Tl;dr: It is more likely that we go up, and not down, into opex (4/21).

Both CPI and FOMC meeting minutes turned out to be nothing burgers. The market was already signaling this through the VIX structure, and we talked about the historically low vol in TF using the graph below:

There are some additional numbers coming out over the next two weeks, but given this muted response to both CPI and FOMC, it is difficult to seem them mattering unless they are significant outliers.

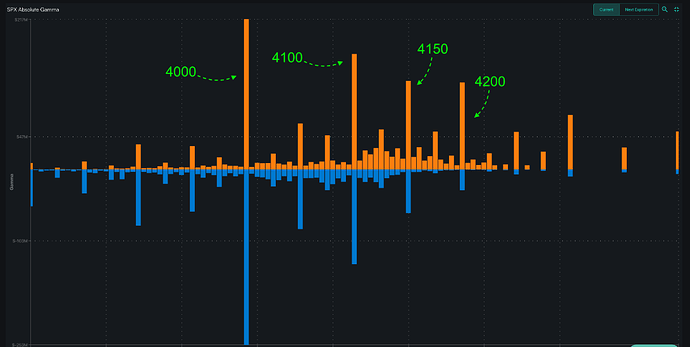

These are the current gamma levels (from SG):

SPX 4000 is significant support, and 4100, 4150 and 4200 are decent levels too. Given where we are in the opex cycle and that we are in positive gamma territor, this is where vanna and charm flows start providing tailwind.

Which suggests that we could slowly walk up to the 4200 level next week. We are unlikely to breach 4200 though.

Note that if we do end up near 4200, it does set us up for a downward move after opex, and we could see some downward front-running after Wed (4/19). But that story is for late next week.