As you may or may not know, I post daily watchlist on this forum using unusualwhales option flow data. I’ve been planning on speaking about how these watchlists are made, and now that I’ve been getting a few questions about it, I decided to finally sit down and write up a quick summary on using unusualwhales data for your trading.

Follow the money:

Before we get into how to use unusualwhales for trade ideas, I want to first start by describing what unusualwhales even is. What unusualwhales provides is the ability to browse through a certain day’s option flow, regardless of the ticker, size of the order, time of day, etc. It also allows you to filter through the “flow” using certain filters like Premiums Above/Below X Price, Spot Price (the price of the contract), Size of the Order, etc. I won’t get into all the filters, but just know that the UI of unusualwhales is probably one of the best, and their service is still getting better.

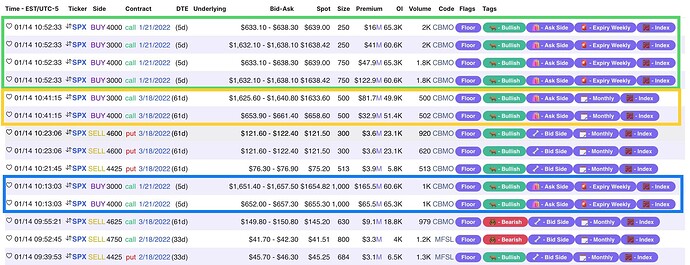

Now, on to the question. Should we follow the money? The answer is yes and no, and I’ll get into why now. Consider the flow from Friday on SPX:

In order for easier reading of the flow, I’ve pointed out certain trades that most likely belong together in one bigger (multi-legged) order. You can take note of the time and infer from there. The only filters that are set on this flow is $3M+ premium and 90 or less DTE. Mostly bullish flow on Friday going into the long weekend. There’s a decent amount of call buying, and some exiting their positions as expected. Now, does this mean we found the short-term bottom of SPX on Friday?

Well, consider this before you answer the question:

The number of stocks in the S&P 500 that are above their 200-day simple moving average are declining, while the S&P 500 is still in above its bullish trend line. Now, take into account macro-level catalysts such as rate hikes, CPI and PPI levels, and many other conditions…Were the whales right? Had we seen the bottom on Friday?

Here’s what happened today on SPX:

It’s safe to say that reading and blindly following the flow would’ve caught you holding some bags…

So now what?

O.K., so blindly following all the flow you see isn’t a safe strategy. So now what? How do we use unusualwhales for trade ideas? Well, let’s analyze two of today’s trades.

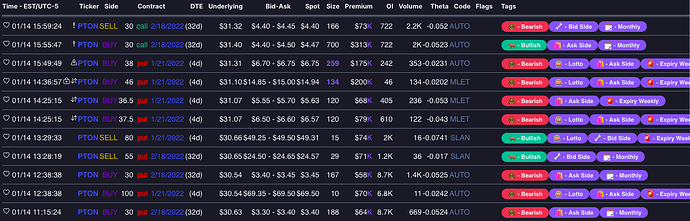

PTON:

My first step in the flow is to filter by premium and by DTE. I don’t do anything else. Then, what I look for is clustered directional flow going into EOD. Now, in the case of PTON, the clustered flow was going in the bearish direction (obligatory FUCK PTON). Now I have a potential trade idea. This doesn’t mean I will automatically add it to the watchlist. This is just the first step in finding potential trades, actually finding an idea.

After I find the idea, in this case PTON, I look for any news that came out that day, either during trading hours or maybe after-hours. It could be a rating upgrade, press release, Macro news, anything. For PTON’s case it was this:

It’s not necessary for there to be news, and we’ll review another trade that didn’t have news in a second, but any news that supports our directional bias (in this case, bearish news) adds even more conviction to the trade.

After looking for news, I gauge sentiment in that specific stock’s sector. PTON is a growth stock that belongs in the technology sector… Do I even have to keep going? We’re in the middle of a growth crash and the NASDAQ is currently in a 10% correction, with more downside to come, in my opinion.

So, now that we have this conviction behind the trade, then is when I plot my support/resistance level:

I always try to wait until after-hours trading is over just because of the possibility of a gap-down/up before I plot my levels. In this case, PTON had gapped down almost 1% in after-hours, and I mentioned the possibility that it could gap down even more in pre-market. So going off of the gap-down, I set my level at a intraday support/resistance level that I think will be key in the next day’s trading. Of course, you don’t have to use my level if you’re comfortable with your charting and scalping skills.

Now, let’s see another trade that did not have news.

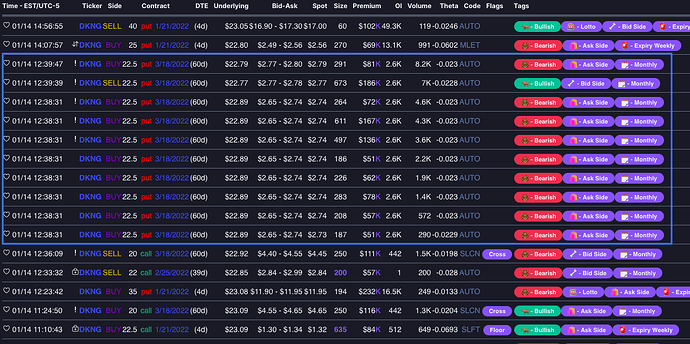

DKNG:

Now, in the case that there is no news, as was/is the case for DKNG, I either look for clustered buying, as I mentioned, or, in this case, one massive order in an out-of-the-money short-dated contract. This 22.5 3/18 contract is at-the-money but finished the day slightly out-of-the-money. This usually means they’re still looking for a move to be made.

Now, same as PTON, DKNG is a growth stock. It just de-SPAC’d and has corrected along with the rest of it’s peers. The sentiment adds conviction to the trade. Now we plot our levels:

I will go over how the trades went and our watchlist for tomorrow shortly.

If you have any questions, feel free to ask!!!