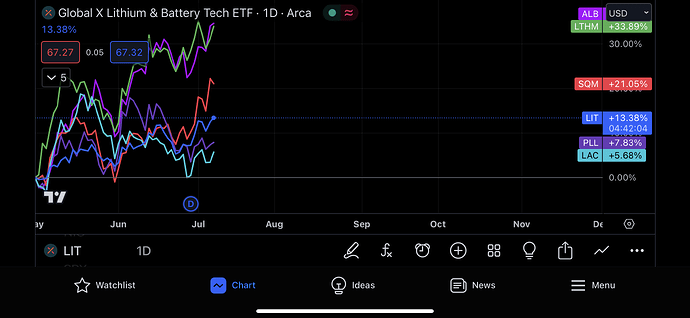

Over the last 2 months, I’ve had several lithium-related stocks on my watchlist, including $LIT which is the Global Lithium ETF that includes miners and battery producers.

What I have seen is, unsurprisingly, a steady increase in the performance of these stocks. Although EV’s are at the top of the “demand” list in our minds, overall the demand for lithium batteries is increasing across all fields due to their efficiency, not only from an energy perspective but also from a manufacturing perspective since we still face several hurdles in development and production of the “next best thing,” especially from an infrastructure standpoint since many countries have jumped on the EV Charger station bandwagon pretty heavily while all but ignoring other up-and-coming vehicle power options, such as hydrogen fuel cells, and alternative fuels (still no deep-fryer engine models hitting mass production, sadly).

All that said, $ALB has made its way to the top of my list in companies to watch for this sector. While everyone else has been piling in to South America, ALB is the ONLY lithium miner currently mining in the U.S. (estimated to hold the second largest deposit globally, first being the Lithium Triangle in South America) while still maintaining a large operation in Chile with plans to expand there as well.

Now, I will note that $LAC is also working on a mining facility at what is believed to be the largest deposit found so far in the U.S., but they have just started construction of the facility this year. I should also note this is in partnership with $GM. LAC is the other stock at the top of my list for this sector to invest in, since they have also been doing very well in their growth.

But, what gives ALB the edge, in my opinion, is that they are well diversified throughout the fuel industry, producing catalysts and compounds used in the petroleum refining industry and hydro processing industry while also producing fine chemicals used in pharmaceuticals. Although the lithium division of its operations accounted for roughly 68% of its profits in 2022, its not the ONLY THING they have going for them like many of the other top Lithium miners. And as the largest producer of EV batteries since 2020, it’s nice to know they are not just a one-trick pony.

So, why should you care?

Aside from the long-term investment implications of everything I just stated, just in the last two months we’ve seen ALB grow over 34% (see chart above), outperforming it’s competitors and the overall Lithium market, but still no where near its ATH from November at $334, or even its Yearly high of $293. We’ve got an ER coming up on 08/02/23, and I think we’re going to see some more upside this go around, as it had about a $10 move this past ER.

Given it’s currently near a $243-ish resistance level, I won’t be taking a position yet until I see confirmation above that for a climb back towards $263 or a rejection leading back near $228.

Happy to hear more input!