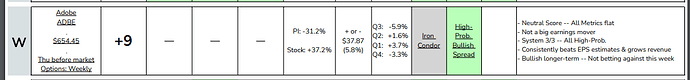

What this is: Earnings Report play guide on $ADBE.

Read: Swing Trades / Riding Trends

TLDR:

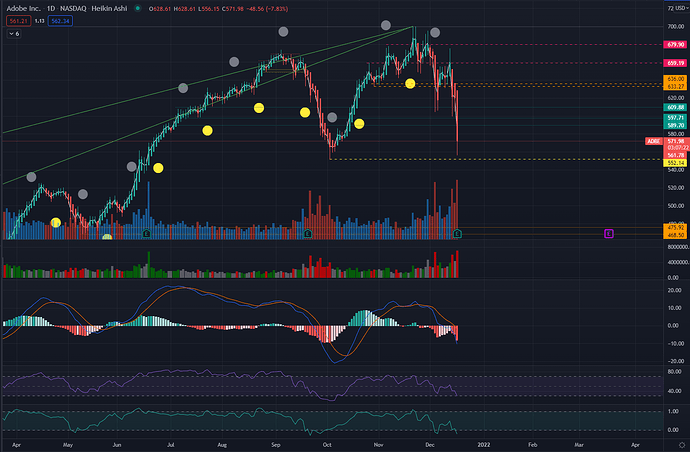

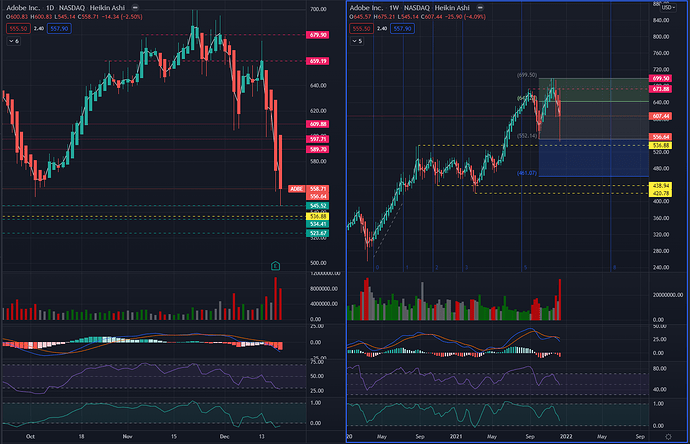

- ADOBE is one of the tech-related gainers since the start of the covid19 pandemic.

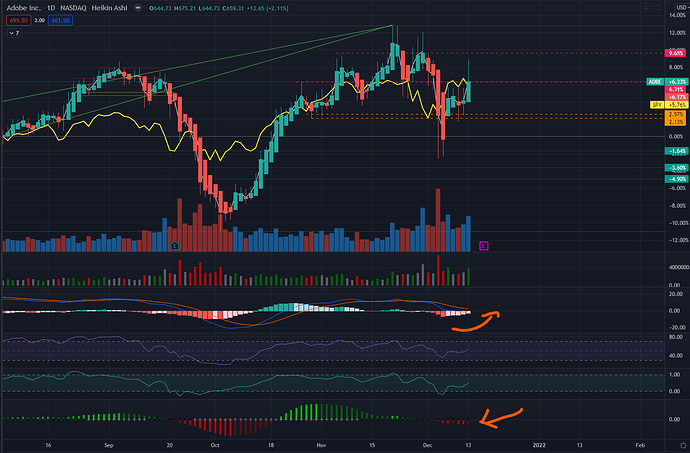

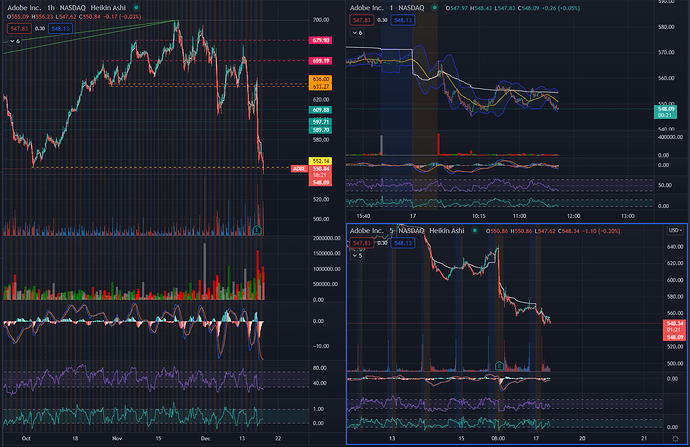

- They are also finally showing signs of weakness in the Weekly, Daily, and 1hour charts.

- Although they beat 3Q ER, they still fell -4.79% the next day, and all the way down to -14.53% before bouncing.

- Looking to see if they will finally break down further starting next week.

Meeting Link

https://www.adobe.com/investor-relations/fa-meeting.html

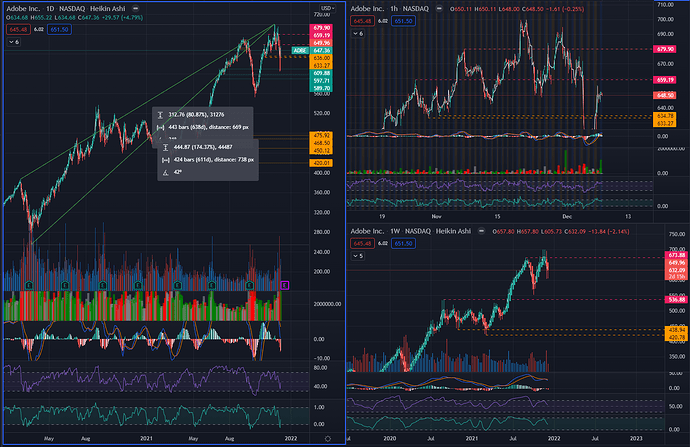

Chart…

Here, it’s measured they rose to a total 174.37% since the crash of March 2020.

If we look before that, then they still gained 80.87% at the peak of Nov 2021.

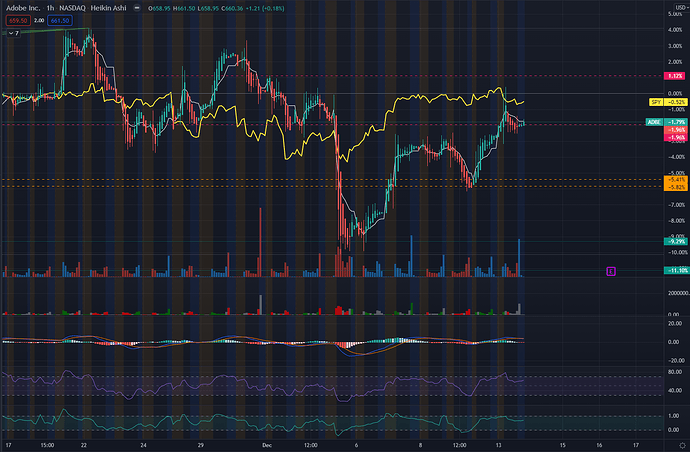

1hour chart shows a clear Head and Shoulders pattern that broke down last week.

Weekly chart is that of a clear Double Top.

Here’s a report from 2019 which resonates their success these past 2 years:

Now though, they are overvalued like the rest of the tech giants, and needs a good correction to be sustainable moving forward.

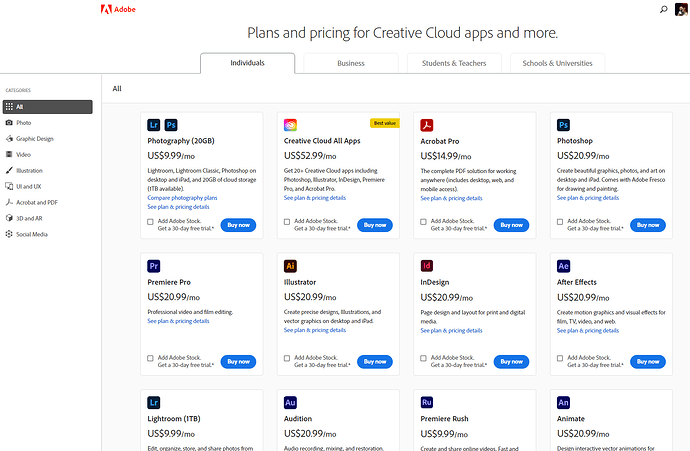

What’s giving them the tenacity is their lineup of products that most independent media producers rely on:

Their photography (photoshop and lightroom) and All-In Creative Cloud apps are 2 of their best sellers.

They also have Acrobat Pro as a separate subscription.

With the addition of Stock Images and Videos, it’s a real solid digital production line.

The only thing missing from them is music.

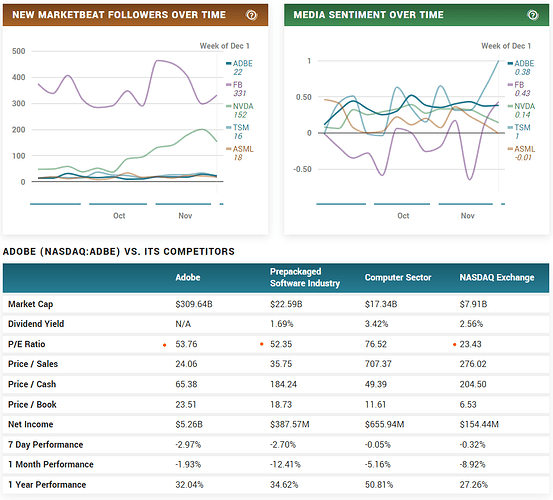

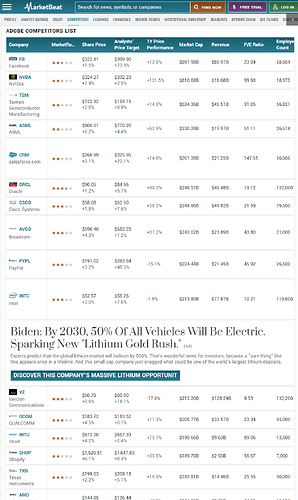

Their direct competitors are not as comprehensive.

For video production, there’s Sony and AVID.

For photography and illustration, there’s Corel and free stuff (some from camera manufacturers themselves).

For PDF, of course we have DOCU.

None of these are all-in-one solutions like Adobe.

Stock Market competition is comprised of the other tech giants:

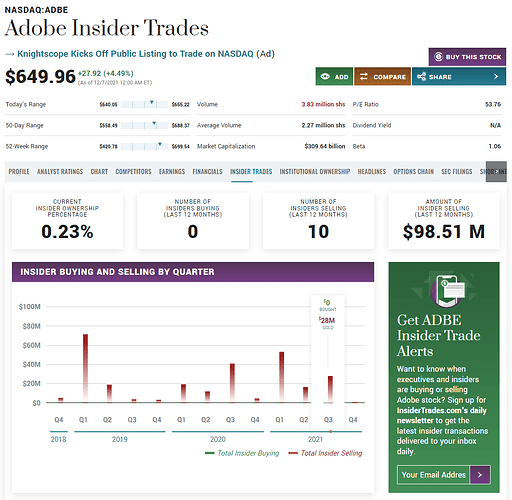

Insider Trades Q3…

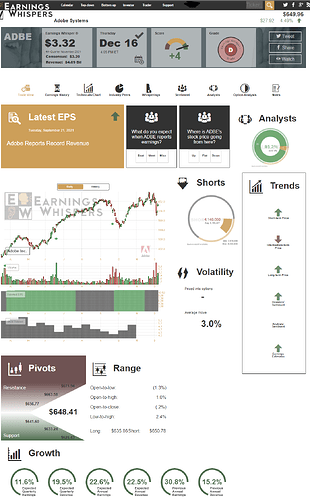

Earnings Whispers…

“Adobe Systems Incorporated is one of the largest software companies in the world. They offer a line of products and services used by creative professionals, marketers, knowledge workers, application developers, enterprises and consumers for creating, managing, delivering, measuring, optimizing and engaging with compelling content and experiences across personal computers, devices and media. They market and license their products and services directly to enterprise customers through their sales force and to end users through app stores and their own website at www.adobe.com. They offer many of their products via a Software-as-a-Service model or a managed services model as well as through term subscription and pay-per-use models. They also distribute certain products and services through a network of distributors, value-added resellers, systems integrators, independent software vendors, retailers, software developers and original equipment manufacturers.”

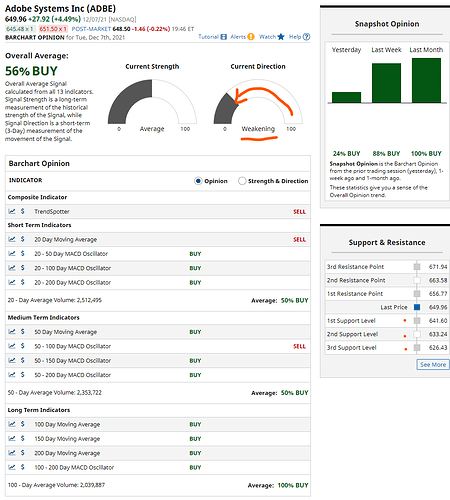

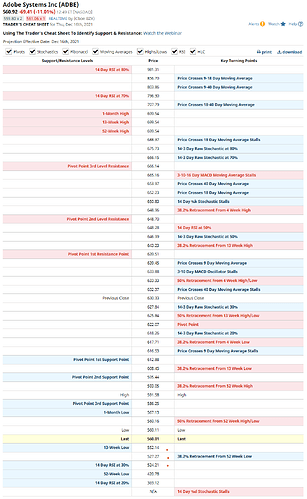

Barchart Opinion Ai…

How this can be played…

ADBE stopped bleeding yesterday and bounced a good +7%.

-

If it gets rejected at the previous support line of 659.19, another downtrend should commence that may last for a few days before ER next week, Dec 16 AH.

If it gets past that resistance line, then it may try for 679.90 again and most likely get rejected there, then trade sideways for a bit. -

Post ER, this is where it’s safest to play since we’ll know the reaction of the market.

-

Gamble with ER? I would say nearest OTM PUTs 2weeks post-ER expiry will be safer than calls–unless there’s obvious influential news published on the contrary.

For bigger players, maybe consider Iron Butterfly as a strategy.

For smaller accounts, I don’t recommend it unless it breaks most support lines prior to ER.

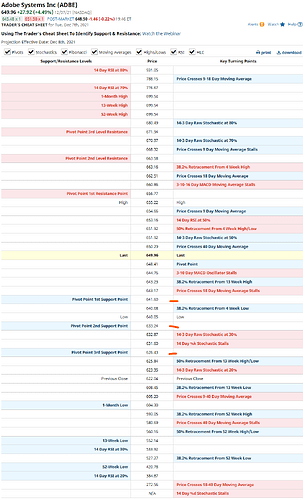

Support: 641, 633, 626, 609, 597, 589.

Resistance: 656, 659, 663, 671, 679.

I’d love to hear your thoughts on this.

Chime in on the comments below.