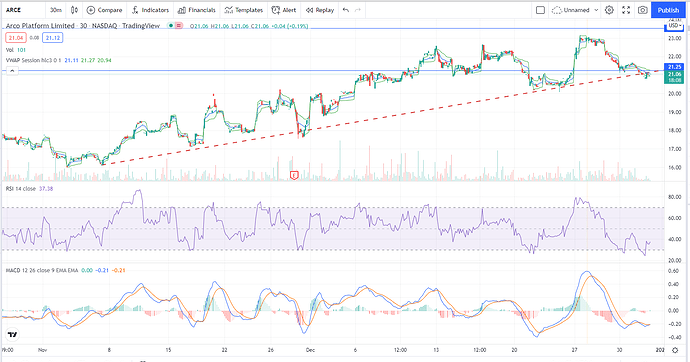

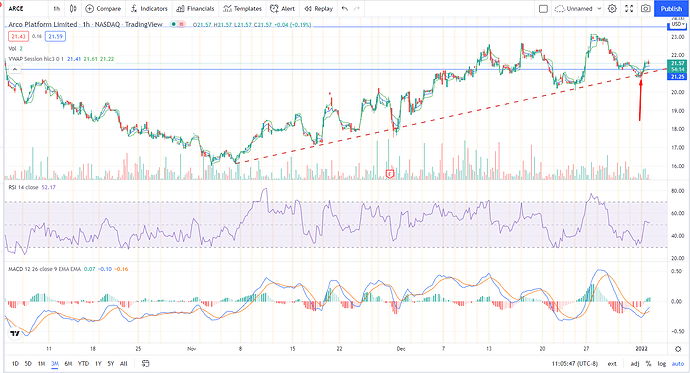

ARCE - A New Squeeze Pattern Revealed by VSTA

All credit to /u/Joeskunk for this DD from Reddit. Link at bottom. tl;dr ARCE is set up similarly to VSTA, which recently had a major upwards move and is similarly poised for price action.

VSTA is an incredible case study that deserves further scrutiny.

It is a small cap that in the span of a week doubled, from 2.3 to reaching over 5 on Friday. What’s more interesting, it apparently happened without any social media buzz nor company events. Just a low key > 100% move. So what happened?

What follows is my interpretation - and based on that - what I consider a near identical set-up:

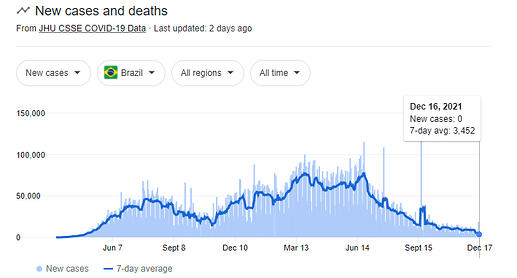

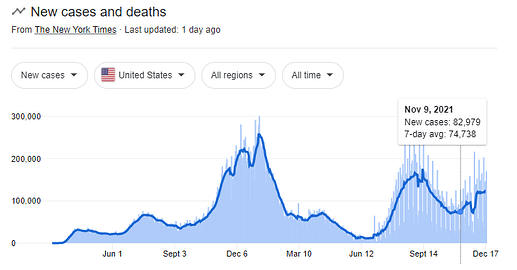

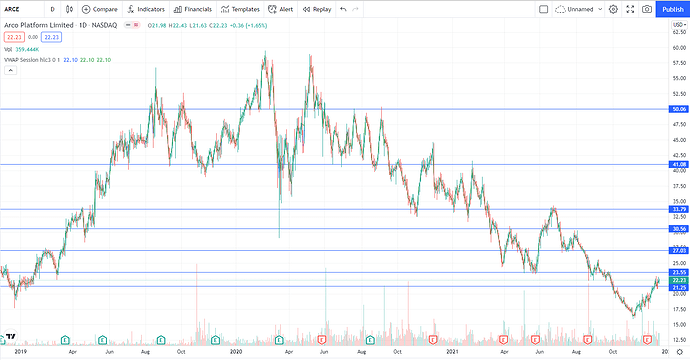

- Brazilian stocks and this company in particular sold off hard this year. Arguably greatly oversold. With QQQ up 30% YTD as of few weeks ago. There is simply no reason to fuck with emerging market technology. Conventional wisdom was big brains trade of the year was US tech, and that’s where traders piled in.

You can see here EWZ (Brazil ETF) trades as almost an inverse to QQQ.

- Suddenly, roughly two weeks ago taper in unambiguously on the table. The QQQ trade show signs of unwinding, and many of the high-flying tech companies start to get serious haircuts.

Traders shift their mind-set from – now that the QQQ momentum trade is unwinding – what make sense on a valuation basis? We can actually see that when SPY, QQQ, IWM were showing their greatest weakness, that is when the VSTA rally began. Clear sign of rotation.

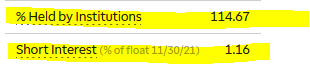

- Here is where things get interesting. Per TD Ameritrade, which I believe to be generally accurate – the institutional ownership is extremely high. When I corroborate with Morningstar, I also get very high institutional ownership, but not 114% VSTA - Vasta Platform Ltd Class A Ownership | Morningstar

What is the source for the discrepancy, and which is most accurate? I don’t know.

Forensic endeavors to figure out precise floats rarely turn provide a definitive answer.

Instead, the proof is found in the pudding – namely, how the stock actually reacts to volume.

Let’s use broad strokes to back down to generalizations: (a) there is some indication that VTSA might have an unusual float situation, and (b) pre-rotation there is practically no volume. I mean some days there is like 1k shares traded.

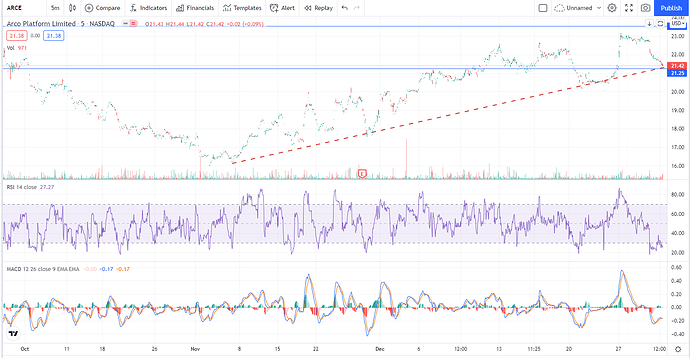

What seems to happen is that as traders suddenly wanted to establish a position – in this low vol, oversold, and potentially tight float – the price started to racquet up very rapidly. We see this occurring from Dec 3 to Dec 9.

My impression is there is nothing that algo’s like more than some low float positive momentum. And collectively, the algos were unleashed on Dec 10. It saw ~10m in vol that day.

To re-iterate. This was a stock that typically sees ~1k in volume over the past months. And it suddenly sees ~10m in vol seemingly out of nowhere.

IMO, this is a phenomenon worth sitting up and noticing. Whatever clusterfuck of conditions that gave rise to this, probably is going to give rise to it again.

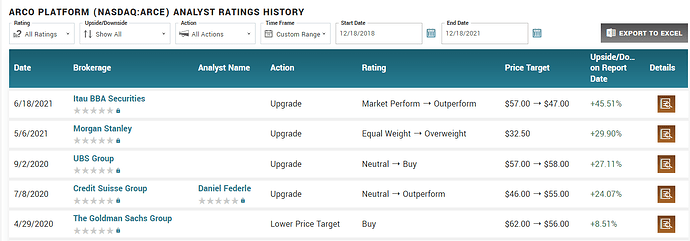

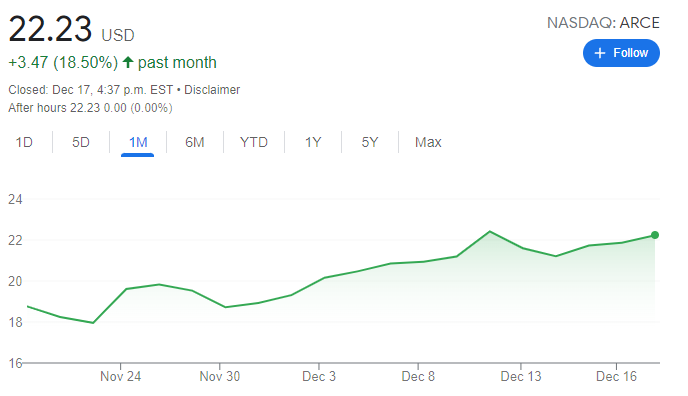

Meet ARCE – identical in pretty much every respect to VSTA:

(a) oversold Brazilian company

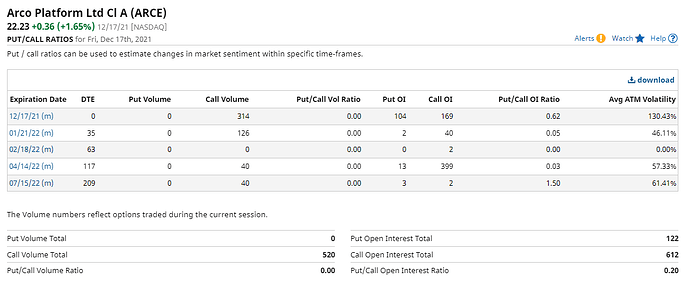

(b) very low volume

(c) seemingly insanely tight float due to institutional ownership. https://www.morningstar.com/stocks/xnas/arce/quote

(d) demonstrated strength as a rotation target as SPY, QQQ, and IWM flagged

Bottom line, I think (a) there is a compelling story for this one on a valuation basis, and (b) there are high odds this takes a trip to funky town in the short-term as it encounters a similar dynamic to VSTA.

All credit to /u/JoeSkunk on reddit https://old.reddit.com/r/CandyAssets/comments/rfovve/arce_a_new_squeeze_pattern_revealed_by_vsta/

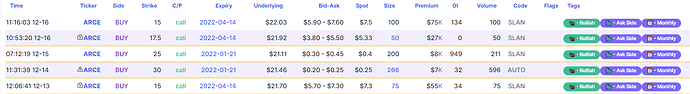

The Jan 21 $22.5s are $1.10, and $0.88 for the $25s.

Going to pick some of these up during the week.

I’m going to look for an entry sometime this week and pick up Jan 22.5s