Daily Comments

Today I’m going to go on a mini rant about pumps. Intraday today the server went a little wild for stocks that were running on no news at all. One of them, had you bought in would’ve been insane gains, however, that play is the absolute minority when it comes to how they “usually go”. How they usually go is pretty much like LFLY:

Let’s break it down. This stock was barcoding and had absolutely no news what-so-ever, then suddenly a candle with 69,000 volume on it creates almost a whole dollars worth of upward movement. This was at roughly 1:20.

Now, it started immediately making the rounds in various pump servers and at around 1:40, it hit 5 rivers. Highlighted in the yellow area on the chart is that timeframe where the most volume after that initial front run buy-in came in. Everyone who FOMO’d into that callout had exactly two candles on the 1m timeframe to sell or else they didn’t get out green.

So to recap, almost all the volume was congregated in a price point that it immediately left and never returned to. That means that the vast majority of people in this play were only green for maybe a couple minutes and most all of them are likely very red now and will be for the foreseeable future.

But there’s one more aspect to this that needs attention. You see that note at the top? The candle responsible for reversing the trend contained volume almost completely proportional to the volume that came into the stock when whoever was front-running this call made their buy-in. That candle belongs to someone dumping on everyone who took this callout, they became nothing more than exit liquidity for someone looking to enrich themselves on the backs of others.

So today I ask you a question; who are you trying to enrich? Is it yourself or is it someone else? If you’re looking to make other people rich, more power to you. But if you’re looking to better your own life, maybe think twice about FOMOing into these “opportunities”. If a stock doesn’t have a reason for running, you usually don’t have a reason to trade it.

Back to our regularly scheduled programming.

Play Breakdowns

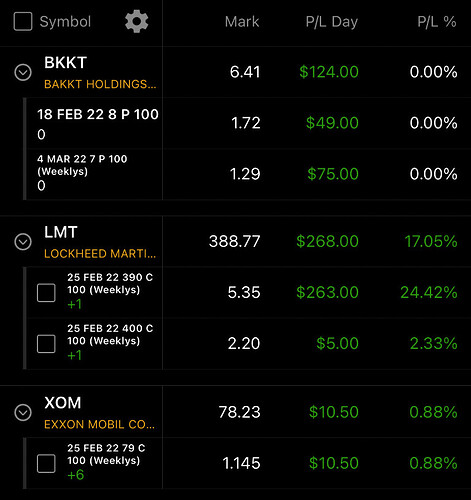

BKKT

I FUCKING GOT ONE MOTHERFUCKERS! ahem, so… I got an earnings hold correct. Last night using the following DD: BKKT - Potential run-up to earnings - I had decided that BKKT’s earnings were likely not going to be too great. I’d been wanting to demonstrate how to properly play earnings and this was somewhat of an opportunity to do so. I bought two puts yesterday, took profit on one and let the other one ride through earnings. I made 30% on it yesterday, today when I cut at open, I made roughly another 100%.

However, I also then demonstrated a bit that we always forget like is talked about in the following thread nobody ever read: Analyzing our earnings plays - which is to play the same play again but instead now taking into account what the results of the earnings were. After noticing the stock had come down significantly intraday, I identified that it was trading in a bear flag. I made a callout on what I believe to be the “tip” of the flag and took 2 puts. BKKT continued downward but also was helped along by SPY’s dramatic cliff diving. In the end, remembering to play BKKT after earnings netted us another 38% gain. So all together we made 30%, 100% and 38%. Now heres the trick: if you remove the gamble which could’ve went against us easily, we made 30% and 38% in two easy as fuck trades with incredibly less risk than we took on to achieve the 100%.

It often makes more sense to make the 30% and 38% then to risk losing all that profit on a coin flip. I think a lot of us should be doing that more often.

LMT

In a development that would surprise absolutely nobody; it looks like Russia is still planning to attack Ukraine. I’m not going to spend too much time on this trade because its been covered, however, we essentially did the exact same thing we did yesterday. We identified an inverse H&S early in the day, took our positions in head and let it ride. The news we’ve been following has been forcing the stock upward out of correlation with SPY so we know that at least at this time Algos are trading it as though Ukraine developments increase the value of LMT. Our thesis is that the stock is currently waiting for confirmation of an invasion and should see somewhat of a pop as a result. However, we’re currently holding green and we have safe expirations and near ITM strikes in case that doesn’t happen.

XOM

I’m actually decently excited about XOM at this point. We watched it respect that $78 support the entire day in the face of some intense downward pressure from SPY. Given the environment surrounding Ukraine, it looks like XOM might be very well positioned for a pop soon and we’ve collected a very solid position at almost the lowest prices the options trade. This type of trade is among one of my favorites. I’ve never been super down, the stock really doesn’t do anything too crazy, we’re just waiting, somewhat stress free until the catalyst comes along and gives us money.

Closing Thoughts

I was really touched to read through all the testimonials of people that have been helped by the challenge in yesterdays update. Thank you to everyone for the kind words and I cannot described how amazing it is to see all the positive changes that are happening. Love this place.

Stats

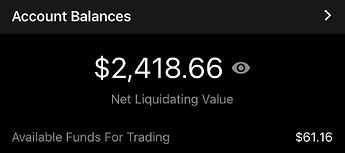

Today: +23%

Week: +102%

Challenge Overall: +141%