10/18/21 Market Close Headlines

Stock futures are flat ahead of major earnings reports on Tuesday

The S&P 500 added ~0.3% and the NASDAQ 100 gained ~1% in a continuation of last week’s gains when solid earnings and reports were strong enough to balance out concerns about energy shortages and supply-chain issues. The S&P 500 has now pared back losses from it’s all time high to 1.1%.

OPEC+ failed to meet output targets as Russia opted against sending more natural gas to Europe, shoving commodity prices higher. However, oil’s drop from a session high eased some fears of inflation and policy tightening.

The yield on the 10-year treasury note climbed to 1.59% while UK yields surged after the BoE warned on the need to respond to price pressures, the dollar was little changed.

Fed members this week are expected to try to ease market jitters about future tightening. additionally, another week of corporate earnings will offer traders more insight into the health of major corporations.

Stocks in Europe dropped, while those in Asia were mixed after data showed China’s economy slowed in the 3Q.

Bitcoin rose to $61320 ahead of the launch of the first futures exchange traded fund. Gold dropped 0.2%.

~Bitcoin has attracted a fair bit of attention in the last few days, hitting $62,857 and just shy of a new all-time high.

Sentiment remains buoyant as we head past weekend trade and into the new week and the potential for the SEC to give their blessing on the ProShares Bitcoin Strategy ETFs that tracks the Bitcoin futures markets.

A buy the rumor, sell the fact scenario may eventuate and is a risk and our trader flow is certainly far more nuanced than usual after the recent bull run, with 55% longs/45% shorts on Bitcoin CFD’s.

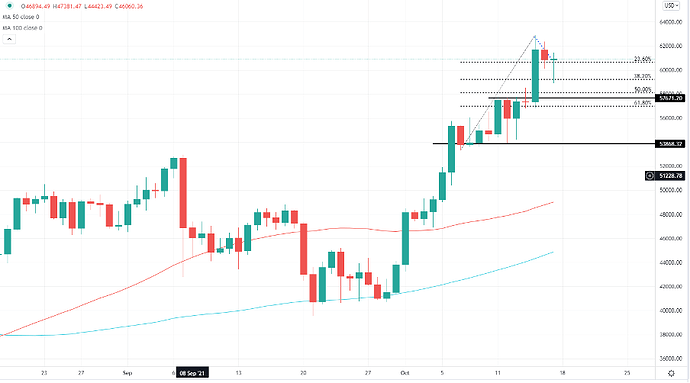

Bitcoin daily chart

( - Past performance is not indicative of future performance)

Analyst have tested the 38.2% fibo of the recent run-up from $53,000 and the price seems to have found a steady platform to build and make a new assault higher – a break of Friday’s high and the all-time high will come into play.

The news of a suite of futures-tracking ETFs is not new to those following the space closely and to many this is a step forward but not the game-changer that some are sensing. That may come in the form of the Grayscale Bitcoin spot ETF, which has been put into motion, but traders have been excited by a spot ETF before, and this may need more work on the regulation front.

The ProShares ETF will attract trader capital and some will venture into this as a long-term play, but most know that tracking the futures price comes with costs especially in a bullish market – in fact, due to the roll charge we’ve seen from the con-tango in the futures curve, traders have likely seen as futures ETF under-perform spot Bitcoin by around 40ppt over the past 12 months.

Performance of the ETF

This will be dictated by the differential between the front-month futures contract and second-month contract. In a bullish world you’ll typically see the further-dated futures contract trade at a premium – a factor known as con-tango – it’s here where the costs blow out, as the position is rolled into a higher-priced contract on the expiry date.

The arbitrage traders are already quite involved in the crypto space, looking to take short positions in the futures, and picking up the positive carry – obviously, as with any long and short (or ‘pairs’) strategy the key here is sizing the trade correctly on both legs. Being able to short the ProShares ETF as a CFD, assuming the ETF gets SEC final sign off, would offer a clean shorting vehicle to express the pairs trade – and you tend to receive swaps on short positions too.

Traders still need to consider the factors driving the primary trend in Bitcoin – the anticipation of the futures ETF is one part in the evolution of the project, but clearly not the only factor driving a 50% rally since late September. While some will disagree, we’ve seen signs of traders rolling out of a variety of altcoins into Bitcoin and what is perhaps the more defensive coin.

Traders can look at headlines around Brazil moving towards the path of El Salvadore and offering Bitcoin as a legal currency. Twitter is allowing users to tip others in Bitcoin and there’s been some adjustments that have increased the speed of transactions. Aside from that we can look at the traditional flow metrics and see open interest in the futures market picking up, reports of solid buying from ‘whales’ have certainly been talked up and momentum traders in the mix as price printed higher highs and lows.

The explosion in Defi continues too with $200b now in total locked value and that is only going one way, as is the flow into NFTs.

So, this is a space to watch and on a number of statistical models Bitcoin is neither over-owned nor over loved. I’m expecting a quick selloff reaction then more positive market sentiment will be needed to confirm the markets trend of a futures ETF, and then we will see this momentum continue to see new highs

Personal Thoughts:

*As week two starts to heat up, the first major week of ERs that was kicked off with the financial sector gave a green-light for a full bull mode. Also cleared the OPEX hurdle. This week and next we have a lot of BIG ERs coming up especially our much beloved Big Tech. This will spell-out an even more positive direction on market confirmation, but if seasonality is anything to go by, we should be looking for overall trend UP to Early December on this seasonal run.*

> Weekly Watch-list (10/18 - 10/22)

> $COIN Calls > 282.43

> Options Watch-list (10/19)

> $DKNG Calls > 49.75 | Puts < 47.84

> $FB Calls > 335.94

> $MRNA Calls > 338.54 | Puts < 320.54

Easy Earning Plays!

IBM (This is going to be fun…)

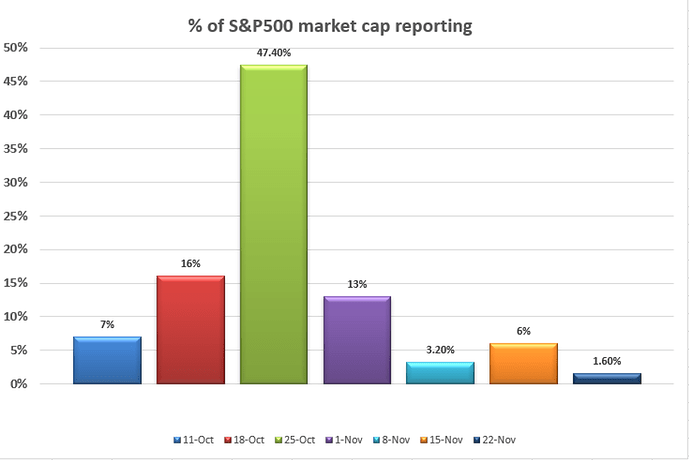

Between the 18 to 22 October we see 62 US companies in our universe of US stocks reporting quarterly earnings.

This equates to 16% of the market capitalization of the S&P 500, which means if the earnings numbers that come out do promote a sizeable reaction in the individual stocks, we could start seeing greater movement and volatility at an index level too.

**

As you can see this coming weeks earnings do increase in their influence on market cap but will be significantly superseded by the earnings that come through the 25 October, where nearly 50% of the US500 market cap report in that week alone. That will be a week to watch out for, as volatility at a single stock and index could rise.

(Past performance is not indicative of future performance)

While we should see some interest in traders looking at names like Johnson & Johnson (19 Oct), Halliburton (19 Oct), Procter & Gamble (19 Oct) and Freeport-McMoRan (21 Oct), these opportunities will likely get less attention than the marquee names due to report. Notably, the big names where we should see most interest, as will be the case in the wider market, will be Netflix, IBM, Tesla and American Express.

Tesla

Tesla (report after market on Wednesday) is the retail trader favorite above all others!

Netflix

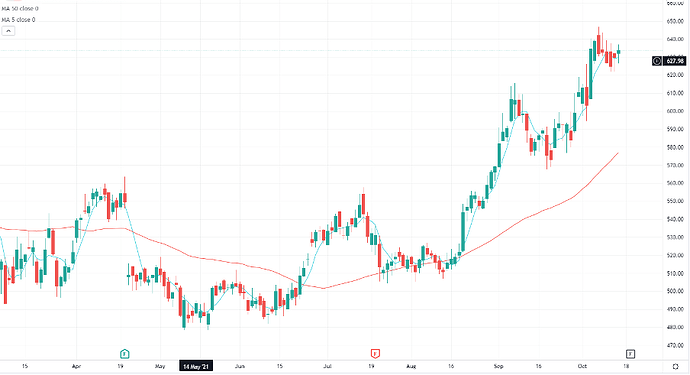

Netflix report after Tuesday’s US close on Tuesday (20 October at 7 am AEDT). We’ve seen the share price rallying 24% into earnings and is currently eyeing a test of the all-time high of $646.84, so expectations of solid numbers and a compelling outlook have risen.

The implied move (derived from options pricing) on the day of earnings is 6%, which is in line with the average (absolute) move we’ve seen (on the day earnings) over the prior past 8 quarters - so if the options market is correct, some could be arguing Netflix is destined for $700.

(Source: Tradingview - Past performance is not indicative of future performance)

By way of numbers, the market is expecting:

- Q3 EPS of $2.63

- Q3 sales $7.48b

- Gross margins (GM) 41.65%

- Global net additions of users of 3.5m in Q3 and guidance for 8.5m in Q4.

- Average global downloads -10% QoQ

- Content updates of upcoming shows for Q4

IBM

IBM report Q3 numbers after the market close on Wednesday and with the implied move at 4.5% on the day of earnings, this could be another fairly volatile stock. In theory, IBM could be testing the 200-day MA ($136.35) or above the 4 October swing high of $146 on earnings.

IBM doesn’t have the greatest track record at earnings closing higher in two of the last six quarters, although things are looking more promising of late, with shares closing higher in the last consecutive quarters by an average of 2.7%.

The market will be watching for:

- Q3 EPS of $2.53 (Q4 consensus expectation are $4.15)

- Q3 revenue $17.82b (Q4 consensus expectation are $3.18b)

- GM 49.59%

- Free cash flow of $1.56b

Bear Case:

“IBM is a good example [that] the greatest scams are hiding right in plain sight through the use of pro-forma accounting” - Jim Chanos

Noted short-seller Jim Chanos, of Kynikos Associates, came out swinging against IBM (NYSE:IBM) on Monday, with some harsh words for the technology industry giant just two days ahead of its upcoming third-quarter report.

Speaking on CNBC, Chanos called out what he called “just more financial engineering” on the part of IBM (IBM) when it comes to the company’s earnings estimates for its fiscal year. Chanos said he was particularly troubled by IBM’s (IBM) use of pro-forma accounting to set its earning estimates, which the company has forecast to reach $11 a share this year.

However, Chanos said that because of pro-forma accounting–a practice of a company reporting earnings excluding one-time or non-recurring items–he believes IBM (IBM) is likely to earn barely half of what it has estimated to earn.

“IBM’s supposed to earn $11 [a share this year],” Chanos said, in an interview with CNBC’s Scott Wapner. “[But], for the trailing 12 months, they’ve earned less than 9 dollars. The really fascinating thing, from our perspective, is if you look at IBM’s operating earnings, and add their IP [intellectual property] royalty stream, and tax it at a normal 21%, the actual earnings are $6 [a share].”

If that wasn’t enough, Chanos added, “Sometimes The greatest scams are hiding right in plain sight.”

My Verdicit: This Chanos and Kyniko sound like Marc Cuban and Woods when they “reveal” there positions. Its definitely because they know there bet is not performing to well or they were short (looks like both)… There is no real reason to broadcast your position. This is not because they are looking for a better entry. Whenever I hear someone on live TV disclose their position its because they no its about to be worthless and are dumping… “DoInG FinAnCiAl EnGinEeRinG” you confidently know they are a crock of shit… No Dip and PayPal isn’t a shadow bank… Anyways take it as you must…But my bet is Bullish…

Here is the deal. IBM is an expert at Financial Engineering!

Executives layoff, offshore jobs, and re-org every quarter to keep the stock from sinking.

Jim should do this when there is more of a chance for a stock market correction in 2022.

Netflix is one of the most volatile stocks around (6.3% average move up or down around earnings releases). This is a good thing as it provides trading opportunities in both directions. Let’s have a look below to find out more.

Highlight for Netflix

Netflix is one of the sexiest stocks in the tech space. It’s a service which finds its way into most people’s lives. Share prices move based on both the macro landscape and company specific drivers. Beginning with the macro side of things, there are two key macroeconomic variables which will affect Netflix. Firstly, with a US 10-year yield which continues to climb it will be a headwind for Netflix. Those high growth cash flows will be discounted at a higher rate, lowering its present share price. The second key factor is what the dollar tends do given Netflix’s global source of revenues. The dollar has been in an uptrend but looking at the beginning of Q3 and the end of Q3, the dollar was pretty much flat with rallies and declines along the way. So this shouldn’t pose as a problem in Q3, but Q4 could see some FX effects filtering through into the results. Lastly, the risk-sentiment prevailing in the market can drag down Netflix despite producing robust earnings – this is known as market risk which affects all stocks.

We know how important subscriber additions are for the market and consequently the volatility it causes in the share price. On this front analysts are expecting 3.63mln new subscribers, coming in above Netflix’s own estimates of 3.5mln. If guidance is strong off the back of new content and Squid Games and comes in higher than market expectations then Netflix may seem some solid bids hit. Speaking of Squid Game, it has really been a big boost to Netflix’s share price of recent and for good reason – estimates are that it will generate close to $900mln in value with a cost to produce of only $21.4mln (not a bad return on investment). However, this could also work against the streaming giant as expectations are rather lofty with room for disappointment. I’ll also be keeping an eye on their cash flow situation and how they foresee that playing out. Furthermore, it would a positive sign if the decline in last quarter’s US and Canada subscribers reversed and we saw some growth in these mature markets.

Some other exciting company news in the pipeline – 1) New merchandising opportunities by partnering up with Walmart 2) The acquisition of a gaming developer called Night School Studio to provide content for subscribers at no additional cost. 3) The purchase to the rights of Roald Dahl’s stories 4) Chatter about entering sports streaming with the CEO recently commenting that he would consider bidding for Formula 1 sports rights.

Preview

(Source: Tradingview - Past performance is not indicative of future performance)

Since mid-August Netflix’s shares have been on a tear. Price is now quite well above its 50-day SMA and 200-day SMA too. Although, price isn’t excessively overbought on the RSI measure. In terms of targets, the 7 October high at $646.84 would be my first score on the door and then past there the round number of $650. On the downside, with a poor result and market disappointment, look towards the 21-day EMA around the $615 horizontal support. On a deeper sell-off there is the $600 support and $575-578 (around the 50-day SMA).

Paypal

In the latest trading session, Paypal (PYPL) closed at $270.33, marking a +0.74% move from the previous day. This change outpaced the S&P 500’s 0.34% gain on the day.

Coming into today, shares of the technology platform and digital payments company had lost 2.89% in the past month. In that same time, the Computer and Technology sector lost 2.7%, while the S&P 500 lost 0.12%.

Investors will be hoping for strength from PYPL as it approaches its next earnings release. The company is expected to report EPS of $1.07, unchanged from the prior-year quarter. Meanwhile, the Estimate for revenue is projecting net sales of $6.22 billion, up 13.96% from the year-ago period.

For the full year, Estimates are projecting earnings of $4.73 per share and revenue of $25.77 billion, which would represent changes of +21.91% and +20.1%, respectively, from the prior year.

Investors should also note any recent changes to analyst estimates for PYPL. These revisions help to show the ever-changing nature of near-term business trends. With this in mind, we can consider positive estimate revisions a sign of optimism about the company’s business outlook.

Extra:

How Does Coinbase Make Money?

Coinbase is the largest U.S. cryptocurrency exchange. It lists about 50 cryptocurrencies for trading, led by Bitcoin and Ethereum. Bitcoin is the largest digital coin by market value and is up just 2% this year after falling sharply in recent months. Ethereum has more than doubled in 2021, according to Coindesk.

Coinbase charges fees of several percentage points to deposit funds and trade, which is one of the main ways the company makes money. Roughly 90% of the company’s revenue, as of 2020, came from transaction fees from trading and services like storage.

Coinbase Stock Fundamental Analysis: Huge Earnings And Sales Growth

Ahead of the company’s debut, Coinbase issued estimates on April 6 for its first quarter ended March 31 and an outlook for the full year ending Dec. 31, 2021. The company expected verified users of 56 million with $223 billion assets on platform, representing an 11.3% crypto asset market share.

On May 12, Coinbase reported Q1 results that slightly missed estimates. The company showed total revenue of $1.801 billion on EPS of $3.05. Wall Street expected Coinbase to earn $3.07 a share on revenue of $1.81 billion. Earnings soared 2,350%, while sales spiked 845% vs. the year-ago period.

On Aug. 10, Coinbase reported its Q2 results, earning $6.42 a share on sales of $2.22 billion. The company warned that its trading volume will be lower in the third quarter than the second quarter.

COIN Stock Technical Analysis

COIN stock is trading about 30% off its post-IPO highs. Shares are breaking out past a double bottom 280.71 buy point. The 5% buy area goes up to 294.75. Meanwhile, stock will be reaching new recent highs, indicating strong out-performance vs. the broad market.

Coinbase Stock News

On April 22, Mizuho analyst Dan Dolev initiated coverage on the stock with a neutral rating and a 285 price target. “Over time, Coinbase pricing — and industry pricing in general — may face downward pressure from platforms like PayPal and Cash App,” Dolev commented. “This is because PayPal and Cash App primarily use their crypto trading products as engagement tools, whereas Coinbase relies on its crypto trading products as its main source of revenue and profitability.”

On May 24, Goldman Sachs initiated coverage with a buy rating and a 306 price target. Goldman analyst Will Nance said in a note to clients that Coinbase is the best way to gain exposure to cryptocurrency ecosystems.

On May 25, JPMorgan initiated coverage on Coinbase with an overweight rating and a 371 price target. In response, Coinbase stock surged 7.6%.

On June 16, Canaccord Genuity started the stock with a buy rating and a 285 price target.

On Sept. 7, Coinbase disclosed it received a Wells notice from the SEC last week. The regulator says it intends to sue the company over the company’s Coinbase Lend program.

On Sept. 24, China’s central bank cracked down on cryptocurrencies, saying all cryptocurrency transactions are illegal. “Financial institutions and non-bank payment institutions cannot offer services to activities and operations related to virtual currencies,” The People’s Bank of China said on its website.

On Oct. 12, the company announced Coinbase NFT, a peer-to-peer marketplace that lets users mint, collect and trade NFTs, or non-fungible tokens.

Is Coinbase Stock A Buy Right Now?

As the popularity of cryptocurrencies — especially Bitcoin and Ethereum — surges, Coinbase Global (COIN) is at the forefront of the cryptocurrency industry.

Coinbase stock rallied nearly 5% Monday. The price of Bitcoin traded around $62,000 Monday, according to Coindesk.

For now, the stock is a buy because it is in buy range past the stock’s new buy point. If the stock moves past the 5-12% buy area, then it will be extended and no longer a buy.