So I was pretty vocal about my analysis of the earnings plays for RH, LULU & CHWY.

- RH - I was supremely bearish and thought this stock is overvalued and should dump.

- LULU - I was supremely bearish and thought this stock is overvalued and should dump. This was also my pick for most overalued.

- CHWY - I was least bearish on this play and figured it was close to bottom.

So let’s take a look at the outcomes:

Outcomes

RH

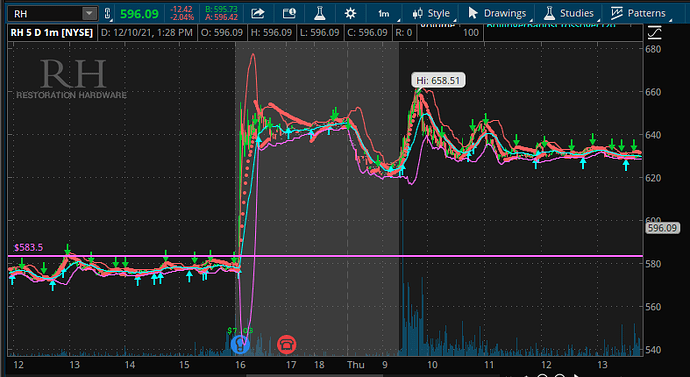

Reaction: RH spiked immediately upon release of earnings. This purchase happened so fast that there is almost no way the entirety of the earnings results were processed making the run up almost certainty simply off a reading of the release headlines. RH released that they had “record” revenue and they beat EPS. The general headlines also stated that they raised guidance as well.

The Call: Unfortunately I was not on the call for the other two, however, I can speak on RH and use some past experiences for examples instead later on The call in RH’s case was abysmal. The CEO was unprofessional, full of himself and only offered information pertaining to his lavish lifestyle. Analysts were shut down numerous times when pressing for material information about the state of the company but eventual were able to get the concession that they were “behind on growth”.

The Aftermath:

Analysts mostly gave RH upgrades and had a general bullish sentiment. However, if we look at the chart we can see a different story on earnings reception which is a continued sharp downtrend that effectively erases all the gains off the earnings release. Directionally it would appear, @Navi and I were right about the underlying fundamentals of their earnings and this stock, which is 96% held by institutions has been selling off in quick fashion despite a SPY rally (indicating true selling pressure).

LULU

Reaction: Now again out the gate we’re met with a bullish jump off the news headlines that LULU had beaten EPS and Revenue as well as raised their guidance.

The Call: While I wasn’t on this call, I’m aware that some bearish aspects to the report were uncovered in the call and a selloff occurred as a result.

The Aftermath: LULU has struggled to form upward momentum most of the day, but has traded surprisingly flat.

CHWY

Reaction: CHWY dropped hard right off the bat. The company announced that they missed EPS estimates by a significant amount and that revenue was just “inline” with guidance. They also announced weaker guidance than expected.

The Call: Unfortunately wasn’t on this one either, but it doesn’t seem to have affected the stock price at all pas the initial drop.

The Aftermath: CHWY spiked a bit at open this AM, but has traded mostly sideways along with LULU. It’s possibly that what downward momentum they would’ve had is being offset by SPY, but that’s of course just a guess.

Thoughts

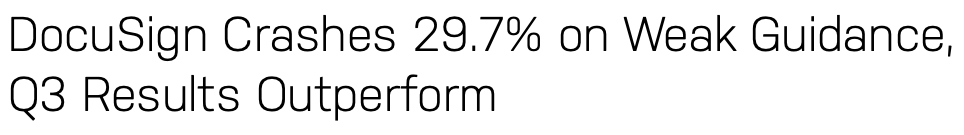

So looking at these plays individually, it’s clear what I got wrong about judging the earnings reactions. In the case of RH, we always expected them to beat their guidance and do well. The whisper indicated this and we never doubted it. But to our assumption, this didn’t matter and we pointed to DOCU several times as justification for this. However, we were missing a key factor that while DOCU did beat earnings… they lowered guidance:

RH reacted the way it did because the three parts of earnings all came up bullish. EPS, Revenue & Guidance. If we look to LULU and CHWY, we see the same thing. LULU came up bullish as well so the stock reacted in kind because that’s all the algos are reading. They’re not doing complex NLP on the whole thing in 10 seconds, they’re grabbing figures and trading directionally based on them. Then, like in LULU’s case, when the details are revealed in the call, further trading decisions are made which resulted in the sell off. Looking at CHWY, it’s clear why it dropped, earnings were atrocious making it, despite objectively being the least overvalued, the farthest drop we saw.

Conclusions

I think we have a better understanding of what is going on when playing earnings and what parts are important. There are three stages to earnings that should be played as three COMPLETELY separate plays to maximize profitability.

-

Pre-Earnings Sentiment - No matter what you think about the earnings potential of the company, the pre-earnings sentiment is by far the easiest part to play. We knew that RH was bullish sentiment days before the report and taking calls and playing that direction would’ve netted serious gains on IV alone. Even though we were bearish on the stock due to fundamentals, the play was calls during this phase. Post Phase Strat: Cut before the earnings call. Sentiment isn’t always dead on and you’ll want to capture profit because IV crush generally erases it all.

-

Earnings Release - We’re in the Matrix on this one. As far as I can tell, the three main points of earnings dominate the reaction here and your profitability. Playing the earnings release requires determining if a company will beat EPS, beat Revenue and raise Guidance and those three things are weighted far above P/E and other fundamentals. The reasoning is that the traders trading on those things aren’t likely selling right when earnings are released. They’re listening to the call, they’re making decisions. Overall this remains the riskiest and toughest part to play. Post Phase Strat: Gambles only as close to the money as you can afford. Taking positions super early is preferred to bake in some immunity to IV but if you get it wrong directionally as we did with RH it’s all meaningless. The best strat here might be to take your gamble position near open on day of release to beat out the last minute IV push and escape most of the danger of being directionally wrong. This is not the main part to play if you want to be a profitable trader, it’s the before and after.

-

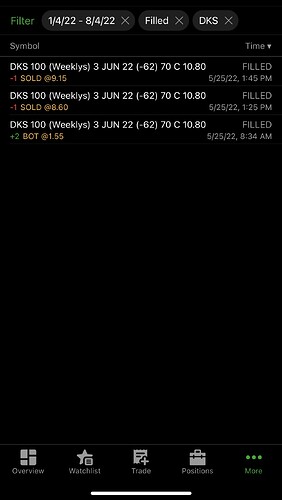

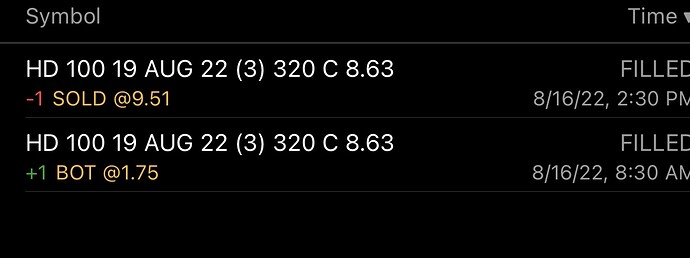

Post Earnings Aftermath - Now this is where it gets interesting. Remember those predictions we made? Well, they’re right. Just not about the earnings sentiment, but we absolutely nailed the valuation concerns and state of the companies. After the dust settled with RH, the selloff from the institutional investors has begun. The stock went from a peak of $658 to a recent low of $582. For reference, you could’ve bought a 12/17 $600p for RH for $480 just after earnings. That put was worth $2,200 earlier today, a gain of 358%. But we weren’t just right about that, we’ve been consistently right about this and have been missing out of these gains almost constantly because we get in our feelings about playing phase 2. If we look to WISH, we were absolutely right there as well and the gains if we had taken puts AFTER the call even though it jumped were in the thousands of percent. TTCF was the same story. After the jump it traded sideways for a bit, but eventually came down all the same from a peak of $19 to a recent low of $14.80. Phase Strat: Play the real underlying fundamentals and sentiment directionally right after earnings. Take expirations that give you room and just let the money come in. We supremely missed most all of these plays and I think more if we look back simply by playing them incorrectly and getting what is important in what parts wrong.

To conclude, we need to look to the market forces driving each phase to predict it’s movement.

- Pre-Earnings Sentiment is driven by the market and retail. We can use tools like stock twits and our own two eyes (to look at the chart) to find the direction and play it knowing we intend to cut before the release.

- Earnings Release is driven by algo trading in the larger part. We can use tools like earnings whispers and other forms of DD to gauge where the company might stand when it comes specifically to EPS, Revenue & Guidance with the latter part requiring a degree of fundamental analysis.

- Post Earnings Aftermath is driven by institutions making decisions based on the grand scheme and the market. The previous phases don’t matter at all here, all that matters is how the market is going to receive the news. RH JUMPED almost $100 in value and has come crashing back down because the underlying fundamentals just aren’t there. This is an extremely profitable phase that we should be focusing on more, because it’s only in this phase that we have all the information we need to trade effectively.

I think if we work more on pushing the community to play the phases independently and stop getting so emotionally attached to the second phase, we’ll all be much better off (and wealthier) for it.