Being pumped hard and back in the $4 range. Don’t really know much about this stock other than it gets pumped hard from time to time. Anyone have any thoughts on this?

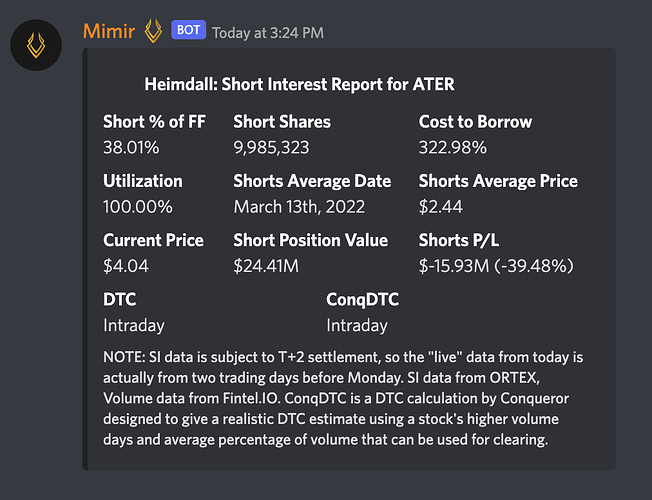

This stock was a server wide gamma play end of last year. The SI is very interesting right now. Need the gamma and short experts to weigh in.

My math may be off, but assuming the 22k OI goes ITM it would be 10% of free float and another 10% including shorts. I think the float is too massive to gamma ramp with a 40m free float.

I believe the float is closer to 26M, subtracting insider shares, institutionally-owned, and those locked up on debt payment deals and such.

That intraday on DTC is basically a non-starter. On the chart it recently had a 145M volume day, could’ve cleared that position 14 times over. I agree with @ItsMrUnknown that the float is likely too large to sustain a gamma with today’s retail buy volume.

I’m probably at least a few days late with this question, but would it be a good idea to average down on enough shares to start selling CCs, or just hope this thing squeezes enough to get me out of a bad position?

as Conq and others already posted, there’s not enough interest on the OI for a gamma squeeze and the percentage of short shares is traded several times over in daily volume so short squeeze is also unlikely. essentially relying on the retail/reddit pump for price action. i would defer to more experienced traders whether to average down and sell CCs

Hard to believe retail has this kind of stamina. It’s kind of relentless. Is it retail + covering? Also, Ortex has DTC as 1.65 (down from 2+ yesterday). Why does the Valhalla bot say Intraday? Can anyone explain the mechanics of what’s happening to a noob?

I believe intraday just means there is enough daily volume and the stock is liquid enough that theoretically if all the shorts wanted to exit their positions they could do it within a day. I believe Mimir uses Ortex data so idk what that discrepancy is about.

This kinda reminds me of the run-up BKKT had a month or two ago heading into earnings. Everyone was like this bagheld trash is done at $5, but then it went to $6 and people thought it was done, then it went to $7, and so on until $8.50 or so.

Except BKKT had a potential catalyst (their earnings report) and this doesn’t. So on surface level I’m not sure what could be driving this movement other than SI and some covering like you said. If anyone has any theories please chime in.

From what I’ve learned about this stock the last couple days, I would bet my life this doesn’t squeeze. Might go up a few more dollars, but I agree with the people above that the float is too big for a meaningful squeeze. I think the only challenge is finding the right timing for put entry.

Or do a bear credit spread. Without a catalyst you can more or less predict what legs you use to be otm to get full credit.

Thanks for the response. Will check out BKKT to see what that run up was like

Seems a lot of stocks that pumped the previous week experienced a significant drop in SI over the weekend. I guess this accounts for ortex’s T+3, which accounts for up to Wednesday I’m assuming. However, ATER’s SI remained constant, utilization and CTB high, and shares available to borrow low. I’m assuming this indicates there hasn’t been any significant covering yet.

DTC remains at around 0.15 over the last two weeks, suggesting that even if shorts did cover it wouldn’t exactly explode the share price.

So that’s what it means? Or does it imply they could cover they entire position with intraday volume and its unlikely to be a multiday move.

Do we have an exact float? How can shorts cover intraday?

Because daily volume is anywhere from 5x to 15x the total short shares.

ATER up 16% during today’s session, sentiment seems mostly positive on reddit and twitter. Could be another pump or a start of something.

Aters calls and commons both starting to move again, Pretty close to the bottom with earnings coming this could potentially pump, trying to enter some 4$ calls