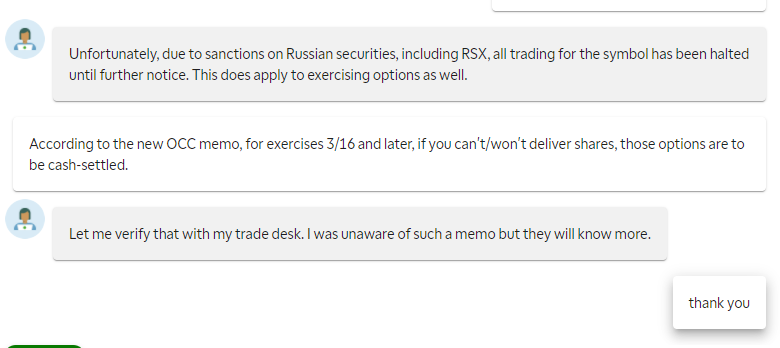

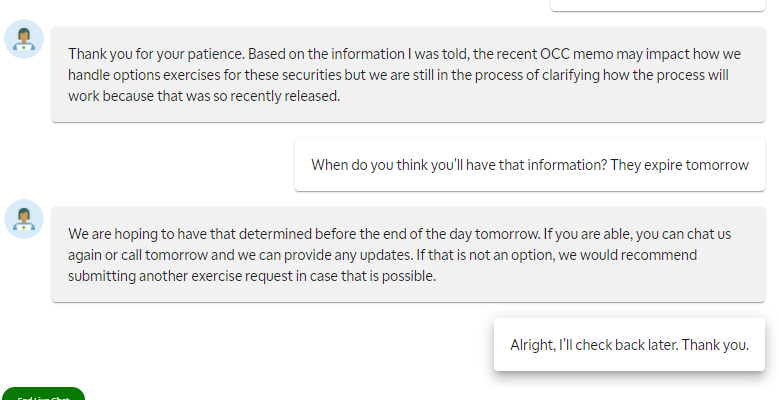

Live chat with TD.

Just called back into Fidelity. I have to notify Fidelity that the conversation would be recorded, and they refused to continue with the conversation until I guaranteed I would not record.

I hope very much you’re right. That’s the avenue I’m taking my ticket as well-

Hi Abe,

Thank you for the quick reply, I hope your day’s going okay too; I imagine there’s an uptick in support requests today, I also hope people are staying calm and collected when speaking with you all. As for my day, could be going a little better, it’s frustrating to have accurately predicted an outcome on options only for a vague and unprecedented extended trading halt to come in and just wipe out all that OI in 3/11 and 3/18 puts. VanEck’s cash holdings have increased MASSIVELY since the halt, they are for all intents and purposes already liquidated, hanging on to two tickers by a thread. It’s (I think possibly literally) criminal.

This situation completely overturns the good faith the market is supposed to be running on. If this ticker can be halted seemingly indefinitely for ‘security concerns’, causing all (some of them extremely ITM) contracts to expire worthless, what’s stopping the people who make these decisions from throwing out an H11 halt on ANYTHING that’s running too hard? Look hard enough and you can find a ‘security concern’ on any ticker. If nothing else, pass this sentiment up the chain to the OCC, CBOE, and the rest of the market makers. They are currently demonstrating the rules only sometimes apply and can be changed on a whim, it makes investors lose faith in the institutions that are supposed to protect us. Sorry for venting, I know RH isn’t responsible for those decisions.

Okay, since shares of RSX cannot be delivered, mainly I’m looking for what the broker-to-broker cash settlement looks like here for these puts. I was hoping you might have information on what that cash settlement price may be and/or when it may come through? Mainly for RSX, OZON is an actual Russian ticker so the suspension there is somewhat justified (if not over extended), RSX is an American ETF with no good reason to still be halted, and should have either unhalted or liquidated by now. Very, very frustrating, but at least the OCC is allowing for cash settlements, that’s some small solace.

Thank you again for your time and patience - real name

TD:

10:50 Anonymous so far: What would it take to exercise all of them?

10:54 Sonja_T : i can ask on that. If approved you would be short shares of a halted security, and if it unhalts it would likely because of peace in Ukraine in which case Russia sanctions may be lifted and the stock could potentially skyrocket, wiping out the account without you having a chance to do anything about it. I do want you to be aware of the risk in this transaction.

10:56 Sonja_T : I do have confirmation that you would be able to exercise tomorrow on day of expiration, you would have to contact us tomorrow, your account would need to be able to support a 500% up move.

Here is where things stand with me:

- I am not allowed to exercise my RSX puts and Fidelity is “not able to locate shares due to MOEX being halted”.

- They do not have the current borrow rate “at this time”.

- They are unware of a margin requirement “at this time”.

- Fidelity will not put anything into writing as the situation regarding “RSX is too dynamic” at this time.

- After explaining to Jasper Hodge, a Supervisor (his title) at Fidelity that the OCC memo clearly states if a broker refuses to allow me to go short, the options should be settled in cash, Jasper stated he will take this internal as this memo is new and they need time to determine how I will be able to exercise.

- Jasper stated nothing will be exercised until I provide confirmation and the process will be a manual process I will need to complete.

- Again, none of this will be in writing as is Fidelity’s official stance.

11:03 Anonymous so far: Hi, I was told last week that TD Ameritrade did not have shares available for me to exercise my RSX put options that expired on 3/11. Since this is the case, I would like to know how TD plans to settle my 3/18 put options in accordance with the new OCC memo. Here is the link for your viewing pleasure, https://infomemo.theocc.com/infomemos?number=50188

11:03 admin: Thank you for chatting with us. We appreciate your patience as the next available associate will be with you as soon as possible.

11:04 Alexander_M : Thank you for contacting TD Ameritrade Trade Desk!

11:06 Alexander_M : One moment please Rodger and I will review your RSX position!

11:13 Alexander_M : I checked with our order romm and they confirmed- assuming nothing changes between now and expiration they will simply expire worthless

11:14 Anonymous so far: Did you not read the memo at all?

11:15 Alexander_M : I did not, We have a risk and order room that assist us.

11:15 Alexander_M : If you want to speak with them directly, please call us at 800-672-2098

11:16 Anonymous so far: Apparently they need to learn to read as well then because the MEMO from the OCC states that if my broker will not allow me to exercise due to them not having available shares then a cash settlement is in order

11:16 Anonymous so far: I am not calling, I am doing this all via chat support or email so I have documentation for the class action lawsuit for RSX for all involved parties

11:17 Alexander_M : I will have them go over the memo- one moment!

11:20 Alexander_M : Looks like RSX was removed from ex by ex processing - thats where we auto exercise if its in the money. You will have to request exercise and margin is reviewing.

11:22 Anonymous so far: How is that possible when just last friday me and multiple other people were told my multiple different TD Ameritrade representatives that they did not have the shares of RSX available to exercise the put options to go short? Or would TD Ameritrade officially like to state that they lied to their customers?

11:23 Alexander_M : And we could exercise if you can upport a move of about 500%

11:24 Anonymous so far: that is insane why is it so astronomically high for highly in the money put options?

11:31 Alexander_M : I should have made a headlined there… I dont know if thats the exact percentage however thats where we are operating from as a firm. For Example, If RSX comes back at $10 a share and a client is short all those shares after exercise his account would be negative. Thats a lot of risk for the client and our firm.

11:32 Anonymous so far: So what is the percentage I would have to pay to exercise my deeply in the money put options for RSX?

11:35 Alexander_M : I will see if I can get an exact percentage! 500% is a safe for what I have seen.

11:37 Alexander_M : Our risk team confirmed, we are approving exercise on a case by case basis: If the account does not have long shares, the account needs to handle a 500% up move on the resulting short stock position.

11:38 Alexander_M : You will need to deposit about 19k and we can then review the exercise.

11:40 Anonymous so far: Okay that is completely unreasobable and insane, also how did TD Ameritrade suddenly come into having available RSX shares to short when they told me and others last week they did not have them available and we could not exercise our put options on 3/11?

11:40 Alexander_M : were only accepting them on dya of ex since the situation with these is changing frequently

11:40 Anonymous so far: and now all of a sudden its a 500% rate once someone reads an OCC memo? Does that not sound completely criminal to you?

11:41 Alexander_M : We can not exercise any shares until tomorrow and tomorrow its a case by case.

11:42 Anonymous so far: Please answer the question of how TD suddenly has RSX shares, when they did not last week and the stock is halted and unavailable for purchase

11:43 Alexander_M : There is no way we could have exercised your shares last week. WE can not exercise it today either.

11:43 Anonymous so far: How is TD going to exercise it tomorrow all of a sudden

11:44 Anonymous so far: please stop walking around the question and just answer how TD suddenly will have shares available to short

11:44 Alexander_M : we dont have the shares thats why you need to support that epr

11:44 Alexander_M : The shares arent clearing anywhere

11:44 Anonymous so far: If TD does not have shares available to borrow then TD needs to cash settle my options

11:45 Alexander_M : once the stock unhalts, inventory of shares would be assesed and if no shorts could be located client would be forced to close

11:46 Anonymous so far: Per the OCC memo “The deliverable for RSX options contracts will remain 100 RSX Shares. If it is not possible for the delivering Clearing Member to effect delivery of the RSX shares on the designated settlement date, then the settlement obligations of both delivering and receiving Members shall be delayed until such time as OCC designates a new exercise settlement date, settlement method and/or settlement value. This determination allows delivering Members the opportunity to effect settlement if they have RSX shares and are able to effect delivery, but delays the settlement obligation when this is not possible. Both the delivering and receiving Clearing Members are required to immediately notify OCC if they are unable to effect settlement.”

11:47 Anonymous so far: Since TD does not have available shares as you have stated, either a new exercise settlement date or settlement value needs to be decided

11:50 Alexander_M : We can exercise your shares tomorrow pending margin approval and if you deposit the 19k. Otherwise, the options will expire worthless.

11:51 Anonymous so far: Did you not read anything from the OCC memo that I just sent?

11:52 Anonymous so far: You said TD Ameritrade does not and will not have RSX shares available to effectively deliver to me by the designated settlement date (3/18) so per the OCC memo, TD needs to designate a new exercise settlement date or settlement value

11:53 Alexander_M : [image]

11:53 Anonymous so far: we dont have the shares thats why you need to support that epr

11:53 Anonymous so far: that is what you said

11:54 Anonymous so far: 11:44 Alexander_M : we dont have the shares thats why you need to support that epr

11:54 Anonymous so far: literally less than 10 minutes ago

11:57 Alexander_M : Is there anything else I can help you with?

11:58 Anonymous so far: Okay so you are just ignoring what I said?

Basically RH saying they’ve read the memo and are choosing to ignore it and not allow exercising and not contacting the OCC.

My response:

Hi Evan,

Thank you for the quick reply. I imagine there’s an uptick in support requests today, I also hope people are staying calm and collected when speaking with you all. It’s frustrating to have accurately predicted an outcome on options only for a vague and unprecedented extended trading halt to come in and just wipe out all that OI in 3/11 and 3/18 puts. VanEck’s cash holdings have increased MASSIVELY since the halt, they are for all intents and purposes already liquidated, hanging on to two tickers by a thread. It’s (I think possibly literally) criminal.

This situation completely overturns the good faith the market is supposed to be running on. If this ticker can be halted seemingly indefinitely for ‘security concerns’, causing all (some of them extremely ITM) contracts to expire worthless, what’s stopping the people who make these decisions from throwing out an H11 halt on ANYTHING that’s running too hard? Look hard enough and you can find a ‘security concern’ on any ticker. If nothing else, pass this sentiment up the chain to the OCC, CBOE, and the rest of the market makers. They are currently demonstrating the rules only sometimes apply and can be changed on a whim, it makes investors lose faith in the institutions that are supposed to protect us. Sorry for venting, I know RH isn’t responsible for those decisions.

Okay, since shares of RSX cannot be delivered, mainly I’m looking for what the broker-to-broker cash settlement looks like here for these puts. I know you said that RH can’t offer broker-to-broker settlement, but will RH contact the OCC to notify them of this? I just find it ridiculous that RSX is in this situation (but not so much OZON as it’s an actual Russian ticker so the suspension there is somewhat justified (if not over extended)). RSX is an American ETF with no good reason to still be halted, and should have either unhalted or liquidated by now. Very, very frustrating, especially because the OCC is allowing for cash settlements.

Thank you again for your time and patience.

My Canadian bank’s compliance department has stated that I cannot close out the RSX position I’m holding in my TFSA. Unfortunately, they won’t be sending me anything in writing so it was up to me to document everything with them. Here’s my email to them:

Regarding OCC Bulletin #50188 and the RSX put options I hold in my TFSA, I suggested the possibility of opening a margin account and transferring my position in order to exercise the put options and receive short shares.

Today, your representative has informed me to open the account and transfer the put options would be past tomorrow’s expiration date of March 18, 2022, and would prevent me from exercise. Furthermore, your representative has stated that there are currently no available shares of RSX to short and will not know when they would be made available.

Your incorrect interpretation of Bulletin #51088, your inability to provide short shares, and your lack of communicating alternative methods of execution has resulted in the frustration of my ability to execute this contract.

To mitigate this harm, I proposed to your representative to explore closing my positions in a Sell-To-Close order. Your compliance department has denied this request. Unfortunately, my best efforts have failed in attempting to mitigate the harm you caused.

Please be advised that I am considering legal action against your brokerage from the halt in RSX, and the resulting events leading up to this email.

@TheOtherePete just wanted to provide a better response since I was in a meeting.

My account is a registered account, so there’s no option to upgrade to a margin one. And according to the chat, even if I open a separate margin account, I could not transfer ownership of my options to the margin account. So there’s nothing I can do about the account situation.

There’s a whole bunch of technicalities thrown around from the CS rep, saying that yes IBKR indeed has the ability to provide me the shares, but the reality is there really is no way that happens with my current situation. From the day RSX halted, there’s nothing I could have done to transfer those shares to a margin account. So yes, IBKR has the ability to let people exercise their options, but not for my case. And they’re using that general assumption that they can exercise the options to say that I am not able to apply for cash settlement.

I am sorry for the stupid question but ITM and OTM puts expiring tomorrow are apparently going to suffer the same faith correct?

Emailed and messaged WeBull regarding my contracts and the OCC memo. They closed my chat ticket with no response and marked as ‘resolved’. I created a new ticket with a screenshot of that ‘resolved’ ticket.

No updates to the email regarding how this will be handled. My previous communication on 15Mar required a margin requirement of 300% to exercise.

I’ll update if I hear back from either chat or email

So I cancelled my STC order for the 1 put and exercised my 2 RSX 03/18 5.5p. basically, there’s no market to sell. this is what it looks like in IBKR. notice, instead of listing a MM, it lists the OCC:

I’m also taking a $30 loss on the exercise and it shows in my short position because the last traded price was $5.65 and I two had $5.50 puts ($0.15 x 100 x2)

TD just upped it to 600%, but they won’t know even that until tomorrow. Right now they think their risk is that it may go higher than the 52 week high on unhalting.

10:50 Anonymous so far: What would it take to exercise all of them?

10:54 Sonja_T: i can ask on that. If approved you would be short shares of a halted security, and if it unhalts it would likely because of peace in Ukraine in which case Russia sanctions may be lifted and the stock could potentially skyrocket, wiping out the account without you having a chance to do anything about it. I do want you to be aware of the risk in this transaction.

10:56 Sonja_T: I do have confirmation that you would be able to exercise tomorrow on day of expiration, you would have to contact us tomorrow, your account would need to be able to support a 500% up move.

10:59 Anonymous so far: I am curious how the shares suddenly became available?

11:01 Sonja_T: They are potentially approving on a case by case basis on day of expiration, it still isnt a guarantee, it is still a none to borrow security, but if your account can maintain the exercise, and a large amoutn of risk , they may allow. it is a very fluid situation

11:06 Anonymous so far: 500% of what though? RSX NAV reported by VanEck is $0.30.

11:09 Sonja_T: It i higher than they initially said, it would be 600% percent, i appologize, they just gave me that updated info. Again this situation is very fluid.

It will go off of 6x the last price of $5.65 so that would be 33.90 per share that is needed in cash in the account.

11:11 Sonja_T: If you do want to exercise tomorrow, you would want to call in directly to margin risk at 1-877-877-0272 and they are ext 1 and they can take that request from you.

11:17 Anonymous so far: So TD’s official stance is that Russian stocks may be worth more post sanctions than pre sanctions?

11:19 Sonja_T: We do not know, our risk reps have determined there is a lot of potential risk on the table, and we are requiring the 600% movement up in the account for that potential risk.

11:21 Anonymous so far: 600% is higher than the 52 week high

11:23 Sonja_T: There is a certain amount of risk that Td Ameritrade is willing to allow, and in this scenario, they are requiring that 600%. It is determined by our risk reps.

11:25 Sonja_T: You can call in to margin risk if you would like to further discuss, but that is just the risk tolerance for Td Ameritrade as a firm.

TD also told me if the shares were still marked as NTB, they would liquidate the position at whatever price they could. My expectation is they would open the short position, say they couldn’t deliver shares, and liquidate them at $30ish/share and take all that collateral.

My reply, same as everyone else’s…wait and hope for the OCC to release something solid. When I get home I’ll try to poke around and ask for more details about deliverable shares etc

Love that brokers are now trying to scare people into not exercising. Russia is about to default on bond payments, and the sanctions aren’t lifting anytime soon even if peace is reached. The odds that the market re-opens and RSX shoots up to 52 week highs seems pretty far fetched.

Can RSX really stay halted for many months without taking any action? I guess I am about to find out.

My big issue with excersing for anything but cash settlement, is that as it stands right now rsx has a nav of .31, however if I exercise and go short I have to secure with new cash which is my retarded choice. However it seems I can not exit it, also I am going to begin paying interest IE: they are chilling away at my cash….but I don’t even know what rate or nav they will charge the ctb? So if I don’t get money I am personally taking the L.

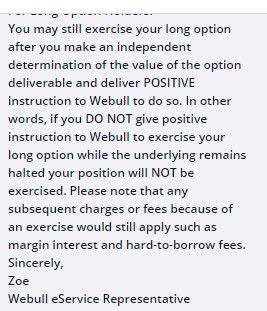

From webull. I have followed up to get details on the fees.