Hey Valhalla,

Just setting up a Mega Thread for all the major news and company overview to help those wondering why I’m long-term bullish on the company (even if we have a recession).

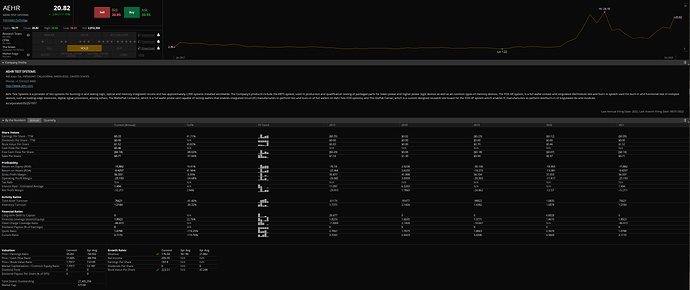

Financials are a big thing for me when I’m looking at any trade. They give significant insight into the companies’ overall health and help you determine if you need to worry about certain mechanics while you’re playing the stock.

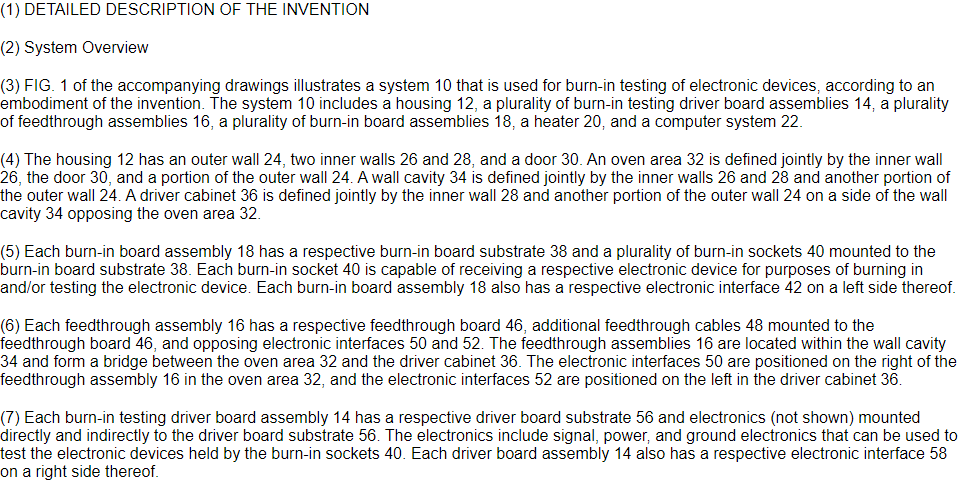

Starting with Profitability:

Their annual ROE numbers don’t look like a company that is performing extremely well especially when considering their PE ratio (45.261). This is normally a pretty big red flag that the valuation of the stock isn’t reflecting the true net income of the company when ROE is drastically lower than their Net Income.

In fact most of their Profitability numbers look rather atrocious… At the annual level…

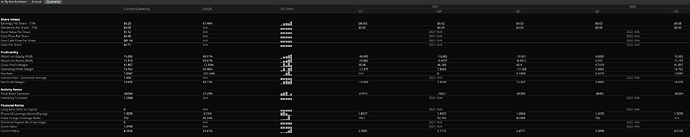

The Quarterly numbers show why this past earnings was such a big deal for me when the numbers came out. Look at how the rapid increase just in this last quarters ER numbers compared to Q2. Alongside them reaffirming their yearly guidance.

But damn… There is this big tidbit which is a valid concern always:

FINANCIALS AUDITED IN MARCH AND USED SAME ACCOUNTING METHODS SEE POST BELOW

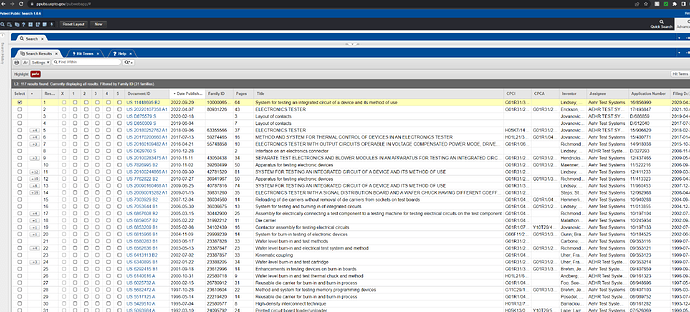

He made some claims on Patents lets check on that

Well damn son… Thats a lot of fucking patents

Main one we care about is US 6815966 B1

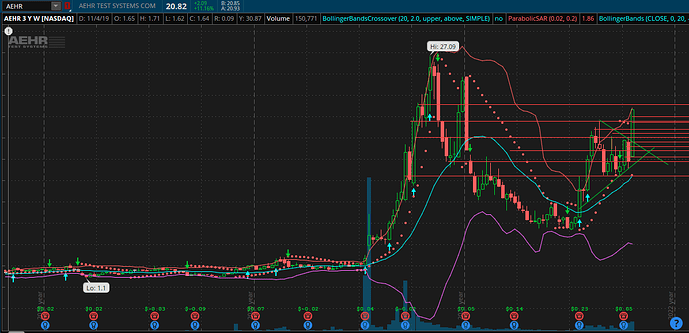

Now the fun part… TA

This chart is the Weekly chart as that’s what matters most to me.

During this week the stock broke rather violently out the bullish pennant it was consolidating within before its most recent ER call. The ER pushed it towards the top of the pennant and it retraced solidly (and as it usually does) since it is a low float with not a ton of institutional investors or exposure to retail investors. This push this week now needs to see some consolidation at the $19-21 levels before I think we see another big move. Now certainly anything can happen but I find it unlikely we continue pushing up on no news past this current level. But it could certainly happen:

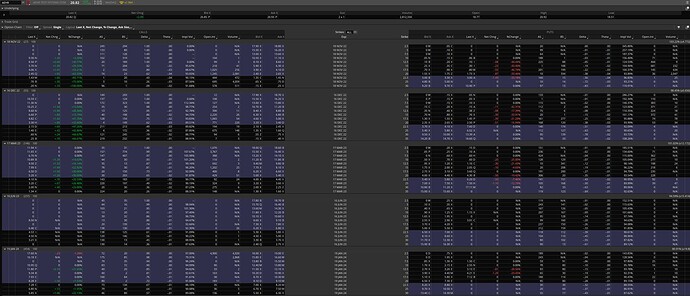

Current date for this options table is 10/22/2022

A massive amount of 2.5C 19JAN24 got purchased on Friday (4.9k worth) and as can be seen there is consistent OI already sitting on the chain and a good amount was purchased on the November strike on Friday. I’ll be keen to see how much OI there is Monday for Nov as well as seeing the current SI numbers.

But to get a continued move I would like more news before I take a position myself again or some consolidation.

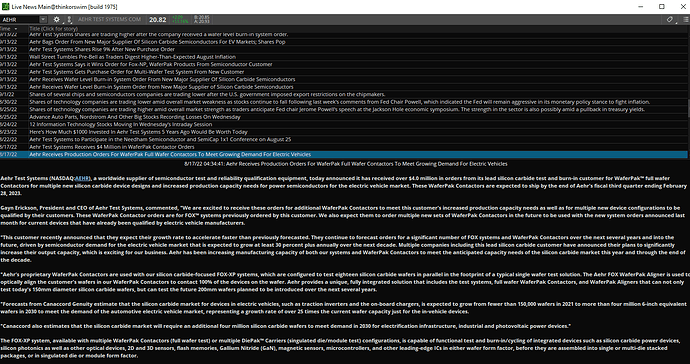

Upcoming News to look for:

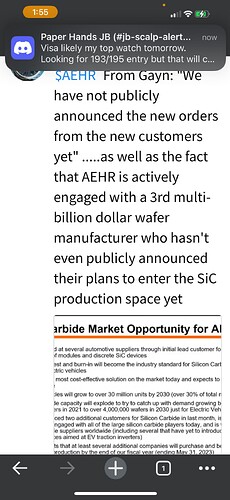

The last time they presented at a conference was Aug. 22 where it seems it is likely they acquired the interest of the EV customer they announced on October 13th. So with the upcoming conference we have some lag time before any big news of another possible customer. But that leaves room open for Wafer Pak orders that are in the millions of dollars themselves since its a reusable component for the burn in and testing system.

Nonetheless bless you all and lets enjoy the weekend