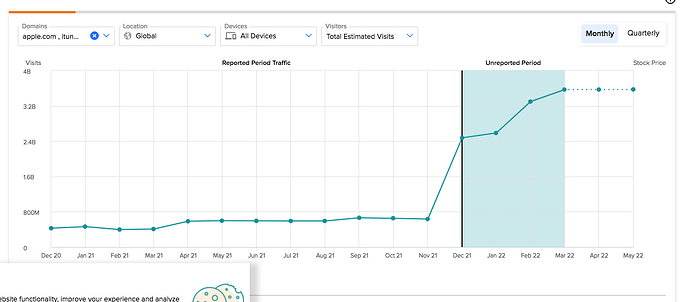

Starting a thread for apple. With amd and nvidia having lower expectations and corsair having a massive loss im thinking if i need to hedge aapl earnings or just not hold anything. Apple is holding up the narket right now and last earnings they did not give any guidance at all. Also the proposition of apple hardware as a service and the entire discretionary vs essentials just gets me worried. So in short im trying to find a stock to place puts on that will crash if apple does poorly and will go flat if apple does great. After some discussion right now its lululemon and verizon. I can post some charts and numbers later to show their relationship with each other. If I dont like anythjng i might just dissolve everything for that earnings.

Previous earnings synopsis

interesting points from a glance

q4 2021 excerpt: 2:04 pm : 1/3 of revenue in 2021 came from emerging markets.

China’s economy is slowing down and they are increasing their savings rate due to all the Real Estate bubble pop there.

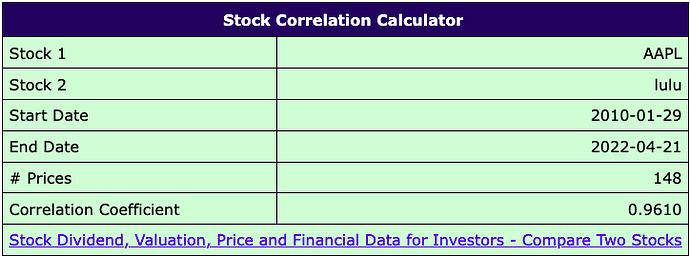

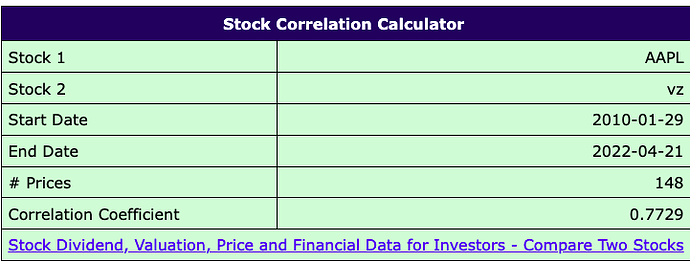

here is calculation on relationship of apple and lulu and vz from

https://www.buyupside.com/alphavantagelive/stockcorrelationcomputeavmonth.php?symbol1=AAPL&symbol2=vz&start_month=01&start_year=2010&end_month=04&end_year=2022&submit=Calculate+Coefficient

I’m very much surprised that we didn’t see any rally for AAPL going into ER as there has been for previous sessions.

Man, you’re consistent with these ER threads. Nice.

I just sold my AAPL strangle for 10% gain, yesterday.

Should IV drop even further, I’ll enter again.