Daily Comments

Well, today sucked. I woke up this morning to the news that SENS had released news of their FDA approval alongside their abysmal earnings projections for the year. But I suppose we should discuss that in the breakdowns so let’s get to it.

Play Breakdowns

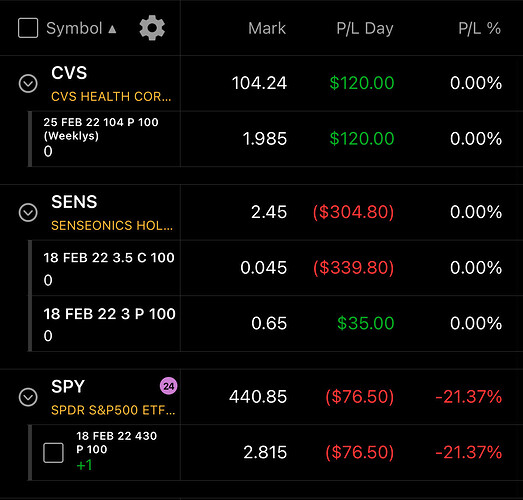

CVS

This was the play I shouldn’t have been in from the start, but thankfully with the down market it started to acquire some SPY correlation and came down hard enough to make me green. One thing that I need to be careful of is to properly select plays, instead of going off of what “everyone is buying”. I didn’t do that here and wound up in a trade I wasn’t really feeling. With that said however, I ended up making $120.00 on this play and it worked out for the best after some strategic averaging down.

SENS

Ugh. I had assumed that SENS would release their approval news over a weekend, but apparently I had assumed wrong. Yesterday after my gains with ASTR, I took a position in SENS at what I believed was a safe cost basis looking for some bullish movement at open today, similar to days previous which I could cut at a decent gain. However, the surprise release of the FDA approval (good) was completely offset by their atrocious outlook for the year. I’ll give @Shamu some much deserved props for his fundamental analysis for SENS in the thread because it would seem that the weak fundamentals of the company were more than enough to overpower the FOMO of one of the most anticipated approvals amongst retail.

My strategy for this was to stop playing it on Friday as in my opinion it had been running a bit hard and was due for a pullback. I never quite wanted to play this through the approval itself, but here we are.

People watching the stream watched me cut my SENS options at open for around a 50% loss which dropped the account to just shy of 1K, effectively erasing all my gains for the week. I became pretty tilted by this but in the short term focused on recovering some of the loss by playing the same play I’d gotten wrong in the correct direction. I took 5 puts and dropped them quickly for a 30% gain, making back $35 of the $339 I had lost immediately.

This left me with one open position at the time: CVS. I’ve spoken on this before and I got the opportunity to show it in action today. While I hated the CVS play itself, I did believe that the play would turn green for me. So instead of getting in my own head and thinking because I lost on SENS, I should immediately cut everything because I suck, I held the position because nothing about that play had been changed. As a result, I was able to make a $120.00 gain on the position today and cut for a profit. So instead of being down 32%, I ended down 19% preserving a modest weekly gain on account instead of ending where I started.

After I held enough composure to get out of my SENS position, I stopped trading. This is another part that I am fortunate to have demonstrated. Had I continued trading at that point I probably would’ve taken something volatile looking to trade back my losses even further, but instead, I went for a drive with my wife and her family, went to a bakery and got lunch. It was nice. Then, when I came back, I was fresh and able to sit down that actually just chill. You don’t have to trade all the time and in most cases it’s absolutely better that you don’t. Today is an example of that.

SPY

I touched on this in the intraday commentary, however, this account is the only account that I am now actively trading. The style is not my usual considering people are now following along and taking my semi-YOLOs all the time would be irresponsible and not indicative of the goals of this challenge, however, every once in awhile an opportunity might arise where I’m going to take a risk and this SPY put is one of those times. Given the current political climate and the fact that we’re heading into an emergency FED meeting on Monday, I can see a path to a gap in the downward direction on SPY. Normally I would’ve road FDs into the afterlife (well, one of them anyway) on this one, but I actually carefully selected a reasonably farther out expiration and an obtainable strike with a FEB 18th 430 PUT. Thanks to @thots_and_prayers I was just made aware that Bullard will be on MSNBC Monday morning so I’m liking my chances that I’ll probably be able to start next week off with this position green. Or maybe not, it’s a risk and that’s why I said so.

Closing Thoughts

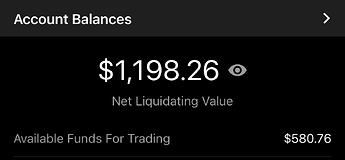

At the end of week one I’m very pleased with how this challenge is progressing. While I undoubtedly made some bad trades this week, the account is still positive and I got an opportunity to show a lot of the stuff that I talk about in a more transparent manner. I honestly feel that at the end of the week, the challenge has already been a help and I am extremely excited to continue next week focusing a little more heavily on the research and trading sides now that the distractions of the setup are behind us.

One of the things I’m most proud of was today’s SENS recovery second to the ASTR win yesterday. With SENS, we called the play from the lower $2’s and safely and effectively rode it up to almost $4. Those following the account watched me take profit several times and reposition at better cost a better cost basis with a similarly sized position each time. Because of this, I was green on SENS overall despite getting completely blindsided by the approval drop:

SENS netted the account a total of $396.00, which is 39% of our starting account value. Obviously some of the misplays have chipped away at that, but it goes to show how properly profit taking and repositioning (not rolling) can protect you while increasing your profitability over time. So for this, I’m extremely proud. SENS went terribly wrong out of nowhere, yet the account is still intact, I’m still up on the week. This is how you succeed.

See you guys Monday. We’re going to hit this a little harder next week and I’ll be way more active in VC as well. Be sure to ask any questions you guys might have or give me any feedback you think is pertinent for the next week so I have time to read and consider it.

Stats

Today we were down -19% on account and we’ve finished the week at +19%.

)

)