Daily Comments

Really interesting day today, felt really good about the stream, I think its showing some of the things I’ve talked about previously in far better detail. I was incredible proud to see so many people be green on ASTR. That was a play that a lot of people previously would’ve lost a lot of money on.

Play Breakdowns

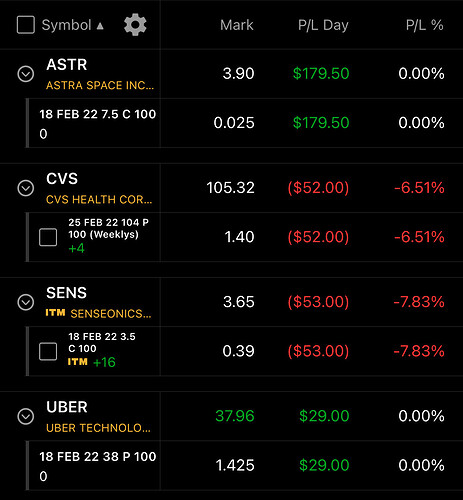

ASTR

This play went exactly how I’d expected. I called out a trim just before the launch window and I sold off some contracts for a profit. When the rocket lifted off we got the further anticipated run of buy volume which we sold into and we were completely out by the time anyone had realized that the launch wasn’t successful. This play was important to me because it accurately showcases why mentally resisting the urge to gamble is so important. I’m sitting there with a 12% gain on account free and clear and had to deal with none of the extra stress of waiting to see how things panned out. This is how you generate wealth, it won’t happen tonight or tomorrow, but over time, these gains will compound and we’ll be much wealthier than we were today.

CVS

I’m going to be honest and say that this play was a bit of a mistake. I had voiced concerns with entries before the CPI data and those concerns were valid and I should’ve listened to them. The mistake I made was getting into a play that I wasn’t totally confident in with little research and not obeying my own intuition. Taking plays that are right for you is paramount. I’ve said many times that I have never traded a share or option on DWAC. Still haven’t to this day because the plays never seem right for me and that’s OK. With that said, I’m still holding this position despite having been able to exit slightly green. I’m currently betting that the overall thesis may still be accurate and that bearish momentum on SPY may drive this one down a little more. I’ve very likely to cut this tomorrow morning at open in the volatility.

SENS

Our beloved was a casualty of SPY today. It had a great run but then ran out of steam and came back to earth. I had called earlier in the day that options had been hovering around that .40 level and it would be a good cost basis, despite having taken a couple options earlier in the day, I took my ASTR gains and averaged down my position to a cost basis of .42 cents, just shy of that golden level (hopefully). This highlights why its important to average into positions. That means buy your position in little spurts not make one large buy and freak out and get over-leveraged.

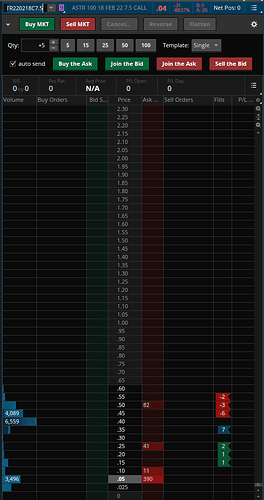

UBER

Made an intraday scalp after UBER’s earnings miss intraday. Those that watched the stream saw me use the price ladder to collect at a cost basis that was decently near the low and then analyze support lines and SPY movement to determine a good exit. This scalp was held for roughly an hour and a half and was 32% gain on position.

Closing Thoughts

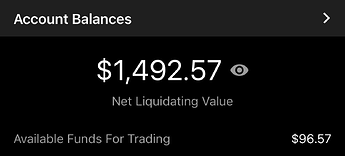

I think this challenge will be one of the greatest things we’ve undertaken in this community. We’re not fully up and running yet and I have several more ideas that we’re going to try as I get more used to trading on stream and providing updates on my thoughts but I can already see the positive effect its having. The challenge has shown this week that by taking careful entries on fleshed out plays, you can substantially increase your wealth over time. I’m not making hundreds of trades per day, I’m not even holding many positions, but my account is growing substantially day after day.

Today I made $80.40 and I didn’t really do anything besides watch a wish.com rocket launch and make a handful of buys and one scalp. You can look at that and think, yeah, ok so what? Well that $80.40 was with a purposefully limited amount of capital. It was 6% which means, lets say I had an account with even $5,000 in it, that’s $300. If we zoom out and look at the week we’re up 49%. So instead of $492 this week, we would’ve made $2,500. Friends, there is no rush. All that matters is consistent profitability. I know there are some of you that have watched the stream and thought “this is boring”, yeah, it very often is. But what matters more? Entertainment or wealth? Its up to you.

See you tomorrow.

Stats

Today we were up +6% on account for the week we’ve hit +49% on account.

If you’ve read the post, please give it a like so I can keep track of how many people are actually following this.