Feel free to call me retarded and poke out all the holes in this play because this is kinda for shits and giggles anyways, but still something I’m looking at.

I’ve been watching ARKK for the last couple days because it looks like it’s about to capitulate and go to the critical support of $0, but strangely, we saw a huge volume green day.

Looking at volume, we were going on increasing volume every day, showing signs of capitulation. Even when SPY had huge pumps intraday, ARKK barely moved up and sold off even harder. Seeing -10% was the regular with higher volume. Then today, we saw the biggest volume we’ve ever seen on ARKK. It pumped hard as fuck in the morning and held green really well even while SPY and the other indices were making new lows. I was interested why and started to look at short interest.

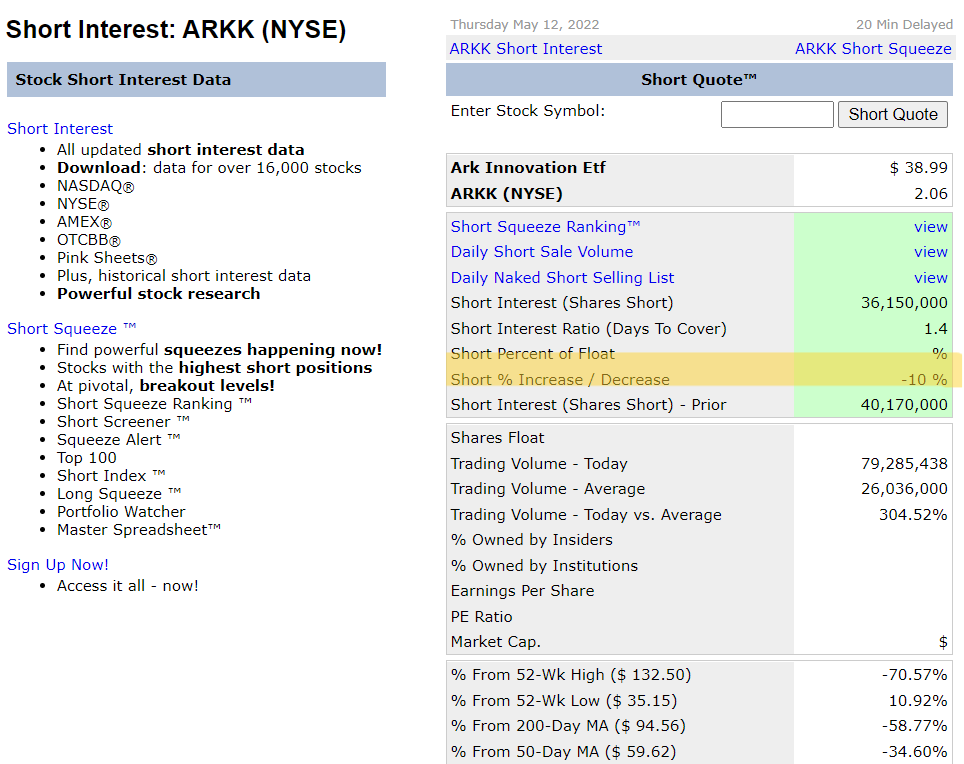

Looking at the short interest, obviously there’s a ton and no one is bullish on this stock. But strangely, we saw shorts covering today. 10% of shorts covered today for some reason. Comparing this to SPY:

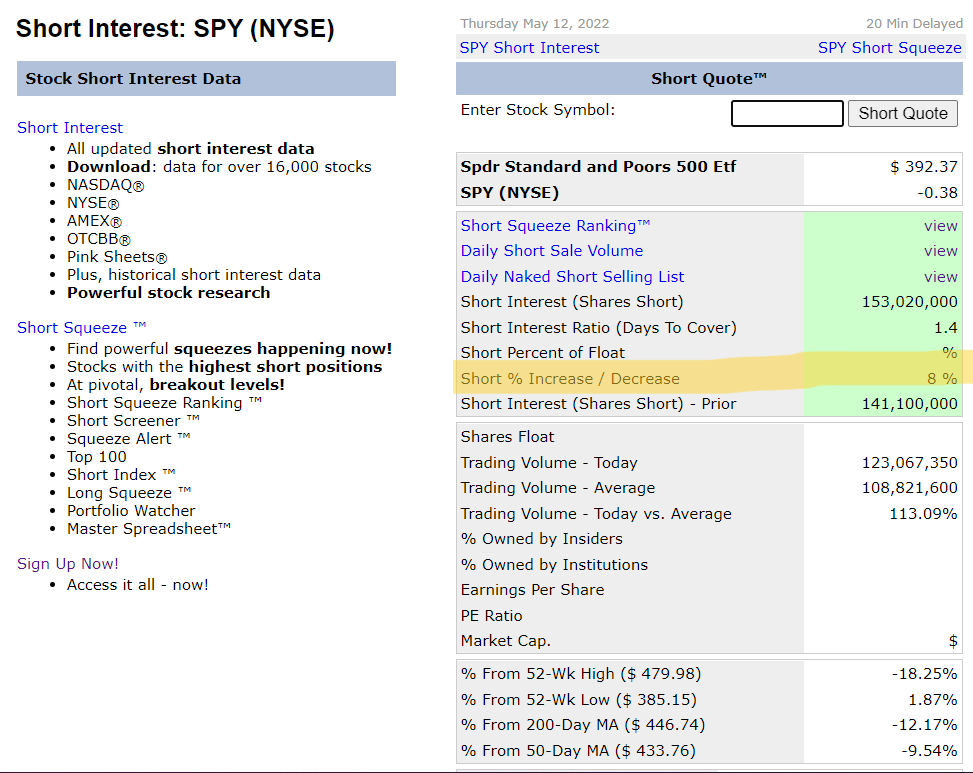

SPY’s short interest grew 8% today. It’s weird seeing a shit ass stock like ARKK’s shorts reduce while SPY goes up. I can’t find data on the % of float ARKK is shorted, but even then a short squeeze can cause huge pumps like we’ve been seeing on SPY.

One thing I think can trigger a cascade of shorts covering on ARKK is if it breaks $40. This can happen by another morning covering of shorts or if the markets start to go up like I predict soon.

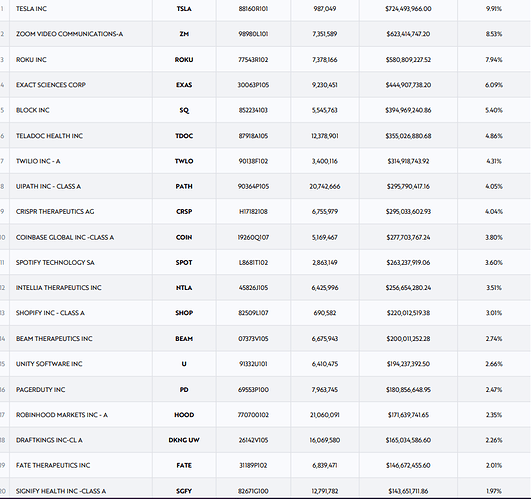

Looking at the ARKK holdings, TSLA obviously holds the most weight. If TSLA can have its retard pump, it could cause ARKK to rise and cause a domino effect of shorts covering.

Looking at Tesla, it held up the 700 support and last time it was this low, we saw an impulsive rally to 900. Looking at the volume as well, it seems like 700 is a huge support bounce zone.

Now do I actually think this squeeze will happen? Probably not because of how shitty the stock is and why shorts would want to cover when they know ARKK will go down anyways. But one thing that makes me believe that this can happen is because I think markets will have a bear market rally soon, causing the holdings of ARKK to pump as well, pushing the newer shorts underwater. Also because capitulation is expected, many are piling onto shorts even at these prices. This countertrend rally from a capitulation move can cause shorts to cover who were expecting capitulation. I’m not expecting a GME type squeeze, more like a squeeze to like $50-70.

Feel free to rail my ass and call me retarded. I’m not bullish on ARKK and I’m going to buy puts at a later time when I think ARKK doesn’t have a chance to retard rally and esp when I think markets will rally soon.