Current placeholder for discussions on the AMC/APE dividend. Will provide input in a minute, just want to give everyone a place to discuss.

Couple things to note.

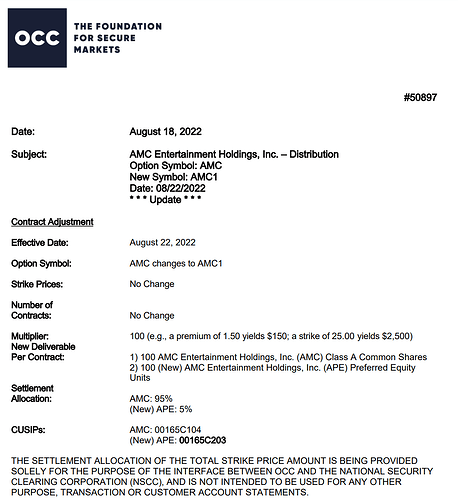

AMC options turned into AMC1. Following is the OCC memo with how the deliverables have changed.

So your AMC options now factor in AMC shares and APE shares.

Essentially for those still unclear about the situation, AMC basically went into a pseudo stock-split/spin-off in a sense.

If you had AMC shares, for each AMC share you had on Friday, you got or will get 1 share of APE.

As a result, AMC decreased in value by the value of APE.

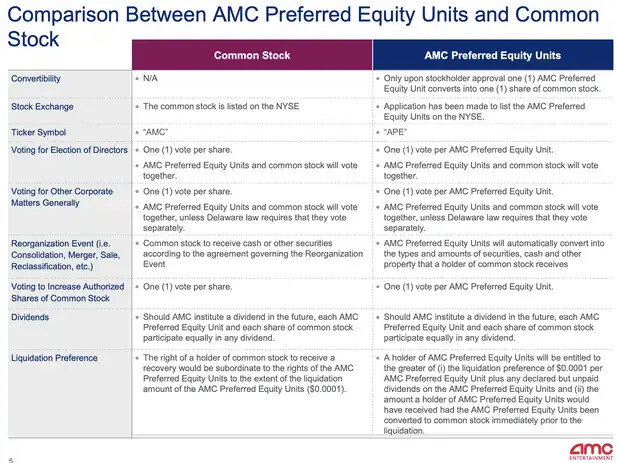

There are minor nuances of this new $APE stock as it is considered a preferred share which has dividend and other implications in case of bankruptcy.

Today APE shares were issued to AMC holders in a special dividend for all stockholders as of August 19 by market close.

The AMC Preferred Equity (APE) is a fundraiser attempt by AMC. They’ve issued 1 share of APE for every share of AMC held, and even AA had believed that the two should open roughly equal to each other. Below is a flier for the implications of the new type of preferred equity.

As it stands many of the non-standard options that were converted aren’t even trading at intrinsic value and some brokers are limiting to sell-to-close only. If anyone is holding these options I would honestly recommend continuing to hold until some of this volatility works itself out and the options market catches back up.

From a puts perspective, the issuance of APE doesn’t suddenly give AMC a 20bn market cap. The theory is that there are three possible outcomes (which is why I hold puts because 2/3 are in my favor):

- The two equalize around $9 by close of trading today

- APE goes bananas and MOASS MOONSHOT and sends AMC down the toilet

- APE has a lukewarm reception and goes down while AMC settles back to where it was last week ($16-20)

Be careful with this one though right now.

I have a conspiracy theory right now that HFS are buying these contracts and getting a steal with $240 for example on contracts that are $500 ITM, getting the shares, and selling to market. They could be doing it slowly to not spook people into spiking puts and why were are seeing these hiccups up then down. This is completely theoretical but it is also why I agree and think we will see that unnatural bleed up on contracts.

Edit ; Has anyone actually tried to buy any contracts today? I’m seeing a lot are not able to buy them currently and only close out. This would double my bet on the above being true.

Quite the trick AA is playing here. Probably one of the biggest gambles this year, if not the biggest.

Pity the fools gung-ho.

In my post above we’re somewhere between bullets 1 and 3. APE didn’t crater at open but it’s current under $7. For AMC to fall more APE will need to rise, or both will have to settle around the $6 mark to get us back to the levels before meme frenzy last week.

As it stands AMC is roughly same value it was on Friday when you add the two equities together which makes sense. Some people are reporting that some brokers won’t have full delivery of APE shares until 8/24 as well, so there could be some more downside over the coming days there which could result in reinvigorated support for the AMC proper equity or the death of both. Time will tell!

I discuss a few theories and address a few theoretical situations in regards to this AMC situation in a video.

This topic was automatically closed 14 days after the last reply. New replies are no longer allowed.