I’m unsure if this is good earnings play or not. If someone wants to add and or look at this from a TA standpoint that would be great. I’m new to this so constructive criticism is always welcome.

Autodesk sells design and building software to Architect, Engineers, Construction and Manufacturing. For architecture and engineering they are one of the top software to use. They are slowly moving up in their construction and manufacturing software.

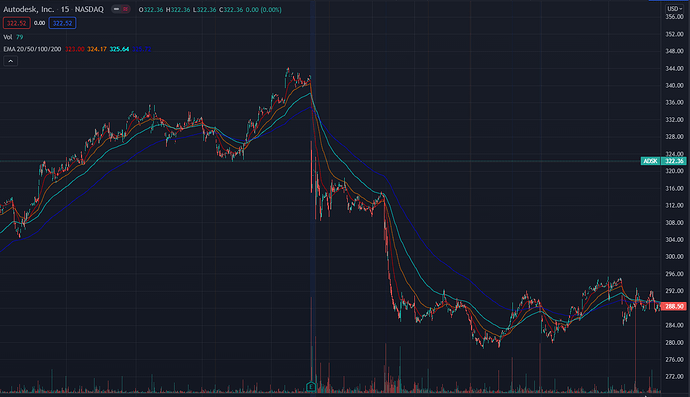

Now lets take a look at their Q2 earnings…

BIG GUH.

Why though?

They were at their all time high previously, they beat estimates but lowered guidance for the year ($1.575 b-$1.65 b down to $1.5 billion-$1.575 b) The reason being they are doing away with multi-year subscriptions and switching to yearly.

Previously, large customers would sign multi-year deals with Autodesk, paying for all of its services upfront with a discounted price. The company has decided to change this to annual billings with lower or no discounts. This will hurt cash flow in the short term (no lump sum payments) but will increase the total cash Autodesk will generate over the long term.

The second drop seems to be when analysts lowered price targets

[size=5]Bullish Info[/size]

[size=4]Autodesk Build[/size]

New this year they came out with construction management software, this actually looks pretty good and I wish it was out when I was working in the field lol. Keeping everyone on the same page, Construction, Architects and Engineers is a huge issue. Looking it over it seems to be pretty robust.

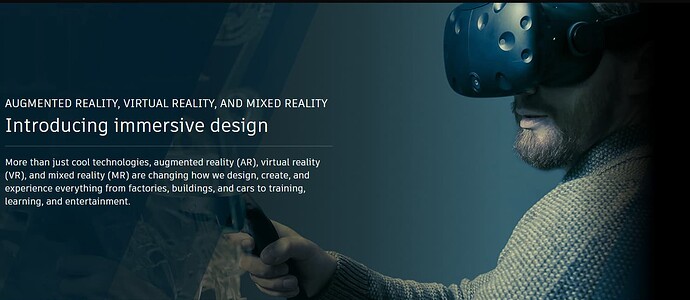

[size=4]Autodesk and the Metaverse[/size]

Could this be big for them? Autodesk already has suite of software for VR and AR, as well as the ability to take designs from Architects and Engineers straight into AR and VR spaces. This could be big for the architects and engineers (their main clients) not having to leave their ecosystems.

I did find quite a few articles including them in top metaverse stocks to watch.

https://www.nasdaq.com/articles/5-metaverse-stocks-to-watch-in-november-2021-2021-11-02

https://medium.com/yardcouch-com/how-to-invest-in-the-metaverse-94e98e603da5

[size=4]Bearish Info[/size]

Autodesk Quality Control

Updates can be buggy. You used to be able to buy the actual software so you learned the bugs and workarounds. Now that thats gone pushed (and often forced) updates can have issues, they generally fix it quick but it is a known issue.

Lowered Guidance

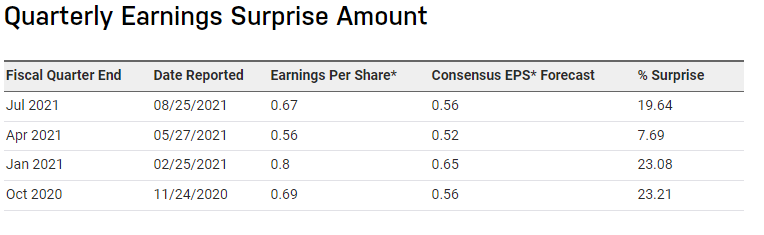

Autodesk generally beats earnings estimates, but they did lower guidance last quarter.

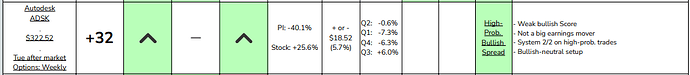

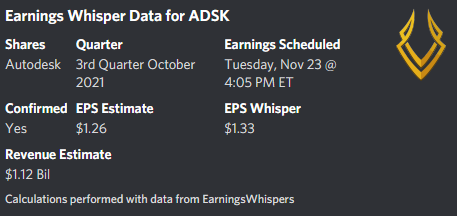

[size=5]Current Estimates for Q3[/size]

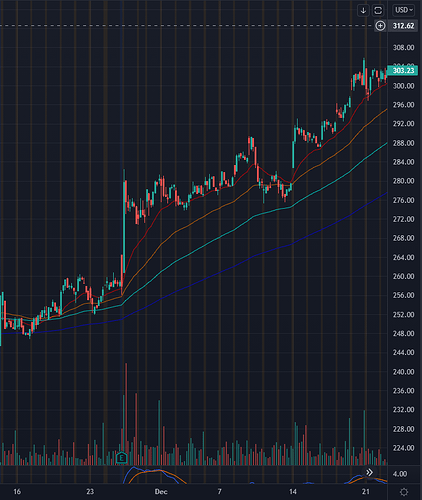

Analyst Target Prices Source

HIGH TARGET 390.00

MEAN TARGET 351.73

LOW TARGET 256.00

Last years Q3 earnings Chart

|Quarter|Estimate|Reported|Surprise|

| — | — | — | — | — | — |

|Q3 2020|+ 0.56|+ 0.69|23%|