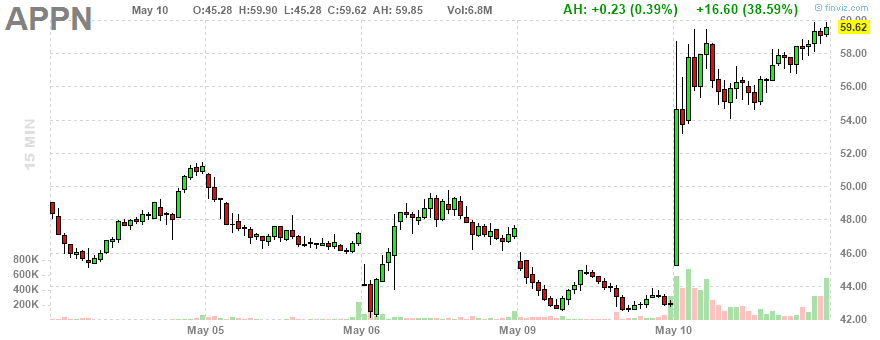

This happened today:

Early Tuesday, the Circuit Court for Fairfax County, Virginia ruled against Pegasystems (PEGA) and order the company to pay Appian (APPN) more than $2 billion in damages for misappropriating trade secrets in violation of the Virginia Computer Crimes Act. The court found Pegasystems (PEGA) guilty of hiring an employee of a government contractor to work at Appian (APPN) and provide Pegasystems (PEGA) with access to Appian (APPN) software.

Some more details on PEGA being daft:

At issue was Appian (APPN) charging Pegasystems (PEGA) with hiring an employee of a government contractor to give Pegasystems (PEGA) access to Appian (APPN) software. In a statement, Appian (APPN) said that Pegasystems (PEGA) “instructed its third-party contracting service to recruit someone who was not ‘loyal’ to Appian (APPN)” to gather the company’s technological information.

Appian (APPN) said the contractor “worked as a developer in the Appian software under a government contract, [and] violated his employer’s code of conduct and his employer’s agreement with Appian by providing access to an Appian competitor.”

$2B is an amazing windfall for APPN. It was a $2.5B company before today’s 40% hike, had revenue of ~$400M, net income of ~($100M), and FCF of ($70M). Like all other tech companies living off of free money, its stock price had been cut ~75% from $150 to $42ish before this spike. $2B is amazing in this context, right?

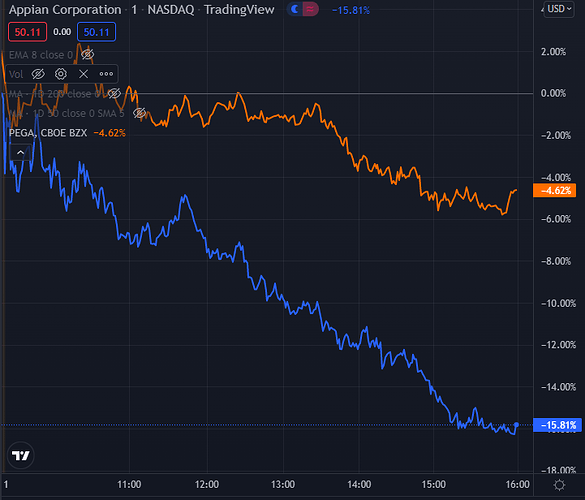

Problem is I don’t see how PEGA can pay this. It’s a 5.6B company with $1.2B revenue and net income of ($80M) and FCF of $32M. It’s a sustainable company but still took a ~50% haircut in price from ATH $143 to $65 before the verdict.

PEGA hasn’t appealed yet, but I imagine they would. At least one analyst is saying the case is so airtight that they will never be acquitted, but $2B is unsustainable. Their balance sheet can’t take on this debt. Could do massive dilution… but their FCF would mean they will need to keep paying for this for generations. Which, of course, they won’t. Options left are, they will either: a) get acquired, or b) declare bankruptcy.

How do we play this?

On the APPN side, there is no way they will get $2B. I think. Since the current price spike is based on this, shorting APPN therefore seems reasonable.

On the PEGA side, given that no form of relief will likely come soon, hard to see an upside, but also hard to see a strong downside unless they don’t appeal. So leaving playing PEGA itself for now as puts are expensive, but will monitor closely.

What do folks think? Any other arb opportunities here to play?