Gonna do a quick and dirty DD given what I’ve known about this company by using their products in college and making some purchasing requests as a teaching assistant for some electrical engineering classes. Actually, the relevance of my experience with these machines starts and ends with: I think they’re the most popular electrical engineering lab tech components company. That’s all as far as that goes lol.

Other things that are bullish af:

- New board member: Dr Otis Brawley (kind of a big name in cancer research; may be interpreted as added credibility/reputation/implicit endorsement of Agilent). Announced 3 days ago.

- Oscilloscope market is expected to generate massive revenue in the near future. See more here.

- Agilent increased cash dividend to 21 cents per share. Announced 4 days ago.

- USC renewed their collaboration with Agilent for another 4 years to conduct cutting edge biomolecular characterization research. Announced 3 weeks ago.

- Global sequencing and reagents market is expected to have a compounded annual growth rate of 12.83% in the 2021-2028 period. Agilent is a leader in this segment. Report came out 3 days ago.

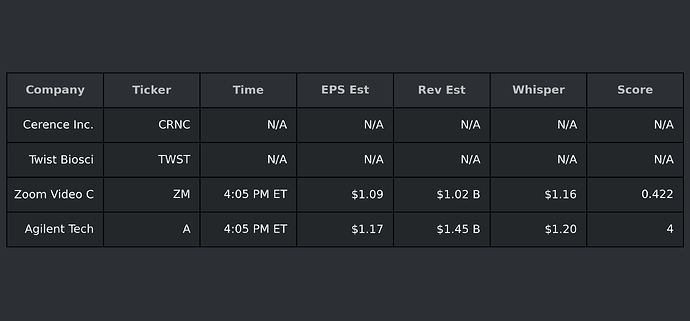

This is a lot of bullish news very close to Agilent’s ER. On top of that, the earnings whisper is $1.20 EPS whereas the consensus is $1.17. According to our bud Mirmir, the score for this whisper is 4, which is highly bullish iirc, but someone correct me.

This was a super quick and dirty DD, so please take everything with a grain of salt and please correct me on any stupid assumptions I may’ve made.

Positions:

Only playing one call: $165c 12/17