Starting this thread on AMD.

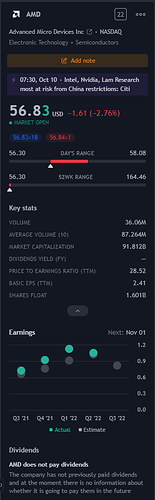

Float 1.601B

No Dividends

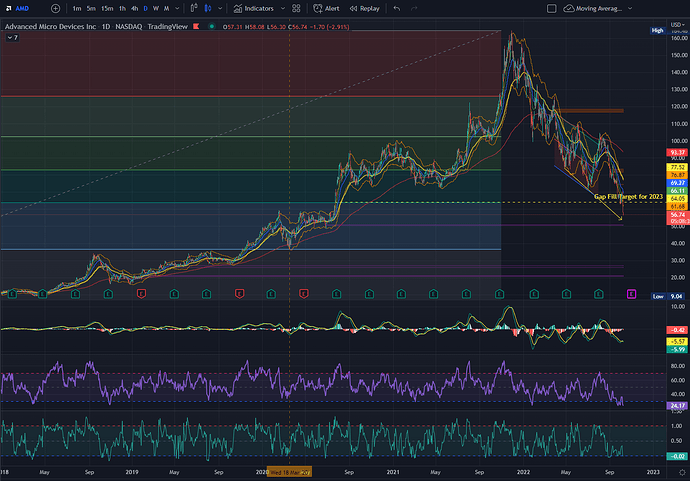

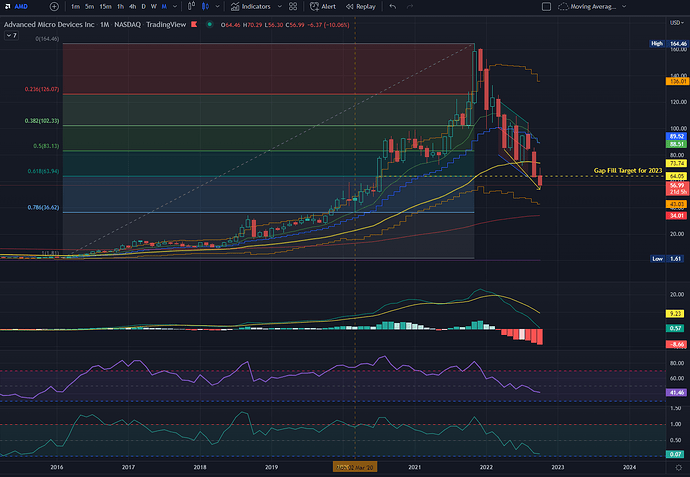

Looking to see if it will fill any of the remaining gaps going all the way back to 2019…

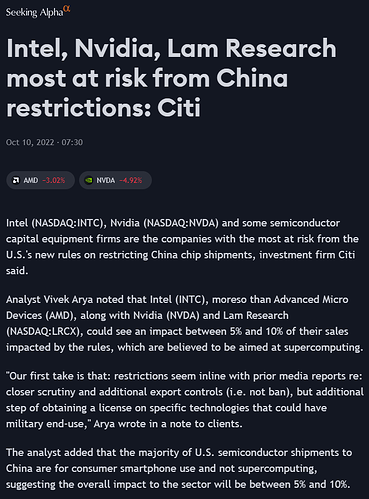

Current News:

" Intel (NASDAQ:INTC), Nvidia (NASDAQ:NVDA) and some semiconductor capital equipment firms are the companies with the most at risk from the U.S.'s new rules on restricting China chip shipments, investment firm Citi said.

Analyst Vivek Arya noted that Intel (INTC), moreso than Advanced Micro Devices (AMD), along with Nvidia (NVDA) and Lam Research (NASDAQ:LRCX), could see an impact between 5% and 10% of their sales impacted by the rules, which are believed to be aimed at supercomputing.

“Our first take is that: restrictions seem inline with prior media reports re: closer scrutiny and additional export controls (i.e. not ban), but additional step of obtaining a license on specific technologies that could have military end-use,” Arya wrote in a note to clients.

The analyst added that the majority of U.S. semiconductor shipments to China are for consumer smartphone use and not supercomputing, suggesting the overall impact to the sector will be between 5% and 10%.

On Friday, Nvidia (NVDA) told Seeking Alpha that the new export controls from the U.S. government would not have a “material impact” on its business.

The analyst added that although the additional step is a verification tool to prove the chips are not being used for military purposes and not an outright ban, it is still likely to impact certain areas of logic chips, NAND memory and DRAM chips.

Arya also noted that some U.S. chip makers, including Micron (MU) and Western Digital (WDC), could “benefit incrementally” as they take advantage due to the restrictions placed upon Chinese memory chip maker Yangtze Memory Technologies.

Earlier this month, Bank of America reiterated its buy rating on Nvidia (NVDA) and several other cloud-related semiconductor companies, noting the group is likely to still benefit from increased cloud computing spending."