This thread is for general discussion about AMD stock.

AMD earnings were stellar and the stock is incredibly beaten down. This morning we saw #amd trade more bearish than SPY, the reasoning for this was likely profit taking off the earnings beat. I collected a call position at the consolidation (next week) and I’m looking to hold it through the FED decision and potentially ride the market adding it’s correct valuation back in. While most of the PT adjustments were downgrades, AMD is still trading at a significant discount to the average.

This is reminiscent of #nvda earnings last year when SPY actually brought the stock down after record earnings and after the market had gotten the news it was looking for, #nvda proceeded to run from $190 to around $230.

AMD will be releasing a refresh to their current 6000 series of cards on May 10. It’s a known event so priced in, but on quick glance I didn’t see an official announcement from AMD. Maybe something to watch out for this week.

These latest announcements are really exciting.

It’s like they trashed Moore’s Law in this single presentation alone.

I’m personally looking forward to even more bullish sentiment for AMD in the coming months.

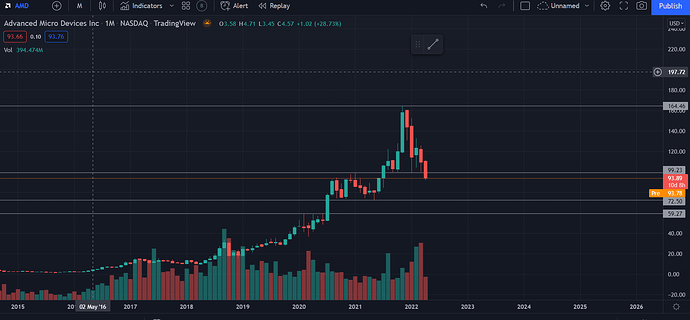

AMD earnings confirmed for Aug. 2nd. After TSM earnings beat might be a good time to pick up a position on a pull back to the mid/high 70s for a potential run up until then

Saw this news article stating, “AMD passes Intel in market cap” after Intel’s horrible earnings & outlook. However with AMD coming up with the sentiment be the same, or will people find more value in AMD?

AMD plans to announce its next gen CPUs on 8/29.

AMD event is at 7 PM ET today (30m). Will be watching their charts and the event for any leads on trading tomorrow.

Link

https://twitter.com/AMDRyzen/status/1559534273350230017

hell of a reaction great dd me

https://www.youtube.com/watch?v=WcH_7xsYtUk full recording

in all honesty i thought their announcements were pretty great, but doesn’t mean they weren’t priced in. will need to observe tomorrow to see if they move more than the market does.

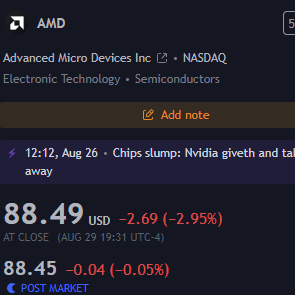

This occurred after hours today but basically the US has halted Chip sales to China which has caused both AMD and NVDA to fall about 3.8% and 6.6% respectively. This would hamper both NVDA and AMD’s sales and business in China, hence the bearish moves. SPY took it harshly and fell another 0.5% after hours. AMD close to that 80 support and may look for puts tomorrow based on market sentiment.

https://www.reuters.com/technology/amd-says-us-told-it-stop-shipping-top-ai-chip-china-2022-08-31/

Nice add thank you! I had previously looked at shares a while ago in SOXL and held some. However been drilling given its make up of almost 8% of NVDA. It’s a cheaper side etf if anyone interested