Damn good play. The drop in pre market was from the permit and housing number crap. Then the market went up too and earning decent so congrats. Way safer and massive profit off one call. Nice.

Going to test this out on TJX maybe if we start to see any kind of positive movement out of the market heading into open.

Small EPS beat and initial reaction is down has some OI on the 70c so may try to get something cheap from someone selling off.

Also LOW had good numbers so will watch that as well

Lowes was an EPS beat, but a big revenue miss… Be careful.

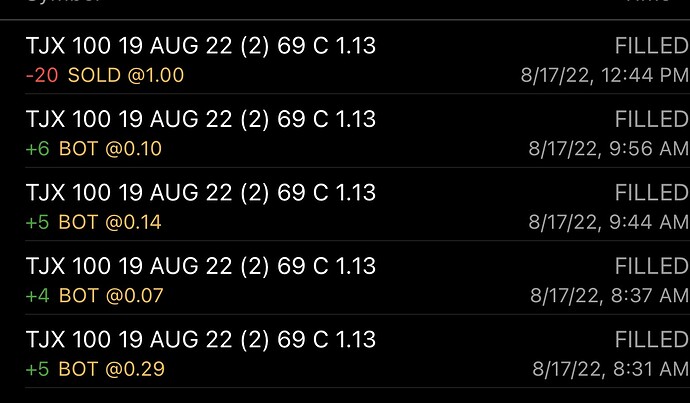

Played TJX as discussed. Ended up missing the drop at open on the fill prices as discussed above on first fill. Second one pretty much hit spot on. Ended up with 20 69c @ .15. Sold them before FOMC to lock in big profits for 1.00.

As JB mentioned it’s important to watch for one’s that become divergent from the market it took a bit but TJX did just that and had continued upward movement. Going to keep watching for the premarket releases that don’t move like they seem they should for the rebounds.

another amazing play. I wish I would have saw this sooner for playing today. All my money was in on SPY but this was even better than that. Nice work again!!

so this is where I should’ve put the target play ![]()

Just to put disclaimer in here.

-

There is definitely something to the getting the fills at open. I know we typically like to wait to see what market does however on these post earnings plays the IV drops so fast at open the not ITM strikes drop fast and more times than not people are scrambling to get whatever they can. I have been setting my limit buy under what the strike closed at the day before but also have been trying to get fill fast. The times on the screen shots are central time so with in 10 minutes of open I had been filled at .19 and .07 the underlying at this point was moving upward however I believe most that we’re hoping for a strong movement on direction or the other are simply unloading most likely at market sells. And likely not paying attention much to what ticker is doing.

-

I try to pick a strike that may have some OI on it and also not some way OTM strike especially on FDs. I typically look back at chart to see what a price it has traded at before recently. Or even can look ATM if it’s has a decent drop but good ER.

Also I’ve only tried this the 3 times mentioned above so by no means is this guaranteed however on TJX today I could have been out of the play in less than 20 minutes up 75-80 percent.

Another example of the premarket earnings that I did not get into was AMD had EPS beat pre market and dropped from previous close then proceeded to have a 5 percent day.

So for the stocks with earnings in the morning, here are the ones worth watching and the expected move according to options.ai

Once they are published we’ll try to discuss in TF and/or VC before open to see which we think have potential and formulate a game plan.

Updated with earnings data:

| Ticker | Expected Move | EPS | Revenue | Guidance |

|---|---|---|---|---|

| KSS | 8.60% | 1.11 v 1.08 | 4.09B v 3.85B | DOWN |

| BJ | 6.30% | 1.06 v 0.82 | 5.10B v 4.56B | UP |

| CSIQ | 5.80% | 1.07 v 0.70 | 2.31B v 2.23B | UP |

| NTES | 4.40% | 1.05 v 0.94 | 3.46B | ? |

| SPTN | 9.10% | 0.66 v 0.58 | ? | ? |

| TPR | 6.20% | 0.78 v 0.78 | 1.62B v 1.64B | DOWN |

| EL | 4.40% | -0.20 | 2.18M | ? |

| NICE | 3.70% | 1.86 v 1.79 | 530.58M v 523.60M | NEUTRAL |

| MSGS | 2.80% | 1.11 v -0.31 | 175.2M v 93.5M | ? |

Updated chart above with EPS/Revenue/Guidance data…

Also took a quick look at PM chart movement and gave % up/down this morning:

KSS - Beat, lowered guidance, -7.25%

BJ - Beat, raised guidance, +6% (pretty close to ATH)

CSIQ - Beat, raised guidance, +6.45%

NTES - Beat, +2.65%

SPTN - Beat, No PM activity

TPR - Slight Miss, -1.1%

EL - Lowered Guidance, -1.42%

NICE - Beat, +2.18%

From AH:

WOLF - Beat, +21.45%

KEYS - Beat, +4.32%

CSCO - Beat, +5.12%

KSS fits theory I’ve been watching the lowered guidance hurts. Also though it’s pretty beat already and could get some recovery since their numbers weren’t thst bad.

So KSS support around 30 or 31 then 24. It’s pretty low already and they did beat everything but lowered guidance. Maybe see if it pulls up a bit before entering puts.

BJ best everything and raised guidance but is at all time high. 74 and 75 resistance for that and 72 support. Will need to watch spy and see if it can push higher. Not sure yet on my play.

I am going to start a spreadsheet, need to review the bot callouts on these plays, and see how many are successful. Could use some help but we need to test these earning plays, how the bot calls them, and what % we are getting or the win rate. So far it has been about 6 fairly good size wins over this last week and 1 bad loss for me on ILMN. I will try and start this tonight but could use others help. Need to compare the chart during the day with Mimir callouts on when you might want to add or sell etc. Hopefully this will help us and Conq with his development of it too. We also had the bots start late because I didnt pick scalp vs a slower swing trade so we need to trade ideas to test. Message me if want to help.

This topic was automatically closed 30 days after the last reply. New replies are no longer allowed.