Chart:

AFRMContent:

AFRM had their crazy earnings fiasco yesterday where some intern accidentally (?) posted a portion of the company’s earnings early on Twitter and AFRM then released its entire earnings report before market close. The stock tanked on the results.

The company reported a 2nd Quarter December 2021 loss of $0.57 per share on revenue of $361.0 million. The consensus estimate was a loss of $0.44 per share on revenue of $330.7 million. The Earnings Whisper number was for a loss of $0.46 per share. The earnings call was even worse. The company’s CEO and CFO kept saying the company was growing at a rapid pace and continuing to grow, but failed to adequately answer any questions whatsoever about how they will be able to trim operating losses.

Normally, when a company is scaling up and not yet profitable, you want to look at what the company’s expenses are, whether revenue growth can eventually outpace expenses, and the target revenue for the company to hit to become profitable. (SNAP is a good example of this, having finally achieved sufficient revenue to report its first positive EPS since going public). This is where the problem for AFRM lies and why I believe there is a strong medium to long-term bear case for AFRM.

Here is the report: https://investors.affirm.com/news-releases/news-release-details/affirm-reports-fiscal-year-2022-second-quarter-results

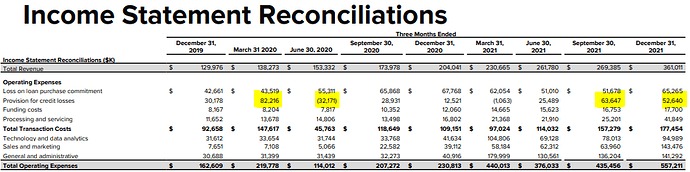

The company reported 27.55% revenue growth in the most recent quarter at $127 million, yet posted an operating loss for the quarter of $196 million. Some of the loss can be attributed to growing pains and certain expenses that are critical for rapid growth but will smooth out over time. For example, the sales and marketing expenses increased by 266.8% from this quarter in 2020. That could be attributed to rapid growth and would likely be expected to smooth out over time and decrease as a percentage of revenue. But that’s not what I am focused on. I am focused on the largest quarter-to-quarter increase in expenses for AFRM: provision for credit losses.

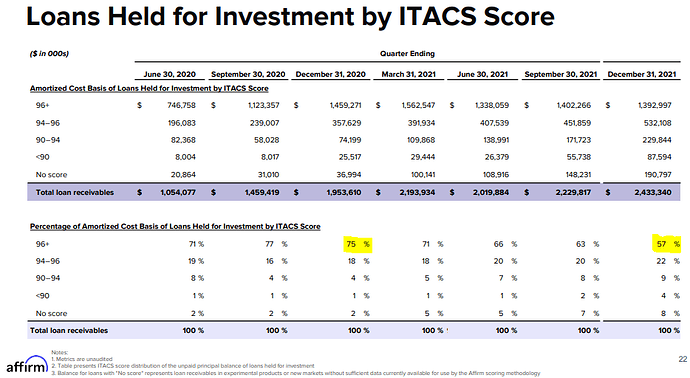

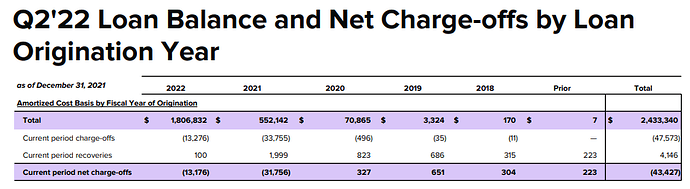

AFRM experienced a 320% increase (!!!) in provision for credit losses for this year compared to 2020, from $12.5 million to $56.2 million. More concerning, their provision for credit losses as a percentage of overall revenue increased from 12.5% to 41.4% (!!!). They had no explanation for this on the call or how they are going to fix it.

What does provision for credit losses mean? Well, when a company like AFRM extends credit to customers by letting them buy a product now and pay for it later, a certain portion of those customers will, for whatever reason, default on their payment obligations. Some of those customers who default will never pay the money to AFRM. Others will, but not until AFRM incurs collection costs.

Here’s the problem: AFRM consistently market themselves as a company that does not charge late fees ever, charges no hidden fees, and has many instances where they charge little to no interest. This is a noble endeavor, but how does a company do that and still make money, especially when some of its customers don’t pay back the loans?

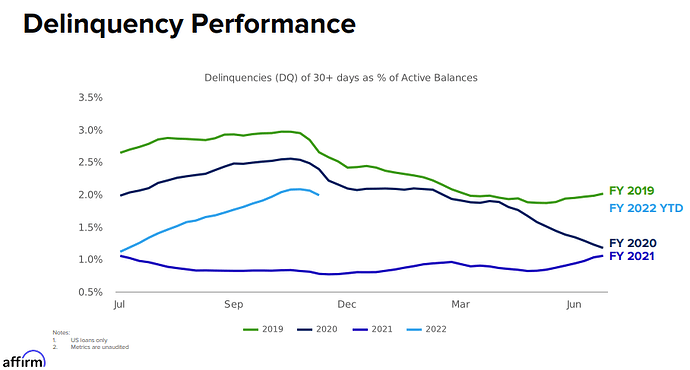

The answer: they don’t. AFRM had to increase its provision for credit losses by 320% but has no solution for how to reduce its provision for credit losses. They continue to say they won’t charge late fees. They continue to offer zero-interest options. They continue to provide lower interest rates than credit card companies. Their stated solution is growth, growth, growth. But the credit loss reserves are outpacing growth and increasing exponentially both in raw numbers and as a percentage of revenue.

Unless, AFRM can get this growing problem under control, it continue to experience massively negative EPS in the near term. Seeing as AFRM does not even acknowledge this is a problem and, even if it did, its stated solution is growth, AFRM does not appear to be able to solve this problem with current management.

I believe that AFRM will continue to drop in value before leveling off to much lower valuation until and unless it can reduces its losses. I am going to look into puts on Monday after the Fed meeting.