Thanks for this clarification!

Circling back to this ticker as I’m eyeing a re-entry. My only hesitation is SPY pulling it back down short term considering the market bull run we’ve seen recently.

@nmhaas - What is it about their balance sheet that appeals to you?

Yo, been on vacation this past week so apologies if the DD is not so rigorous.

Basically the thing I’ve been looking at with what’s publicly available has been the sheer growth for UWM and the fact that their holdings and profits simply don’t match up to their share price. Other lenders of comparable size by market cap simply do not even come close to UWM’s loan origination, and UWM is actually innovating in the space simultaneously with new platforms like Bolt

In 2020 they originated the second most mortgages in the country, behind only Quicken Loans. A key point there is that the increase in originated loans from 2019 to 2020 was about 70%. This growth slowed in 2021, but they’ve managed to maintain a very rapid upward trajectory in terms of loan production.

Another thing that stuck out to me is the speed with which they’re able to clear a loan. In 21Q3 they released their Bolt platform which cut clear-to-close time on conventional loans by about 5 days. This speed is paramount in today’s housing market. Sellers want to sell quickly and buyers want to buy even quicker. This positions UWM for a larger share of the market. Finally, and this makes no sense to me personally, but real estate analysts the nation over continue to predict a record year for housing despite the lack of supply. Every damn article I read about real estate is citing some different housing market analysts that says the same shit: 2022 is going to break records. How does that make sense with such severe supply constraints? I dunno, but I imagine it has something to do with the fact that houses are selling for 10, 15% above asking price the day after they’re listed for all cash.

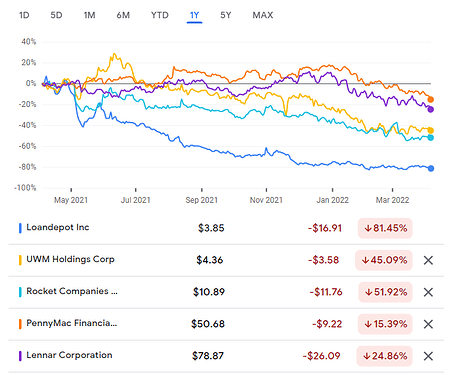

As a final note before I return to my hole of ‘please don’t ask me questions about the companies I invest in haha’, I threw some comparable companies into a 1Y chart with UWM, and it’s pretty interesting.

Not a single one of these companies is up overall in the last 365 days, and in fact all of them are near their 52-week lows; UWM is near its ATL. I just don’t see any justification for why these companies are down 15, 50, or 80 percent over the past year. But that’s probably just my unga bunga brain screaming ‘buy the dip’. That’s primarily why this play is a mid-long term play for me, because while UWM might have more short-term downside, the long term profitability of this company is basically locked in. Unless we see something like 2008 in the coming years, this price point is just a bargain from what I’ve seen.