looks like the strike started today. some analysts feel that the strike won’t be prolonged as there was a month-long one back in 2019 and don’t feel workers have the determination to see through another long one. but definitely bearish. this can trade on news like when John Deere was dealing with strikes: updates on the progress for negotiations moving the ticker

https://www.nasdaq.com/articles/sibanye-stops-south-africa-gold-mining-operations-as-strike-begins

1 Like

Thanks for the link.

I closed the march 20cs I still had yesterday for a loss. Added shares for a longer hold.

I have some July calls I’m hanging onto, might add some more long to bring down the cost average.

If precious metals hold these levels it could see a nice bump down the road.

1 Like

can’t help but wonder how this trade would have turned out if the strike didn’t happen. i have two 20c on it and considered rolling them out but probably cut for a loss tomorrow. agreed that metals holding this price level still make SBSW attractive. gonna keep it on my watchlist!

This will stay on my watchlist as well. If this strike last longer than a week I’ll be looking at lowball bids in for July and October expiration. Most recent strike lasted 5 months.

1 Like

I still think there’s potential here, but obviously the strike changed the thesis. Palladium/plat/gold still have elevated prices. It’s had three separate analyst price upgrades in the past few days. I think it can pop once a labor agreement is reached. But, that could be next week, next month, next year.

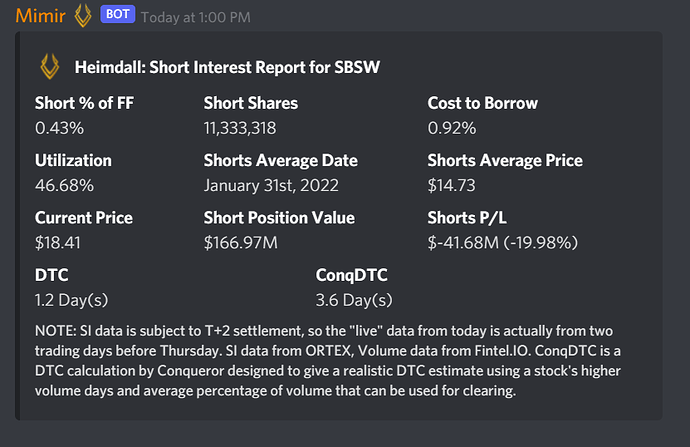

Looks like short interest is increasing:

Obviously, someone who controls a lot of money thinks this could go down farther.

Thesis was correct, there was money to be made up to the strike announcement. Will continue to watch, but there are more fish in the sea. As an alternative platinum metals group play, PLG might have some more room to run. I’m not familiar with their portfolio though.