my stop loss to 6.74 for INDO. Market just died a bit and not great for scalping shares right now <@&895135662867619930>

out of my DAL call leg, bought in with limit fill at 75 cents sold at 90. Put leg purchased for 21 and is currently a sad sad man. Will hold this one for a little longer. Averaged down for one more put at .19. Still probably not a bad play to grab a couple for the low cost and see how this pans out.

146 is a p btw

CPI was potentially leaked. Watch for a dramatic recovery if proven false or major downside if the numbers are correct.

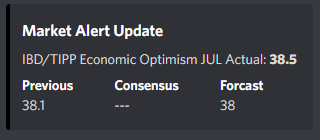

Downside could’ve also been due to this figure that was released at 10AM but it’s doubtful considering it doesn’t seem like a negative.

Hey so there are a couple of things that make me pretty sure the leak was fake. Small things. Energy is capitalized in the fake release, not capitalized in the prior press releases. The prior releases also refer to tables, not charts. And the last sentence has a mis-print. It says “The food index increased 11.7 percent for the 12 months ending May”. Not June.

sold my SPY puts there. Looking for re-entry if market rallies after fud is confirmed and market re-adjusts.

stopped out of aapl puts for a swole pp sized loss

bounce on GOEV from that 4 support callout. If I entered I would probably sell here unless it breaks that 4.30 then retests 4.50 Quick scalps for me today <@&895135662867619930>

Entered an AFRM $19 Put FD. It’s on the rise and not the best entry, but seems like it has better potential for green before EOW than my $15 Put.

Want to remention AFRM again before tomorrow. Lower highs today and likely to move down much further if today leads Bearish. If you do play, I’d recommend a monthly and the 20 strike

my SPY puts there are I like money. May take 1-4 new ones if we get any push up for tomorrow’s numbers but I like profit <@&895135662867619930>

17% on that RIVN put from the bot tweet, selling now. I bought and got a good fill when it was near HOD. So even if that tweet didn’t do what I thought, SPY and market dropped it. AKA perfect opportunity to take profit. <@&895135662867619930>

earlier today - SPY channel trading probably until tomorrow and good support from 380 and 382 and resistance at 384 and 386/387. So watch 382 and 380 now. <@&895135662867619930>

Sold my August 388 Spy puts for 20% About $400 profit I held these for a week, going to add to my AFRM position with bearish expectations for tomorrow.

Testing123

thinking CPI comes in under expectation or this is all mostly priced in. We also tapped the 3800 side which I had marked. Grabbing some lotto calls AH. This is a huge gamble so please blame Phil if the trade goes wrong.

going to bed tonight holding 14 x 7/15 SPY 375p. Blame swole if this goes wrong.

Went with SPY strangle 384c at 1.50 and 377p at 1.45

Holding SPY 374P TSLA 600P UVXY 15C