Sanctions on Russia related to airline industry

My main source comes from this Twitter thread: https://twitter.com/janedvidek/status/1498723248183382020

Someone working in the aviation industry considers that Russian airlines have, at best, about 3 weeks before they’d have to fold.

In addition to airspace closures, it looks like Russian airline planes are owned by leaser (lessor?) companies, with several of them being based in Ireland. A website dedicated to Irish business suggests it’s a $100B+/year industry. This Wikipedia page on aircraft leasing is informative as well.

The primary thesis is that, unless sanctions are lifted, lots of the airframes currently used by Russian airlines could be grounded soon, on account of restricted access to manuals, spare parts and access to maintenance facilities. With Russian banks being cut off from SWIFT, could they even make their lease payments?

Alternatively, it’s possible some of these will have to be returned to their country of registration and/or Ireland. If so, the leasing companies will burn money trying to store the airframes (planes only make money while they fly). If the leasing revenue falls off a cliff and additional costs are in the picture, I can see some of these companies losing value.

Possible Play

There are multiple aircraft leasing companies based in Ireland, and the largest is AerCap Holdings N.V., trading as AER on NYSE. The current stock price is $54.50, up 2.5% on the day.

This Bloomberg article mentions AER shares fell 13% (to $51.64) on Monday when the sanctions were rolled out, and that the company leased 150 airframes out to Russia, which constitutes around 5% of their plane portfolio. It’s unclear if any of these were returned until now, and based on the Twitter thread above I believe the issue can get worse for them.

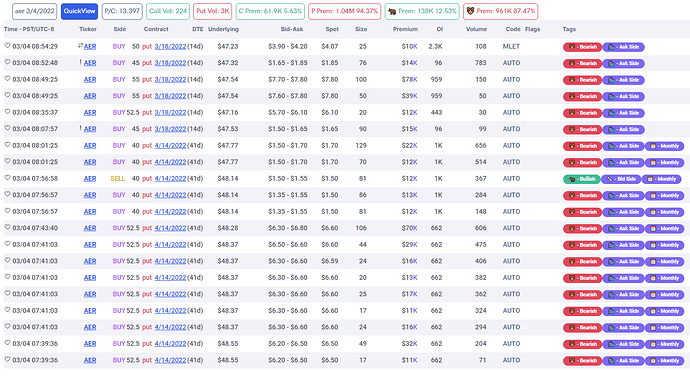

At the moment, I’m considering puts for 4+ weeks out, but I don’t hold a position atm. I’m going to look into the other large airline leasing companies in Ireland as well, and I’ll update the thread if I find anything new.

Relevant Links

AerCap Halts Russia Contracts as Lessors Seek Return of Jets

(Bloomberg)

Irish aircraft leasing firms face ‘mission impossible’ recovering planes from Russia

(The Irish Times)

Hundreds of Russia plane leases to be axed after Western sanctions

(Reuters)

Sanctions on Russia End Aircraft Leases – Affect About Half of Russian Airlines Planes

(VOA)

This tweet includes a link to a podcast on Irish airframes returning to Ireland due to sanctions. (disclaimer: I haven’t listened to this yet)

PS. This is my first DD, so go easy on me. Any feedback is appreciated. ![]()