[size=4]The Company[/size]

Ace Convergence Acquisition Corp. (ACEV) is a pre-merger SPAC that is merging with Tempo Automation, Inc. (Software-accelerated electronics manufacturer).

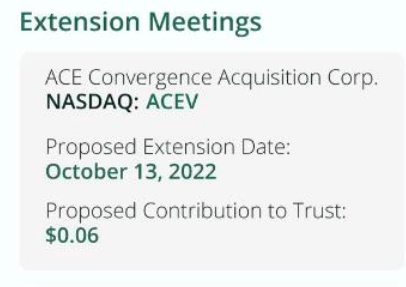

The deadline for the initial business combination is July 13, 2022.

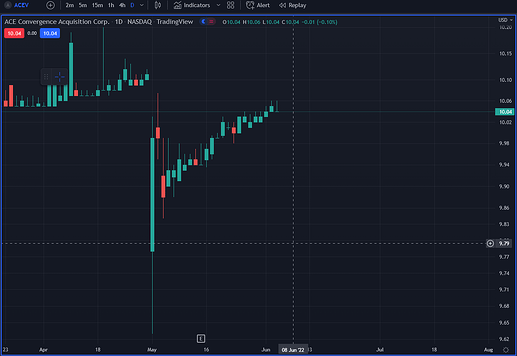

From my understanding, it’s NAV is $10.00 - which it’s currently trading under at time of writing this.

[size=4]The Components[/size]

As I was learning how to reverse engineer ESSC, I formulated a checklist of what to look for to make a SPAC play viable. The following are the components that I’ve researched and found that could make this the next ESSC.

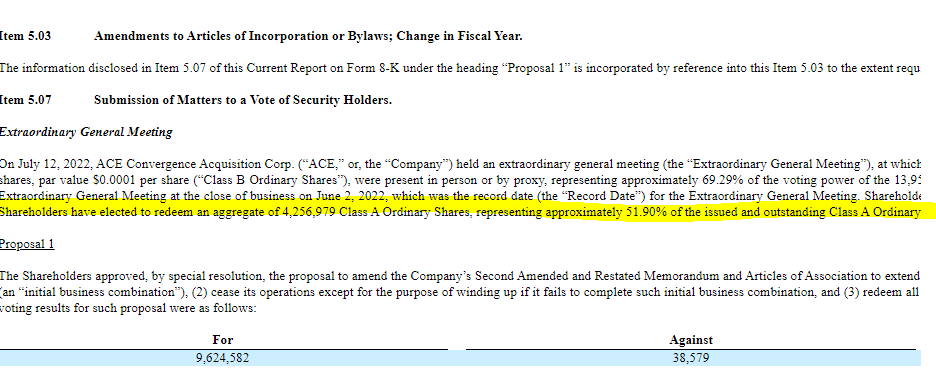

- Is the current float already relatively small? Yes, current float is 8.2M (refer to 8K form above)

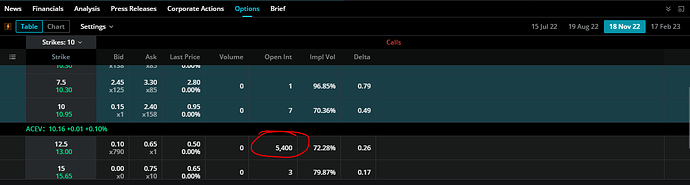

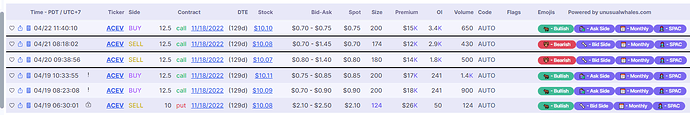

- Is the ticker Optionable? Yes, on Webull - I can’t confirm for other platforms.

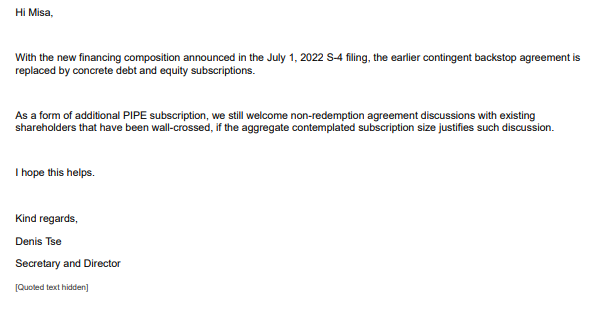

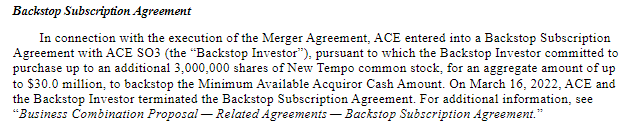

- Is there a Backstop Agreement? Yes.

[size=4]The Missing Piece of The Puzzle: Redemption[/size]

The play is contingent on the amount of shares that are actually redeemed.

Free Float = 8.2M

Shares Redeemed = ???

Backstop Subscription Agreement = 3M

New Float = ???

As a simple formula:

(FF - SR) - BSA = NF

(8.2 - SR) - 3 = NF

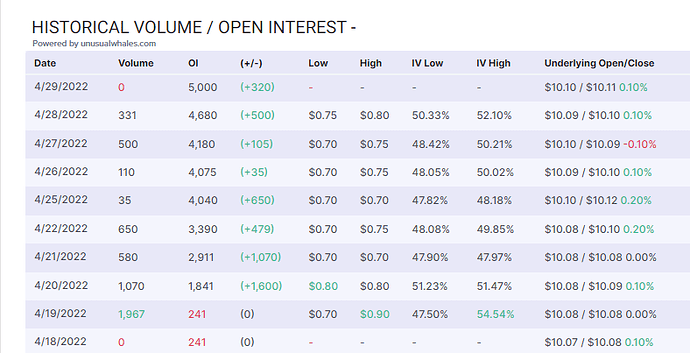

As we can see, it would take about 4.2M (51% of FF) shares redeemed to get a New Float of 1M or less. This would translate to an option chain that would only have to have 10,000 ITM OI to make it 100% of the New Float.

In terms of where the SPAC is right now, they’ve yet to announce the date for the finalization of the Business Combination. Also, important to note: there was significant price action back in January & February and I’m not sure what caused it.

Anyway, if the SPAC continues on course and the open interest starts to accumulate, we could be witnessing the start of something really incredible.