This is about AT&T, ticker $T, because recently there were:

- Recent major news,

- Unusual options flow that may be linked with the news,

- A big potential reversal/gap up on the chart, and

- Recent bullish analyst price targets.

However, this is tagged with Requests because I am very inexperienced with telecom companies and telecom technology, and as such, I don’t fully grasp the significance of 5G and the recent news. Hoping someone who is more knowledgable can fill the gaps.

Disclaimer: This is by no means a complete DD for “I’m buying $T and here’s why.” This is more like “$T looks interesting. Here’s what I just dug up. Anyone know more?”

Let’s start.

[size=4]What is AT&T?[/size]

AT&T Inc. is an American multinational conglomerate holding company that is Delaware-registered but headquartered at Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company and the largest provider of mobile telephone services in the U.S. Wikipedia

Most recently, they (and Verizon, a separate telecom company) are preparing to rollout the 5G network, which is a data service that is faster than 4G? I think that’s what this is? Apparently you can download a music album in 2 seconds or something. I read this page on the AT&T website and didn’t fully grasp the ‘wow’ factor.

[size=4]Recent News[/size]

Apparently, the 5G rollout has an impact on aviation services, so airline companies have been fighting against AT&T and Verizon to delay their rollout. However, interestingly over the course of about 24 hours, AT&T and Verizon rejected the US government’s request to delay the 5G rollout and then changed their mind. AT&T and Verizon had previously already agreed to delay the rollout by a month to January 5, and are now agreeing to delay for another two weeks to January 19. See below headlines:

[size=4]Unusual Options Flow[/size]

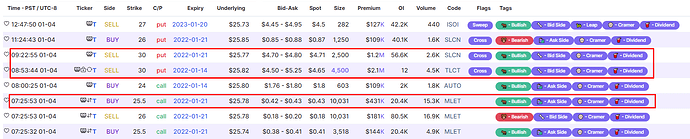

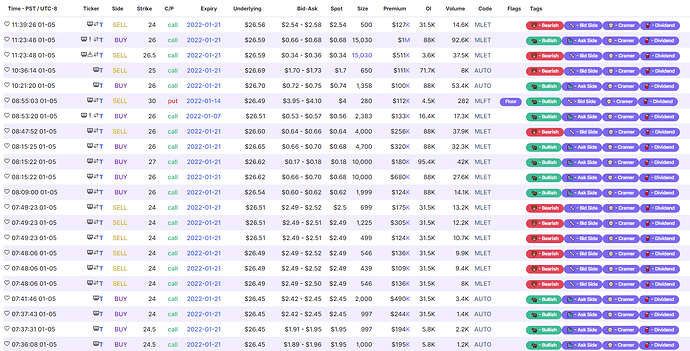

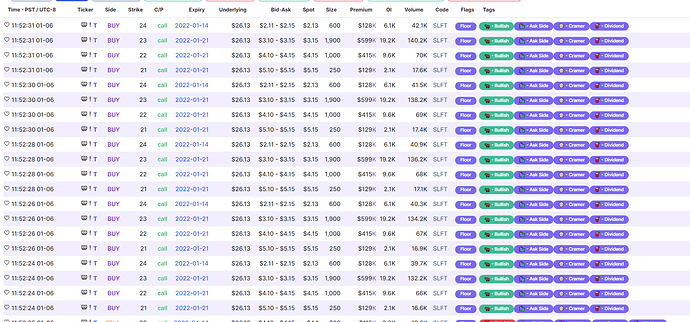

Sorting with a premium filter of >$100k, I spotted unusual bullish flow today for $T this month:

The $2.1M bet on 01/14 30p is a confirmed “Sell to Open” as defined by UW with the lock symbol under the Ticker column. The stock closed at $25.64 today. Essentially this means that this person is receiving a premium to agree to buy shares at $30 per share by January 14 which represents a 17% upside from current price.

There was a similar size transaction made yesterday for sold 01/21 26p, although it is unclear if this was a Sell to Close to Sell to Open as it lacks the ‘lock’ symbol. In fact it could even be a Buy and not a Sell, as we recently learned that UW Buy/Sell tags are based on how the option filled at the bid/ask, and UW algo just tries its best to tag accurately.

Scrolling down the past few days with a filter of >$100k, I could not find any similar Options Trades with such a size and short expiration. Therefore, I suspect these big short-dated flows are related to the recent news.

[size=4]Big Reversal for the Stock[/size]

Prior to the March 2020 COVID drop, $T was trading at >$37, and was easily at least a $32 stock from 2012 to 2020. See below for the chart since 2010:

Here’s the chart showing the COVID drop and sideways trading between $28 and $32:

Recently, $T did a double bottom at $22 and now looks like it is gapping up.

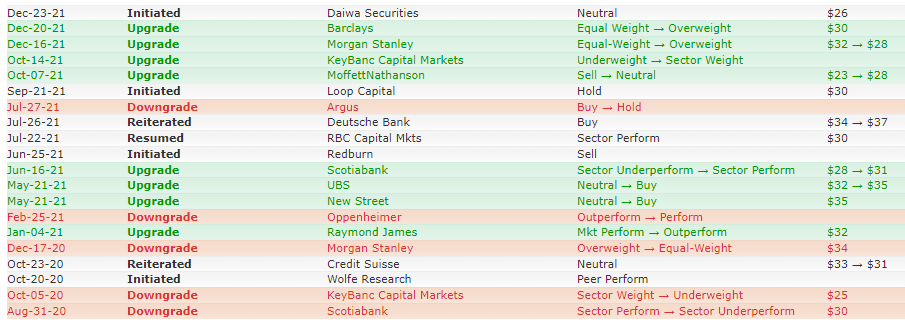

[size=4]Analyst Price Targets[/size]

This is pretty self explanatory but basically these PTs are easily ranging from $28 to $32.

[size=4]Options[/size]

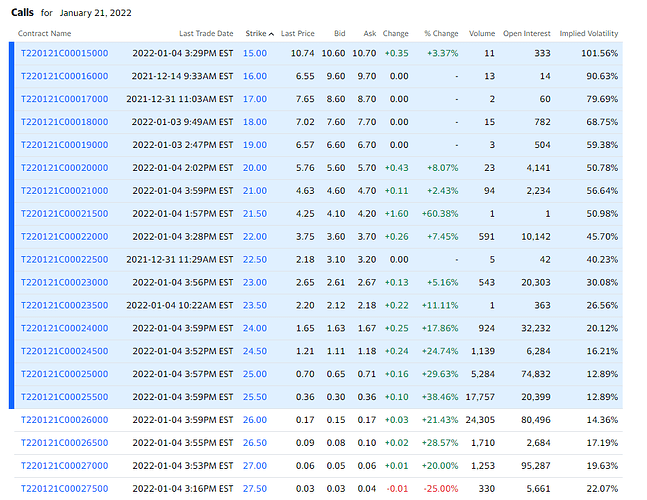

Bonus section. As you can see, on a +0.21 (0.83%) move for the stock today, the 01/21 options moved significantly at around 20 to 38% due to the insanely low IV. If $T actually gaps right back up to $28-$32 this month as seemingly betted on by the unusual whale, which corresponds with the analyst PTs, we could see some insane gains on the options. I was thinking 01/21 26c or 27c or 02/18 for more time.

The put/call OI ratio is 0.66 which is not particularly amazing, but there is quite the options activity for January 21, with a whopping 122,895 OI for the 30 strike. However, on the flipside, there is a whopping 101,200 OI on the 25p.