My 2nd only DD on this forum and this one is a bit more of a formal format with links to data/sources than my previous one. Hopefully this one is better than my first one and hopefully someone finds it useful.

Now without further ado… Here you go!

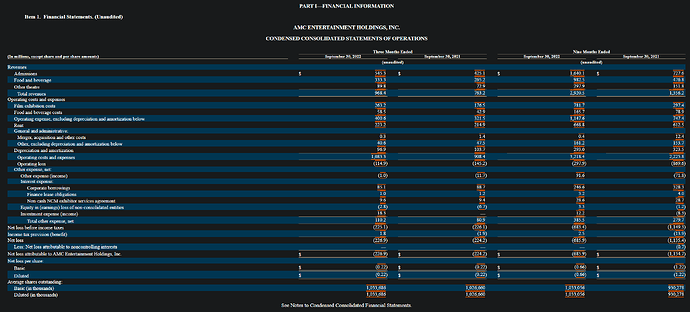

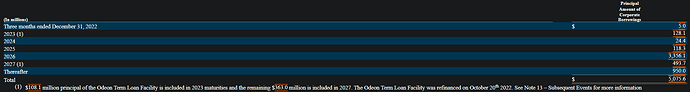

Attached in pics below are the main figures I pulled from the SEC EDGAR filings for AMC financials along with links.

Excel Pic #1

What I did in this picture is put it into Excel some of the more relevant things for me in my analysis.

If you notice, AMC has been burning 228.6mil per quarter. 685.9mil over 3 quarters (9 months) or roughly 76mil per month.

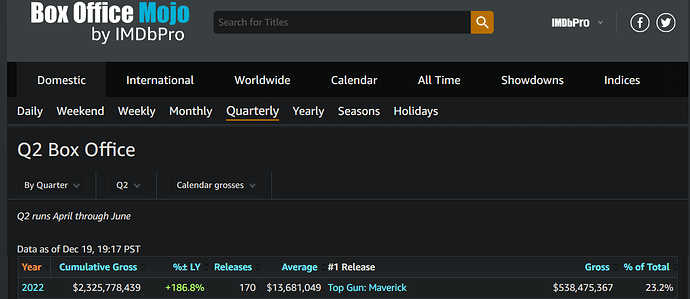

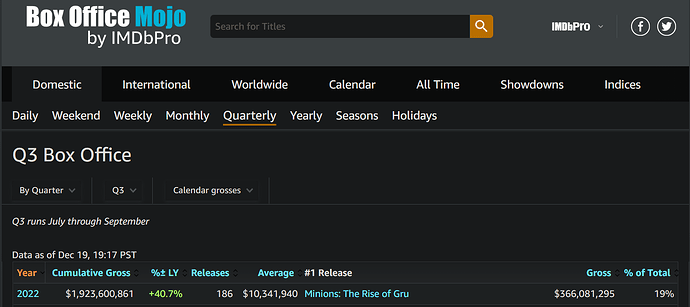

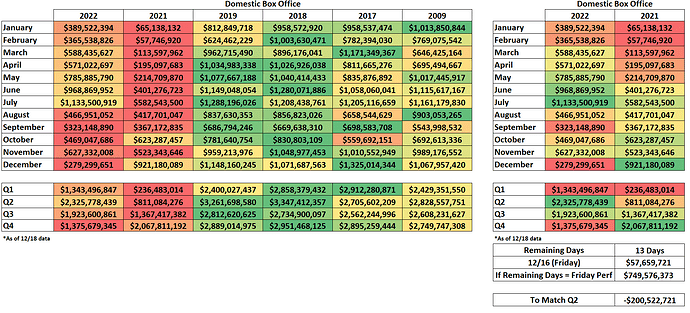

Now I also added Domestic Box Office Gross figures in that table but here are the sources.

*edit fixed the q3 2022 not showing

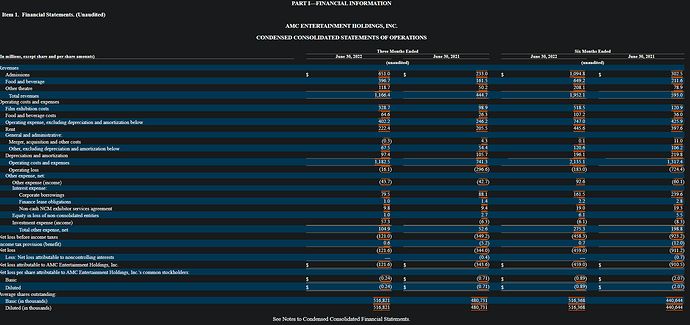

Excel Pic #2

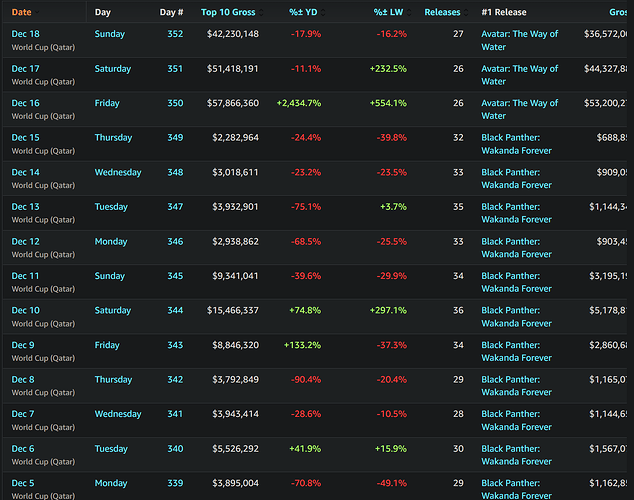

So let’s tie up all the Domestic Box Office Gross Figures and get some context.

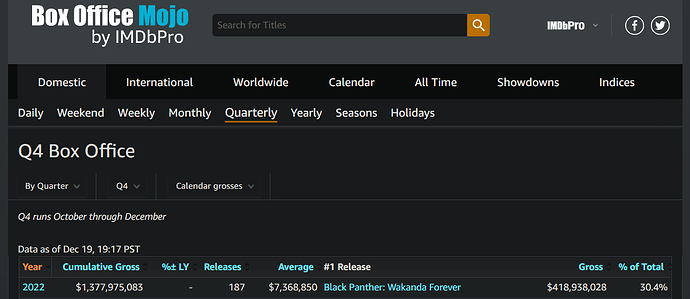

Q4 currently is at 1.37bil. Q2 was 2.32bil. Meaning roughly 950mil is needed in roughly 13 days to hit Q2 figures. Now if you look at past performance, 950mil in a month let alone 13 days is extremely tough.

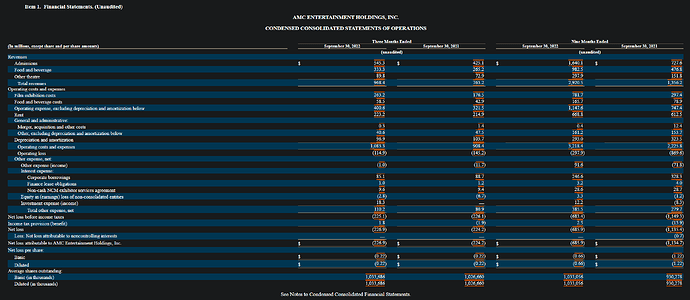

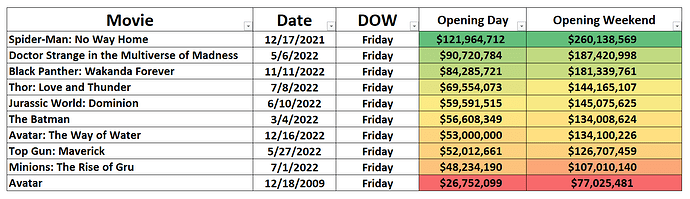

Avatar 2 which was hyped up to be the savior of AMC’s Q4 had a pretty slow opening. To put some context to their performance here is a chart.

Excel Pic #3

134mil opening weekend is far below some of the recent big hits.

Now you don’t need to be a genius to figure out that as movies go on after their opening weekend, they tend to drop down in box office gross as the market of movie watchers for that movie is saturated.

But if we refer back to Excel Pic #2 I did a rough calculation. If the remaining 13 days for the domestic box office used Friday’s performance (opening day of Avatar 2) for every single day for the rest of the month, what would the numbers look like?

Well my calculation showed that domestic box office gross would be down about 9% vs Q2.

Now if we refer back to Excel Pic #1, we know that AMC had net loss resulting in a cash burn of $121mil. We can guess that domestic box office will be down at least 9% vs Q2 if not significantly more. So that means as a result AMC’s revenue will also be down.

Don’t get confused if movies do really well overseas though. Because almost 80% of AMC’s revenue comes domestically and markets like in China, Japan, Korea, etc… won’t help AMC.

So Q4 performance for the box office is looking to be at least 9% down from Q2 and maybe at best 10% above Q3 2022.

If we average the Q2 and Q3 domestic box office figures, it comes out to 2.124bil. This is close to what my previously calculation would come out to if domestic box office were to avg roughly 57.6mil per day everyday for the rest of the year.

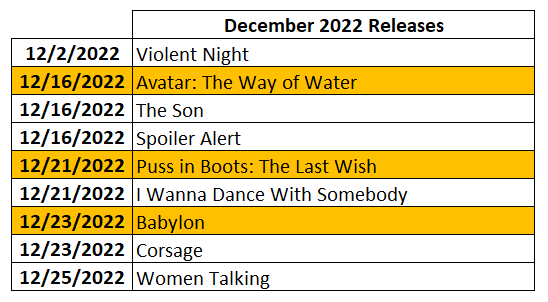

Now my confidence in why that 57mil figure won’t be hit on a daily rate besides just typical box office decrease week over week is also due to the fact that Dec 2022 releases arent that strong.

Attached below are the major releases lined up for the remaining part of Dec 2022.

To put some past performance into perspective, Puss in Boots original back in 2011 did $92,175,928 in 15 days but it will only be out for 11 days for the Q4 2022 count. And early projections of Babylon is only showing roughly 75mil-100mil for its opening.

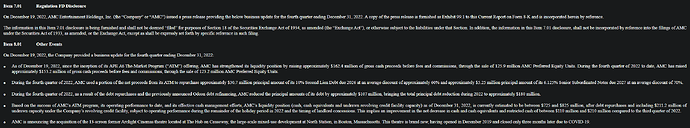

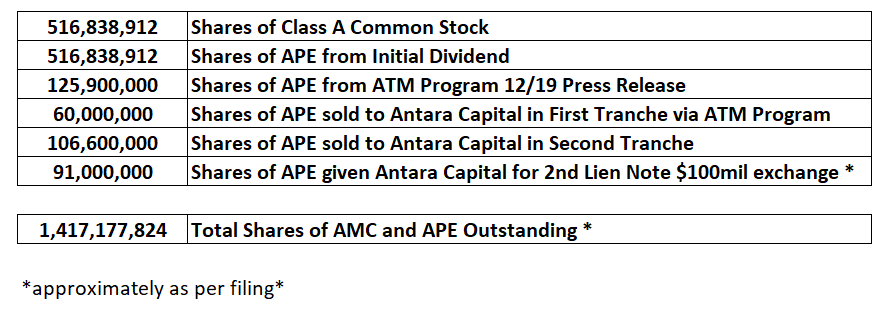

Now let’s factor in AMC’s liquidity status especially since AMC gave an update in regards to their APE dilution and estimated liquidity situation.

They state that they would have in between 725-825mil cash/cash equivalents + undrawn revolving credit facility which is 211.2mil.

So correct me if I am wrong but I interpreted that as saying that minus the credit facility they would have between 513.8mil to 613.8mil of cash. And that would be all after the current dilution to date which added 153.2mil cash minus fees/commissions.

Now remember AMC ended Q3 2022 with 684.6mil cash on hand. So best case scenario thats 70mil less cash vs Q3 even after all that money raised. Meaning cash burn would’ve been in the 200-220mil range.

So that was Q4 when AMC was hyped with big movie releases such as Avatar 2 and Black Panther 2.

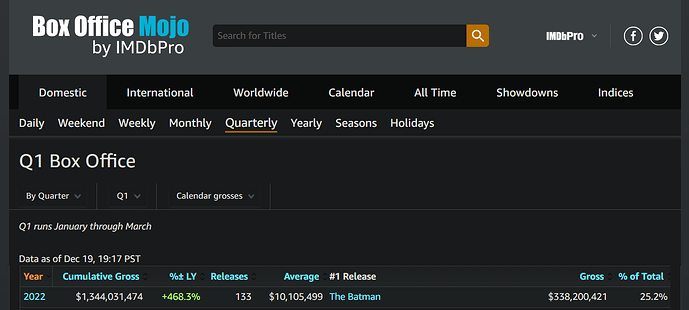

Now that is all Q4 2022. Let’s look towards the next quarter in Q1 2023.

I pulled up some of the bigger movie releases and notices coming out in Q1 2023.

I highlighted the ones I knew of and could get some coverage.

Q1 and Q3 for movie theatres are known to be pretty slow.

Here is a consolidated table of financials for AMC 2018 and 2019.

You see that Q1 and Q3 are noticeably slower and with less attendance than Q2 and Q4. This is a typical industry trend where things slow down. Notice that in pre-pandemic 2018 and 2019 Q1, AMC lost 120mil+ in Q1 2019 and only had 17.7mil profit in Q1 2018.

Movie releases are still slow to come out. Even the CEO stated that industry avg to produce movies takes about 2-3yrs. If movie production started to ramp back up to normal in the later half of Q3 2021, that means movies at the soonest won’t be really hitting the theatres in force until later half of Q3 2023.

So from current box office figures AMC is likely to have burned $200mil+ in Q4 if it were not for APE dilution. 125.9mil APE out of 425mil have been sold already which is nearly 30% of total authorized so far. However, APE is currently trading at around $0.67 per share meaning not much more meaningful money will be able to be raised.

Now Q4 2022 which was hyped to be the best quarter yet falls flat on its face and Q1 2023 is expected to be another slower quarter, you could expect another $200mil+ cash burn quarter unless there is a significant dilution of even more ape. And even at that they would have to sell alot to cover the losses.

Using the avg Q4 2022 cash liquidity that AMC states minus the credit facility which would be 563.8mil approximately, if no APE dilution occurs and AMC incurs another $200mil+ cash burn quarter, their cash on hand would drop to $363.8mil.

Now remember, under AMC’s debt covenants, they need to have a minimum cash liquidity requirement of no less than $100mil. If they breach that debt covenant then all hell could break loose.

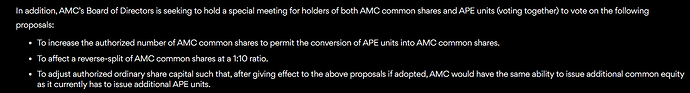

Now at the same time, AMC also announced that they are acquiring 13 of Arclight’s former theatres.

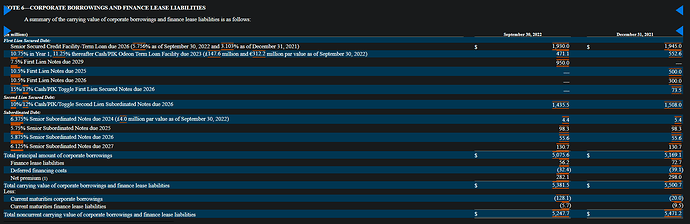

So operational costs will be increasing, AA also announced on Q3 earnings call that CapEx will be increasing because they are installing new laser projectors, Fed is increasing the interest rate and they have some seriously nasty loans at high rates they need to deal with.

Now this still doesn’t count for all the deferred rent and lease payments they got a reprieve from due to the pandemic.

While some hopium/AMC bulls will think that AMC has until 2026 to even worry about their debt of which 3.3bil is due in 2026, I see no way for AMC to even make it out of end of 2023 with some sort of miracle occurring let alone having to raise enough money in 2024/2025 for them to cough up 3.3bil when their debt is due.

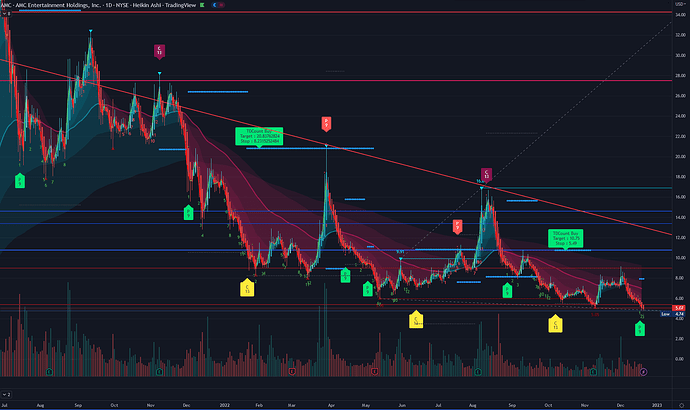

So I think running into Q4/FY2022 earnings for AMC, the writing is already on the wall and the stock price will only continue to go down further as lack of movie releases, the lackluster performance of movies in theatres now all drag down AMC.

AMC credit cards, popcorn in grocery stores/doordash/uber eats, zoom conference rooms in theatres, etc… all these things are for naught.

This is one shit company that expanded waaaay too much starting with initial domino drop when it did the carmike cinemas acquisition and odeon acquisition. They banked too heavily on thinking the movie industry would suddenly explode for years on end without having a sure way to really finance and pay off all that money they were burning.

Meme stock retail traders were able to help pump the stock and helped it stave off initial bankruptcy when the pandemic hit along with some nice rent/tax/lease deferments but as those start to run out and as macro conditions start to change for the worse especially if we turn more heavily into a recession, it does not bode well for movie theatres especially AMC.

So TLDR what was the point of this? My point is that the short thesis for AMC is still well and alive. AMC currently has been bleeding hard lately but I expect a minor bounce back up due to technicals since it seems to be nearing a pretty extremely oversold territory on the daily chart.

A push to $5.5-$6 range is what I would think to load up on Feb puts to ride AMC down to what I think would be the $3.75-$4 range in the upcoming weeks when the news of poor movie showing continue to hit the news.