Personally opted to take puts on RSX (1) and OZON (2). The sanctions are a certainty, but as far as raw materials go, we’ve got things like the US releasing reserves that could influence the price against us if we take calls. So for now, the safer bet is just against Russian stocks and we’ll have to see where sanctions go. I’m probably looking at UNG, LNG or WEAT at the moment. Aluminum is another possibility but haven’t fleshed it out.

One possible play is on Uranium. The US gets a fair amount of uranium from Russia and in that area.

https://www.eia.gov/energyexplained/nuclear/where-our-uranium-comes-from.php

Sources and shares of total U.S. purchases of uranium in 2020 were:

Canada 22% / Kazakhstan 22% / Russia 16% / Australia 11% / Uzbekistan 8% / Namibia 5%

U.S. and five other countries combined 14%

If Russia cuts off our supply then not only will uranium prices likely go up but the companies that mine / refine them will go up too.

Companies I usually watch / play are:

- UUUU - Energy Fuels

- CCJ - Cameco

A couple others I just found that are also moving:

- DNN - Denison Mines

- NXE - NexGen Energy

- UEC - Uranium Energy Corp

- URG - Ur-Energy

- URA - Global X Uranium ETF

- URNM - North Shore Global Uranium Mining ETF

I believe there is still a uranium supply squeeze as well, from those Sprott trusts that we’re opened last year. Haven’t read up on it since last year, but wanted to point it out for those looking into it. Keep in mind also, Uranium as an industry moves extra slow, moreso than other miners even.

If Russia starts cutting oil supply to Europe, some of those countries that were trying to scale back before from nuclear might end up ramping back in to meet energy demands. So while I do agree that it typically is a slow mover I think this could be one of those extenuating circumstances / catalysts.

I like the uranium angle. These are mega up so entry right now is not ideal, so watching. Will likely enter CCJ though.

it was brought up on TF about fertilizer prices going up with sanctions against Russia (Beaker, LittleBear, Jopps, Groupie, and Menoir).

this is an article by a Canadian paper forecasting increasing Potash production from Canada’s largest (world’s biggest) fertilizer company, Nutrien (NTR).

thought i’d bring it up because it was trading higher at open while the market was gapping down. had earnings 02/17 and knocked it out of the park. lots of big wicks on the daily candles too. fertilizer is so closely tied to oil prices so my gut tells me there’s more nuances to this trade than just “sanctions on, fertilizer up”. will try and do some more digging.

Not sure if this has been discussed yet:

Ukraine is a major producer of neon gas critical for lasers used in chipmaking and supplies more than 90% of U.S. semiconductor-grade neon, according to estimates from research firm Techcet. About 35% of palladium, a rare metal also used for semiconductors, is sourced from Russia.

The great thing about Neon is that it comes from air and is a byproduct from numerous processes… It was likely that the bulk was being bought from Russia simply because it was the cheapest.

While I’ve seen a few articles mentioning it, I believe it’s just one of those “out there” things but will honestly have zero effect on the industry.

CF & IPI seem to be the ones for this. Unsure about a good entry.

Took one CCJ 18 MAR 21.5 CALL @ 1.71

Took 1x BNO 18 MAR 26 CALL @ 1.45

I’m also watching YNDX for a put now, it touched above $20, with an impressive correction after the drop. I may wait until tomorrow for a longer dated put if they add new strikes.

It’s interesting that TSM is correlated to this as well. I think it has 2 things fueling the recent slide: raw materials reliance on Russia/Ukraine and the possibility that China annexes Taiwan. Could be a play post European conflict prior to China making a move.

got 2 YNDX 20p on the double top at $23, cut one just before close for a 100% profit, letting the other one ride

Was reading about the civilian ship that was hit by an attack when leaving Odessa today.

It was a ship with wheat that is chartered by Cargill, Cargill is an insanely big private company dealing in anything feed worldwide.

So Cargill is not possible to do anything with.

But for players in the same area I tried to find some:

BG Bunge

MOS The Mosaic company (actually a spin off from Cargill to avoid going public at one point)

ADM Archer Daniels Midland Company

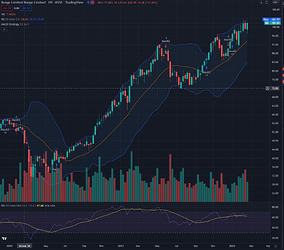

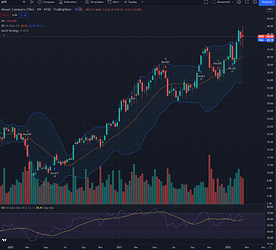

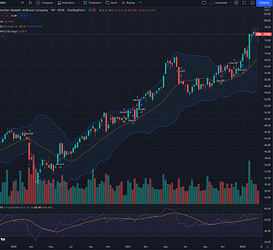

They have all been on a rip since March 2020…

The ingredients for all of their products are going to increase in price now with the war.

Not sure how these can be played.

MOS have had some interesting movement between earnings and dividend after missing the last two earnings.

ADM is at an ATH going all the way back to 1968.

BG and MOS had their ath back in 2008, BG is moving closer to that area, MOS havent been in that much of a rip since then and have still a long way to go.

I know for fish feed companies usually have quite big contracts with fixed prices for longer periods of time.

But they may be more in the spot market, where retail will be the one to pay in the end.

Please give me some feedback if any of these companies would be interesting to look more into.

Their profit margins may go down with more expensive ingredients, and they seems to have been thriving in covid times for some reason.

And btw, sorry for the bad english ![]()

Oh and also, DRY-Bulk rates may surge going forward. But I havent read much about that yet.

Speaking from a strategic standpoint, the next 48 hours are important. Russia is going to have to choose it’s next course of action. What we have witnessed so far is largely strategic air strikes and specialized units conducting attacks and disruptive tactics in preparation for what is likely going to be a hell of an attack. This will likely involve targeting of highly populated areas under the guise of attacking those “resisting”, especially with announcement of mandatory conscription. This gets a lot of attention.

Due to today’s rally, it’s a toss up how market will react. I agree with all above sentiments and current plays. Great work.

We might want to start getting ahead of possible issues with surrounding or loosely involved countries. And also factor in refugee situations and potential impacts of that.

Poland, Romania, Belarus, all stand to be effected by refugees and economic, transport, and defense issues.

Germany, Turkey, and Iraq/Iran come to mind as possible starting points to look into as well, as they continuously butt heads with Russia to some extent. Wanted to get the great minds here involved as we’re probably early in this line of thinking. But this Russia issue certainly doesn’t stop soon and will evolve every day. I’m going to dig into companies/sectors/markers tied into this regions as a starting point for possible future plays as this develops.

Cyber security had a good day along with the rest of the market. I was just watching an interview with a general who said that if Putin does come after the US/other NATO countries it will most likely come in the form of cyber attacks. This isn’t surprising, but something to continue to keep in mind as sanctions start to piss him off.

Chenerie Energy #LNG is a company that needs to be added to this watch list.

*Cheniere Energy, the first company to export LNG from the lower 48 states (in 2016), has become the leading U.S. LNG producer. It operates two LNG facilities along the U.S. Gulf Coast that export gas to foreign buyers. Cheniere was the second-largest LNG operator and fourth-largest LNG supplier globally in 2020.

Sentiment gave them a huge pop today of %17.5 that held pretty solidly.

Also note, the Nord Stream 2 is a natural gas pipeline, not oil.

Have we thought about trying to play Nickel(I know, this falls in the raw materials category)?

So after reading this article:

https://www.google.com/url?sa=t&source=web&rct=j&url=https://www.thestreet.com/.amp/investing/aluminum-nickel-prices-soar-russia-ukraine&ved=2ahUKEwjU4sK08pn2AhVZj4kEHcRmCGEQFnoECAQQAQ&usg=AOvVaw1W-BxcsHRpxNLlcDoSS0kC

I tried looking into BATT(a battery materials ETF that also covers Nickel). It seems to have had a slight selloff this morning on the Ukraine news, but started rising through the day.

Any other nickel related tickers we might be able to play?