Still a work in progress but I want to spell out my strategy and at least my initial thoughts to begin conversation.

[size=3]Findings[/size]

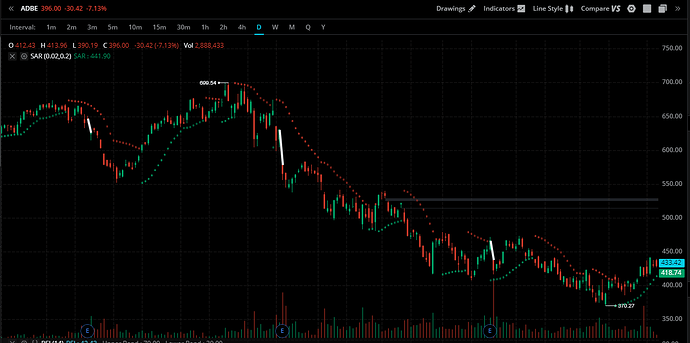

To analyze the previous earnings for the dips, I’ve found that they’re pretty good at beating EPS and revenue, but what’s suffering is their forward guidance. They’ve lowered guidance for the past two earnings calls and it shows in their performance.

Someone more involved with ADBE as SaaS can likely pipe up on what their outlook might be, but given hiring freezes and general cost-cutting initiatives being taken ahead of a probable recession by numerous tech companies I would think that revenue may show as flat for this ER. Fortunately for many of these software partners the act of killing a subscription to SaaS is easier said than done, especially after significant investments have been made into them, so I’m not expecting massive loss of revenue.

On Tuesday, the Shantanu Narayen-led Adobe (ADBE) said it expects to earn $3.30 per share on $4.34 billion in revenue. Analysts were expecting the company to earn $3.35 per share and $4.4 billion in sales.

Adobe dips on weak Q2 guidance, Street worries about Russia-Ukraine conflict (NASDAQ:ADBE) | Seeking Alpha

[size=3]Peers in the Space[/size]

Related peers in the space include Oracle (ORCL), VMWare (VMW)

VMWare is currently being targeted for a buyout by Broadcom so I’m going to focus on ORCL.

Oracle’s earnings are slated for Monday after hours. This presents an interesting potential to go on a sympathy and IV ride for ADBE’s ER call on Thursday after market close.

[size=3]How I Will Play This[/size]

IV runs on earnings are a good source of gains, and having a peer having their earnings a few days prior to them will help set the tone on ADBE up until their earnings. My intention is to enter a strangle on Monday and cut one leg of it on Tuesday morning after ORCL earnings are announced.

Monday, June 13

Take two strikes:

- +25C above the stock price

- -25P below the stock price

Tuesday, June 14

Sell off whichever strike is in the opposite direction that ORCL moved and proceed to hold.

Thursday, June 16

Sell the remaining option by 3PM EDT