Short Term Oppurtunities

Astra just completed a static burn for their next rocket, which will be its first to deliver a commercial payload to orbit. It will be launching a smallsat for NASA. The static burn completion means Astra now has to wait for its launch license to set a date, which will very likely happen soon.

This is Chris Kemp, Astra’s CEO

ASTR is currently trading just under $5.00 and has been dropping ever since its last successful demo launch on November 20th

Underbought on the RSI, every time it was even close to this stock rallied soon after.

With this downtrend tightening up, its ready for a big move. We have it, the NASA launch.

If the launch is successful, we could see a flood of new launch contracts coming in for Astra from various communications, observation, and mapping companies as well as governments. This means the launch could potentially be more than just a sell the news event this time around.

This was resting at 7-9 with an unproven product, and is now at 4.88 with commercial launches and a bright future ahead.

The Long Term Play and Why It’s Undervalued

ASTR is undervalued. It has a great product and a smart team that could disrupt the small-sat industry once they get up and running.

Astra’s edge over competitors

Astra is competing mainly with Rocketlab and other smallsat-focused rocket companies. Its first edge over competitors is its price to launch. Lets compare two similar rockets from Astra and Rocketlab. Rocketlab’s Electron costs around 7.5 million dollars to launch , Astra’s Rocket 3? Less than half that (2-3.5M). One of the biggest factors to launching payloads into space has always been the price, and Astra beats most of its competitors here. Another edge Astra has is it’s launch frequency. They plan to launch 55 payloads into space in 2023, bringing in over 200M in revenue for the company. Astra wants to eventually have “daily space delivery” in 2025 according to their CEO. Here's what investors should know about rocket builder Astra as it prepares to go public

No other rocket company is currently able to launch that frequently

Astra also has a slight advantage over SpaceX’s rideshare program, which is a service offered by SpaceX to launch hundreds of smallsats on a Falcon 9 for a similar price (as low as 1m according to SpaceX). However, this service does not provide access to specific orbits that customers may desire, it only provides three. Astra can launch to almost any orbit near earth.

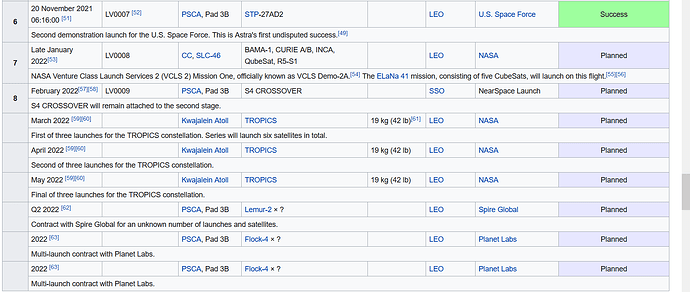

It’s already getting pretty busy at Astra this year

Can ASTR turn a profit?

It will be able to, but most likely not a large one this year. Astra is still in R&D phase and it has only had one successful launch and zero commercial launches yet.

My Positions:

50 Shares at 4.88

-2/7/22

Sold 50 shares of ASTR at 5.65

#diamondhands

#diamondhands