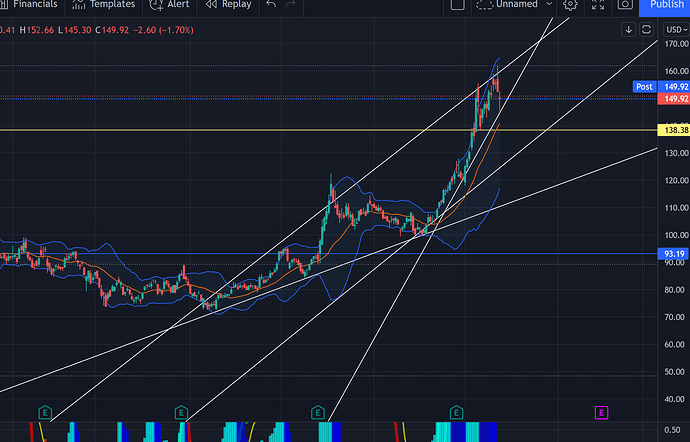

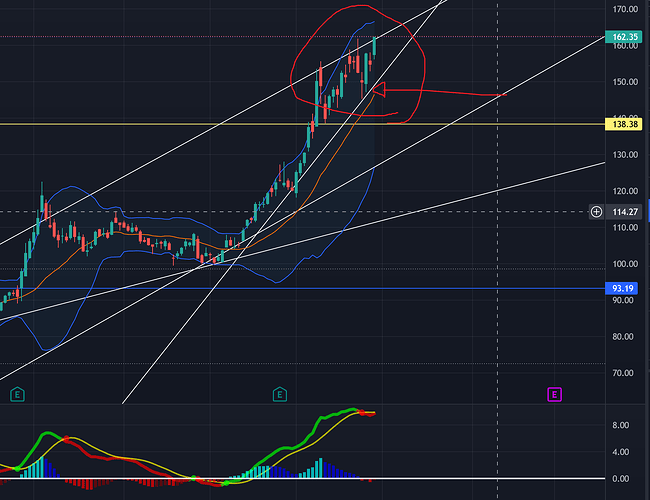

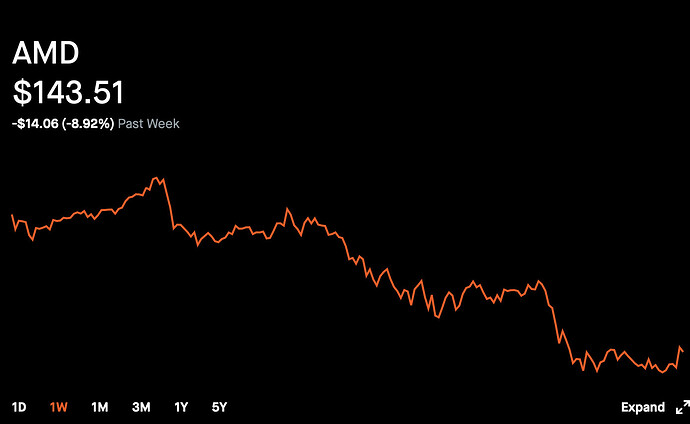

The target audience for this is those considering to put their longer term investment in something that may be more profitable than something like SP500. It is obvious that this is a higher risk for higher reward play.

Here are the main points for AMD.

- EV/EBITDA

AMD: 51.28

NVDA: 85.40

INTC: 5.86

AMD is undervalued compared to NVDA. This is not a huge secret, but it is worth mentioning that while NVDA may hold the crown, AMD is right behind them in product positioning and eager to take the crown back at any moment NVDA shows weakness. GPU market is incredibly low on the supply side due to the boom in cryptomining/supply shortages and it bears mentioning that every GPU gets sold out regardless of brand.

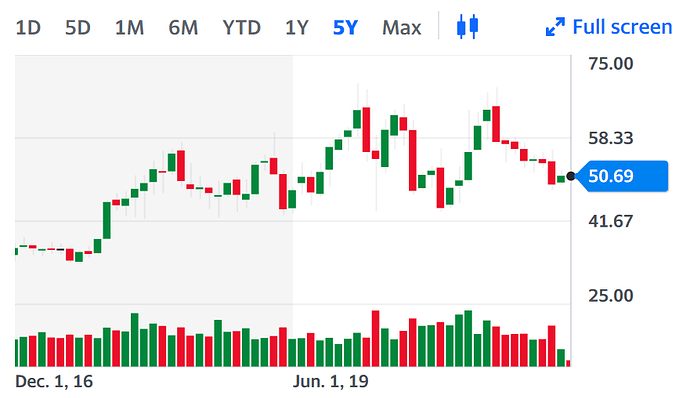

On the face value, INTC looks like it’s way undervalued. However, looking at the price history, you can tell INTC has been a dividend focused stock for last 5 yrs.

-

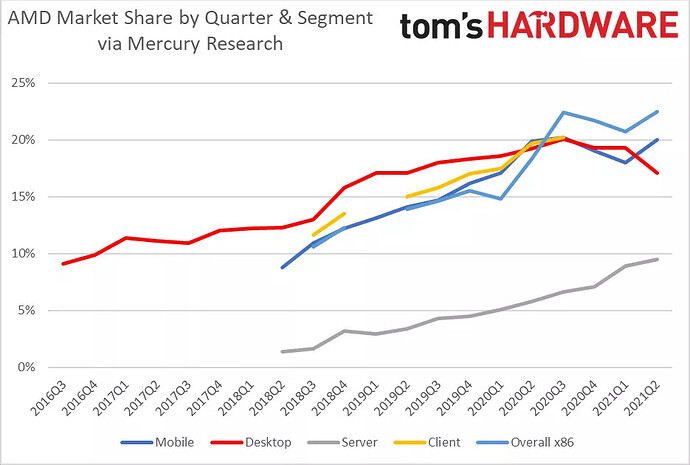

Intel is lagging in innovation and let AMD gain on them in 5 yrs

Due to myriad of challenges posed by mismanagement/fab delays/competitions popping up, Intel really let itself slide in the last 5 yrs while others caught up and managed to outdo Intel in terms of price/perf. AMD released Zen arch back in 2017 and AAPL has really up’d their M1 line enough to wean off x86. -

AMD is poised to take Intel’s server market share. Latest Meta deal is only going to be in AMD’s favor.

-

NVDA ARM acquisition still under EU competition investigation

https://www.cnbc.com/2021/10/27/nvidias-takeover-of-arm-faces-in-depth-investigation-in-europe.html

The probe, announced by the Commission on Wednesday, is the latest setback for the chip companies who have already said the deal is unlikely to be completed before the initial deadline of March 2022.

This merger may or may not happen in 2022, but all we know is that the merger is still very far away, and NVDA is in no shape or form to release a competitive product in the CPU segment.

- Practically owns console market (minus Switch)

It bears mentioning both latest PS, XBOX use AMD APU.

Xbox, PCs and gaming drive AMD and Microsoft's revenues | PCWorld

Revenue in AMD’s Enterprise, Embedded and Semi-Custom segment revenue was $1.28 billion, up 176 percent year over year. The vast majority of that came from the game consoles that use AMD’s embedded chips: the Sony PlayStation 5, and Microsoft Xbox Series S and X.

- Apple is king of perf/power but vertical integration means no direct competition

Apple’s M1 Max line of chips are no short of impressive in the computing department. It peaked in perf/power, and only thing holding it back is price and vertical integration forcing you to buy into Apple’s ecosystem. Competition from Apple may come way later and there will be loads of buyers hesitant to make the switch. - GPUs out of stock everywhere (almost)

The supply shortage means that GPUs are selling like hotcakes. Just cursory research leads to most GPUs barring the most expensive tier and ebay scalps are unavailable to buy. CEO Dr. Lisa Su has stated that supply shortage will continue until 2024 but will continually improve over time.

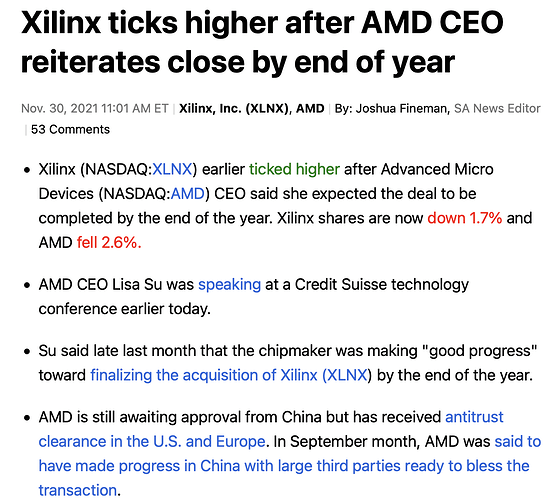

AMD Video Cards - NowInStock.net - Xilinx acquisition means huge amalgation of chip design talents

If you’ve paid attention in acq/merger in semiconductors, you would’ve known about Intel acquiring Altera. I assume AMD acquiring Xilinx is very similar. For Intel, since acquiring in 2015, their PSG division sales grew, but margin went down. All in all, not a bad change overall.

Disclaimer I own AMD shares and leaps. Play at your own risk and adjust position. I am not responsible for your entry/exit points.