At the request of a few people from TF the other day and in an attempt to help the “not rich YET” folks here build a solid nest egg that I feel is SO VERY IMPORTANT to have before doing aggressive trading, I’m posting an explanation/instructions on how I use cash back credit cards and high interest savings accounts to make about an extra $2500 a year. My wife and I have been doing this for about 6 years now and it has worked great. Once our savings accounts reached the point of “we could lose our jobs and be fine for 4 months” we used the extra cash to pay down mortgage/student loans and cars, furthering the gains from this system. Full disclosure, I will be adding in referral codes that can make you and I extra cash, so please use them if you want to set this up for yourself. This might seem long, because it kinda is, but you will probably spend more time reading this than actual screen time setting it all up. Also remember that applying for credit cards does put a hard inquiry on your credit so if your planning on getting a loan anytime soon, take that into account. As far as what affect this had on my credit, it lowered my score at first due to the hard inquires but not by much. It also lowered my score when I was only using 1 cash back card because it looked like I was maxing my credit limit each month. Once I got 5 cards and the hard inquires were gone, this actually raised my credit score a lot because I was only using a small % of my credit limit per month.

So here is how I’m going to break this down.

1.) Quick summary of how I use both cash back credit cards and high interest savings accounts to make extra money that is basically risk free and the majority of it tax free.

2.) Credit cards I use with details on benefits/risks

3.) Savings accounts I use and how to automate the process

4.) Step by step instructions to follow to set it all up and tips to prevent you from making some of the mistakes I made with this. You can skip to that section if you don’t want to read all this and just trust me, but I recommend understanding what you are doing and I will try to be as thorough as possible to prevent mishaps.

That being said, take it slow, don’t be overwhelmed and enjoy the process. Once we got it all set up, I really didn’t notice any difference between this system and the traditional checking/savings account and debit card use except for it made me a lot more money. Just putting money in a different bank and using a different piece of plastic. Its also much safer to use credit cards as far as ID theft goes.

1.) Summary of what Im talking about

Basically what Im doing is a combination of 5 cash back credit cards to buy everything, to pay all our bills (except for loans and a few utilities) and also moved damn near all my money out of my regular checking/savings accounts and into 7 high yield savings accounts. Doing this means that every dollar I spend gets me anywhere from 2-5% cash back and every dollar I save also makes 0.5 - 5.0% interest. Ally bank is the .5% unlimited, so it is used more as tool than a savings account. The other savings accounts are 5% and allow up to 10k for 1 person and up to 20k for you and your spouse. There may be other savings accounts with higher interest rates than Ally but they didn’t work right or charged hidden fees. Ally savings is the only one I could get to work perfectly for this so I stick with it. Your regular savings/checking may work too but I know for certain Wells Fargo and Regions do not. As for how much extra money this will make for you, thats impossible for me to know. It depends on how much you keep in savings and how much you spend on the cash back cards. For my situation, this is how much my wife and I get.

1.) Cash back credit cards - about $1440 per year

2.) savings accounts

-

Netspend accounts - $500 per year

-

Varo bank accounts - $500 per year

-

Ally savings accounts - about $150 per year

2.) CASH BACK CREDIT CARDS

These cards get me the bulk of the annual 2.5k and are a good place to start since they are easy to set up, cash back is not taxable and if you have no savings at all you can use the cash back to build that up. I use 4-5 cards to maximize my cash back. The bad thing is that it is a credit card and if this system is misused, you may negate all the cash back gains with late fees and interest owed on your balance. KNOW THY SELF! If you or anyone using these cards can’t be trusted to not spend more than you have or to remember to pay the bill on time, you may want to just skip to the savings accounts. Also this is just a list of cards that matched my spending habits. There may be others that provide more benefit to you but thats on you to find out. With that said here is the breakdown.

- CITI DOUBLE CASH BACK CARD - 2% cash back . Gets me an average of $55 per month

This one, as mentioned on TF, is my bottom bitch. It gets you unlimited 2% cash back on EVERYTHING! Once the bill is paid you get the option of direct deposit into a bank account or lowering your balance. I always do the direct deposit so that cash back then starts earning interest or can be used to pay loans, saving you interest in the long run. Also the way this card works is 1% back on what you bought then 1% on the amount of the balance you paid. So if you use the cash back to lower the balance, you also just lowered the amount of cash back you get. We put all monthly bills like streaming services on this card and most utilities also. We don’t put all utilities on this card because some of them charged a fee for paying with a credit card. If the fee to pay with a credit card is more than 2%, just pay out of your checking account.

DISCOVER IT CARD - 5% cash back on up to $1500 per quarter. Gets me about $25 per month.

This is my number 2. “But why poster is it number 2 when it’s 5%?” Well, it has certain 5% cash back places each quarter and is limited to up $1500 spent. So the max you can get is 5% on $1500 spent which = max of $75 per quarter. Everything after that gets 1%. Still the places it gives 5% cash back on make this one worth it to me. Just remember to activate the savings every quarter. Here are the quarterly categories

JAN - MARCH - 5% back on groceries

APRIL - JUNE - 5% back at gas stations

JULY - SEPT - 5% back at restaurants

OCT-DEC - 5% back at amazon, Walmart and target

USBANK CARD - 4% on restaurants** . Gets me about $35 a month on average

Kind of simple. 4% back on restaurants. No max but they only give the option for direct deposit of cash back if you have a usbank checking account, which I do not. So I just take the statement credit on this one.

CAPITAL ONE WALMART CARD - 5% at… you guessed it … Walmart. Gets me about $15 per month

Actually gets more use than I originally thought. With Walmart delivery and grocery pick up, it does us well. It doesn’t give a direct deposit option but they will mail you a check. I just do statement credit on this as well. Full discloser, I own a bunch Walmart stock, still a solid card though.

CHASE FREEDOM UNLIMITED - Gives unlimited 5% back gas for 1st year, 3% back at drugstores and 1.5% back on everything else. The first year I got about $35 cash back per month, now about $8 since I know longer use it for groceries.

I really just got this one for the $200 bonus and the 5% back on gas for the 1st year. Now I just use it at drug stores and every now and then they give some special thing that gets like 10% back at exon or marathon or other places.

3.) SAVINGS ACCOUNTS - 5% with Varo Bank and the Net spend accounts. .5% with Ally

Ally Bank.

The reason I use Ally is because it allows unlimited free ACH transfers which is key to automating this thing. Never use Varo of Netspend to initiate transfers, they charge you for the service. Also they have free checking and .5% savings account and reimburse atm withdrawal fees.

The Ally savings account basically serves as my checking account. The big difference is it gets .5% unlike a checking account. I know .5% is not much but when I started this it was getting 2.4% I think and the way things are going, Ally will probably raise rates soon. I also have an ally checking account that I keep about $15 most days. This is used mostly to transfer $1 back and forth from my ally checking accounts and my net spend accounts. I’ll explain this when I get to those accounts.

The thing to remember is with most savings accounts you only get 6 WITHDRAWALS PER MONTH! After that 6 withdrawals they start charging penalties. I’m not sure what the penalties are because Ive never got one. I avoid them by using the cash back credit cards to buy everything and to pay most of our utility bills. This gives me just 4-5 bills to pay per month and if I need cash or to move money around for whatever reason, I still have 1 or 2 withdrawals to spare per month. My wife pays the mortgage, car note and the utilities that we don’t put on cash back cards out of her savings account. Thats the work around for the 6 transaction limit. Have multiple savings accounts. If not married you can open as many savings accounts as you need to pay your monthly bills. Next, the high interest accounts…

All of these savings accounts are Fdic and if used correctly, allow you to get 5% interest on 10k for you. If you are married you and your spouse can open your own accounts and have 20k earning 5%.

Varo bank

You can have up to $5000 getting 5% in this one. Right now they are doing 3% but they are raising the rate in april to 5%. Here is what you have to do to qualify.

- Open a checking account with Varo bank and maintain at least a 1 cent balance in that account

- Make direct deposits totaling at least $1000 a month into the Varo checking account

- Maintain your savings account balance to NO MORE THAN $5000. If your account goes over $5000 then the rate drops down to the base rate of .5%.

To accomplish all this I set up a direct deposit with my employer to put $500 into my Varo checking account each paycheck and the rest goes to ally savings. I also set a reoccurring $23 monthly transfer from my VARO SAVINGS to ALLY SAVINGS that happens on the last business day of the month. This avoids the VARO interest payment on the 1st of the month from bringing my VARO savings account over $5000, which would drop my interest rate. Then you can set up one more reoccurring transfer that happens every 2 weeks (the Monday after payday) of $500 from my Varo checking to my ally savings. All of this is easily automated using ally.

The NETSPEND accounts

These sound a little trickier but once its all automated the only thing you have to do is manually withdrawal your interest every quarter if you choose to. I don’t always because it doesn’t really affect your returns much if you let it sit in these accounts.

These savings accounts come with a prepaid card account. NEVER USE THESE CARDS! They charge like a $1 fee per transaction when you swipe the card. Fucking predators preying on the poor, unbanked people of society, but not me. I prey on them.

There are actually 5 different savings accounts to open here. Each one gives you 5% interest on up to $1000 and I think .5% on any amount over $1000. This is not like VARO. If your account goes over $1000 they still give you 5% on the $1000 but not on anything above that. The requirements to get the 5% interest are…

- Make at least one transaction with the pre paid card every 90 days. Thats it.

I avoid the fee by doing yet another reoccurring transfer of $1 that happens every 2 months from my Ally CHECKING account to each of the prepaid accounts. Then I set another reoccurring transfer of $1 that goes from my net spend cards back to ally checking. This one is set to happen 1 week after the transfer from ally to netspend. So all Im doing is transferring $1 back and forth between ally checking and the net spend cards. This is automates the process and satisfies the requirements for 5% interest.

So here are the 5 NETSPEND accounts

-

Netspend

-

Western union

-

Brinks

-

Aceelite

-

HEB

4.) Set up instructions - finally

So how you go about this obviously depends on if you just want the cash back cards, just want the savings accounts or gonna do it all like me. Im going to write it as if you are going to do it all. The highlights for setting it up are

1.) Order cash back cards and set up ally accounts for both you and the spouse. Here are the cards and current bonus offerings right now

- Citi double cash back - no bonus as of right now but is my go to card

- Discover IT card - We can each get $100 statement credit using this link Discover Card Application Just make 1 purchase in the first 3 months with the card.

- U.S. BANK ALTITUDE® GO VISA SIGNATURE® CARD - you can earn a bonus $200 cash back when you spend $1000 or more in the first 3 months

- CHASE FREEDOM UNLIMITED® - another $200 bonus when you spend $500 in first year. And 5% back on gas for first year

- Capitol one Walmart card - no bonus, just 5% back at Walmart.

2.) Move your money to Ally Savings accounts and set any loans (mortgage, cars, students loans act…) To be paid out of this account. Remember you have a limit of 6 withdrawals per month per savings accounts.

3.) Set all non-loan bills such as Netflix, Amazon prime, utilities (that don’t charge fees for credit card payments) to be paid with citi card.

4.) Order the 5 Netspend cards for you and 5 Netspend cards for your spouse and fill em up to $1000 each using ally to transfer the funds

5.) Use Ally checking account to set up reoccurring transfers of $1 to and from each account every 2 months.

6.) Set up your Varo bank account. Get your employer to direct deposit $500 per pay check into Varo if you’re paid biweekly or $1000 if you’re paid monthly. I also have the rest of my paycheck deposited into my ally checking. That way I have the option to move that instantly into savings, to get some cash or pay unexpected bills without using 1 of my 6 transactions from savings account.

7.) Use ally to set up a reoccurring transfer of $500 every 2 weeks after payday to deposit into your Ally savings account. Then another reoccurring transfer of $23 on the last business day of the month from Varo savings to ally savings.

Thats it, all automated now and you don’t have to worry about it anymore.

STEP BY STEP

Now for the Step-By-Step instructions! Move slowly. It seems like a lot but it is not that bad. The worst thing is waiting for the cards to arrive. The set up wont take more than an hour total in front of a screen.

. A.) Order all the cash back credit cards you want. Please use this links above for Discover to reward me for this work.

. B.) Set up an Ally savings and an Ally checking account. Do this for both you and your wife.

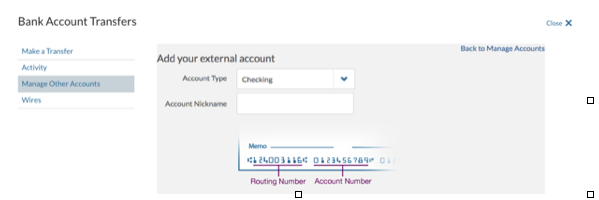

. c.) Link your current bank account to ally. Log in to ally, go to Transfers in the top bar of your Ally bank account. Then click on Manage Other Accounts. Then click Add New Non-Ally Account. For account type, choose Checking

Then enter an account nickname and the routing number/account number for your bank account. For the nickname, I name it by the bank or for the brand of card I received. This makes it easier later when you have like 7 or more accounts linked up. Move however much money you are comfortable with into ally savings from your bank account then put at least $15 into ally checking account.

d.) Once you have your cash back cards begin setting up bill pay for (most) utilities, Amazon, Netflix etc. using citi card. Use your other cards for their given purpose. I wrote in sharpie on my cards to remind me of where to use each at first. You have to activate the cash back each quarter with discover so don’t forget to do that. Also set up the Cards so you can pay the balance from your ally SAVINGS account. Do not use the ally checking account to pay the card balance. I made that mistake in the beginning and it cost me $25 in overdraft because I only have $5 in ally checking and paid a $3000 Citicard bill with it. I also set reminders on my phone to remind me when a credit card payment is due.

e.) Order these 5 prepaid debit cards for your netspend accounts and 5 for your spouse. The ultimate goal here is to fill each of these cards up to $1000 each for both you and your spouse. If you have $10,000 in savings now, good for you rich mofo! Fill them all up ASAP. If you only have $450 awesome, put 50 into each one except brinks using the codes I give you and you will instantly make $20 on top of getting the 5% interest. If you have no money wait until you get you first $50 from cash back then set these up. You have to deposit at least $50 and use the links below to get the $20 bonus and 5% savings rate. READ INSTRUCTIONS 1ST!

Netspend Prepaid Debit Card - Refer-a-Friend | Netspend Visa Prepaid Cards

Ace Elite Prepaid Debit Card - Sign Up Now | ACE Elite Visa Prepaid Card

Western Union Prepaid Debit - Western Union NetSpend Prepaid MasterCard

H-E-B Prepaid Debit Card - Get an H-E-B® Prepaid Card

Brinks Prepaid Mastercard - Brink's Money Prepaid Mastercard

Below, I’ve listed step-by-step directions on how to set up your 5% interest savings accounts with Netspend. It is the same process for all of these prepaid debit card savings accounts. It might look like a lot of steps, but it really isn’t as complicated as it looks. The process of opening up all of the accounts will take some time, but the actual work of setting up the accounts only takes a few minutes. Most of your time will be spent reading this or waiting for the cards to arrive in the mail.

The most important thing is don’t rush it! Follow these steps carefully, enjoy the process, and avoid the urge to skip ahead or do multiple steps at once. This is a money hack, and if you skip ahead or try to do multiple steps at once, you’ll end up causing more headaches for yourself and making the process harder and take more time than it needs to.

Again, take it step-by-step, exactly as I’ve laid it out below, and you can’t go wrong.

1.) Sign up with netspend and order the card using the link above. Do the same for your spouse.

2.) After you’ve signed up with Netspend, wait for the prepaid debit card to arrive in the mail. It probably took about a week before my Netspend card arrived. The packet will have a bunch of stuff that every bank has to send. Think of things like the fee schedule, truth-in-lending act documents, etc. I pretty much just shred all of that stuff. Also included in that packet will be your routing number and account number (just like with a regular bank). Make sure you keep this information somewhere because you’ll need it in order to link your Ally bank account with your Netspend account.

3.) Now, follow the directions to activate your card. You should default into the “pay-as-you-go plan.” Stay on this plan since it has no monthly fees. We don’t care about the usage fees because we’re never going to use the prepaid debit card. Make sure that you’ve also activated your online banking account as well. Once you’ve activated the card, stick it in a safe or a drawer for safekeeping. You’ll never use that card again.

*IMPORTANT: Do not try to link your Netspend account to your bank before you’ve received the card and activated it. Your bank will likely deny the transaction, and then you’ll have way more of a hassle to deal with.

4.) Link Your Bank Account With Your Netspend Account.

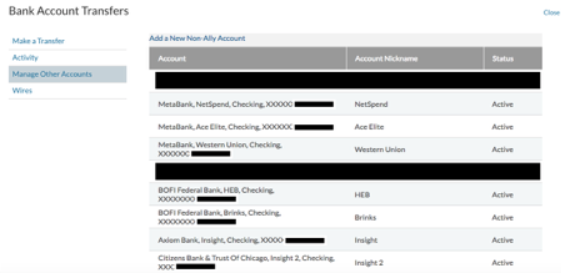

Now that your Netspend account is activated, we’ll need to link it to your Ally bank account. Same process as linking your regular bank account to Ally. Go to Transfers in the top bar of your Ally bank account. Then click on Manage Other Accounts. Then click Add New Non-Ally Account. For account type, choose Checking. Then enter an account nickname and the routing number/ account number for your Netspend account. For the nickname, I typically name it by the brand of card I received (i.e. Netspend, Ace Elite, Western Union, etc). Your external bank account screen should look something like this once you’ve linked all of your accounts:

Once linked, your bank will probably send some test deposits for you to confirm. When the account is confirmed, you’ll be able to transfer money from your bank account onto your Netspend prepaid debit card. I did have 1 issue with waiting to long to confirm the test deposit so do it quick and call ally if you have any problems, they fixed my procrastination problem pretty quick.

5.) Next, transfer money from your bank account onto your prepaid debit card. For the Netspend, Ace Elite, Western, Union, and H-E-B card, the savings account should become available once you transfer any amount of money onto the card (remember to transfer at least $50 on your first card in order to snag the referral bonus). For the Brinks card, you’ll need to transfer $500 in order to activate the savings account. Since we can get 5% interest on up to $1,000, I recommend putting the full $1,000 onto each card, if possible.

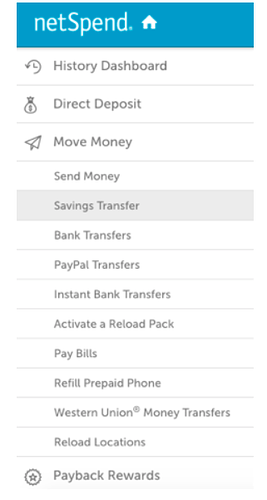

6.) After you’ve transferred money to the card, you should now be able to gain access to your savings account. In your Netspend account, go to Move Money in the sidebar, and then click on the option that says Savings Transfer. There should be an option to activate your savings account Remember, the money in your savings account is FDIC insured, so your money is subject to the same protections as any another bank.

*Note: When you first move money onto your Netspend card, they might send you an additional Netspend “Premier” Card in the mail. Don’t activate that card. Just stick it in a drawer once you receive it and ignore it. They will also always try to “upgrade your account”. Ignore that also.

7.) Transfer Money From Your Prepaid Debit Card Into Your 5% Interest Savings Account.

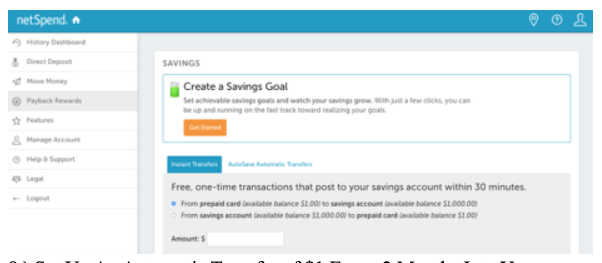

You’ve now got money in your Netspend account, but it’s still sitting on the prepaid debit card. Now that we’ve activated the Netspend savings account option, we just need to transfer the money from the prepaid debit card into the savings account. Go to Move Money, then click Savings Transfer, and then transfer all of the money from your prepaid debit card into your savings account. Your savings account should now have a balance of $1,000. Your prepaid debit card should have a balance of $0.

8.) Set Up An Automatic Transfer of $1 Every 2 Months Into Your Netspend Account in order to avoid any inactivity fees.

Success! You’ve now got $1,000 in your FDIC insured savings account earning 5% guaranteed interest! We’re not done yet, though! The only fee we need to worry about is an inactivity fee. Netspend charges an inactivity fee if there’s no activity in your account for 90 days. They don’t count withdrawals as an activity, so we’ll need to set up an automatic transfer of $1 onto the prepaid debit card at least every 90 days in order to avoid that fee. To be on the safe side, I set up an automatic transfer of $1 every 2 months. To set this up in Ally, log into your Ally account and select Make a Transfer. Then schedule a transfer of $1 from your Ally account into your Netspend account. For frequency, set it to transfer the $1 every 2 months. By doing this, we’ll never have to worry about any inactivity fee because there will be a $1 deposit onto the debit card every 60 days or so. I then did the same transfer using ally but in reverse and starting 2 weeks after the transfer from ally to Netspend. Now that $1 just moves back and forth between Ally and Netspend. Repeat with the other 4 prepaid cards and your all set with getting you 5% on 5k or 10k for you and your wife.

Last piece of the puzzle.

9.) Varo Account - You and I get $50 if you spend $20 in the first month. https://varomoney.com/r/?r=Robert6073

This one is pretty straight forward. Just set up the accounts, load them up with NO MORE THAN $5000 in savings account and at least 1 cent in checking account. Get your employer to do a direct deposit of at least $1000 per month into your vary checking account. Next use ally to make a reoccurring transfer from your Varo SAVINGS account of $23 dollars that happens on the last business day of the month. This keeps your savings account from going over $5000. You can also do a reoccurring transfer of the direct deposit from your Varo checkking account to your ally Savings account but I just do it manually so I can top off the Varo savings account each month.

PHEW thats it. Let me know if you have any questions or suggestions.