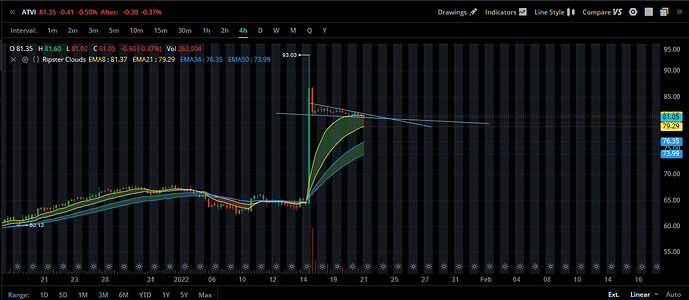

ATVI shot up the other day on news about MSFT buying Activision. It’s been on a complete downtrend since and it’s formed a bear flag. There have been rumors on twitter and websites that the deal may fall through. If this does happen, ATVI could fall back to 60’s, making the lotto play a 5k-8k% gainer. 1/28 80 puts are trading for .22 to .25 a contract. MSFT also has earnings coming up on 1/25. That could help this play gain traction. Reminder… this is a lotto play,

About the deal falling through - have the rumors mentioned why and how soon it would be public knowledge?

MSFT has until 4/2023 to complete the deal. If they don’t, MSFT needs to shell out 2.5Billion dollars before 1/2023 or 3Billion dollars after 4/2023. Shareholders and regulators haven’t voted yet. The bounce on the price was the rumor of MSFT acquiring ATVI.

NVDA’s deal with ARM is a prime example of a big acquiring. The deal is STILL getting talked about after 2 years. There are cries of a monopoly from the public already, ATVI has not seen the best reviews with their customer base, and lawsuits and probes coming their way due to this deal.

I’m playing this as a lotto per the chart. But these rumors are definitely going to fuel the fire to make the price go down.

Does the rumor mill have guesses on why this deal might fall through? That might advise us on timeline.

If it is because of antitrust (unlikely), it’ll take along, long, loooooong while because it’s the govt at the other end.

If it’s because the metaverse synergy (or lack therefore), the only folks who’d object are MSFT shareholders as ATVI ones must have sighed in relief when this happened. Nadella’s star is still shining very bright, and this doesn’t sound totally absurd, so this is unlikely.

Could it be because the deal no longer makes financial sense? This, I think, is most likely. MSFT offered $95/share, near ATH, valuing them at $69B. Every high-PE tech story is going through a massive correction. ATVI was clearly desperate already, accepting a price below ATH. I think MSFT could make a claim that ATVI is just not worth $69B anymore. Could pin it on the market, on stuff that comes out of due diligence, or something else they can claim as material.

$3B is not a high price to pay if ATVI is deemed to be worth much less than $69B. Much better than taking a $50B write-off in a few years. And if they claim materiality, they could just yank the plug, or go to court and settle for much less.

These things take time though, and with the first breakup fee milestone being a year away, we’ll probably see this deal wallow for a while before anyone pulls any plugs. So I’d consider the next earnings to be an extremely risky timeline to play this, and even perhaps the next earnings.

Total guesstimate, but I’d bet on Q4 as when it is likely the deal will fall through, if it does. Gives MSFT enough time to assess ATVI, with a few more earnings seasons under their belt, and management isn’t embarrassed from looking like they rushed into a metaverse play.

1/28 seems way too soon for me to play a rumor like this, when the purchase was just announced last week.

Seems like the merger will be looked at and scrutinized hard. Workplace sentiment also looks to be a big pr challenge/nightmare for Microsoft.

I think it might be worth a long enough put. The big buy so far hasn’t changed anything about ATVI and likely the deal would change to value them lower. The point is this is the highest offer on hand. If the deal changes, it’ll likely be for acquisition for less.

I think Microsoft will be using about 50% of their cash on hand for this Activision deal. And with a complete need to restructure, I think it would be quite some time before they see a decent return on their investment.

I feel like MSFT earnings won’t be as good as they are slated to be. If we see MSFT pull back, ATVI is going to pull back to 70.

I don’t like this play. First off we need to discount any TA, there are much bigger factors at play here.

Secondly, I don’t see this falling through just because Microsoft will see weakness in their share price or we think they overpaid. Microsoft has over $130B cash on hand, they can easily pay for this deal. This isn’t even the biggest gaming deal we’ve seen. If anything, due to the weakness in ATVI, Microsoft managed to get a steal on this company. ATVI owns IP that defined PC gaming for a generation. If anyone can turn them around and create a gaming powerhouse again, it’s Microsoft under Satya’s leadership.

Thirdly, while we may see a pullback in the market for larger macro trends, I think large tech companies will weather the storm and eventually come out on top. You won’t see Microsoft going away any time soon, and if we do, we’ll have much bigger problems to worry.

Short term I expect to see weakness in MSFT (due to market, not their ATVI or other moves), but extremely bullish on them long-term.

I think there is a small chance this deal falls through if the market plummets, but if that is the thesis, I think there are better plays in the market with less associated risks. This play, especially with the suggested entry, screams YOLO play.

I think the bigger argument as to why this could fail is that they will be under a lot of scrutiny from the FTC & Biden administration. The Biden administration is increasing their focus on cracking down on anticompetitive mergers. I don’t know if they are related, but the news article on this topic just so happened to release the same time as the merger news. The opposing argument is that this is vertical integration rather than horizontal integration of the companies. The merger does need to be approved by the board, but I could see the FTC making an example of Microsoft. Should this be the case, we would need to figure out the timeline in which the FTC board would approve/disapprove the merger.

well, in the title it says “lotto”… not a yolo… a lotto.

Please disregard my previous comment, it was more appropriate for TF not the forums.

I still think 1/28 is way too soon to play this.

If you rely on regulatory policy to be the catalyst for failure, you will need to extend your timeframe for this play. That is a notoriously slow process and is influenced by politics as much as industrial economic and antitrust policy.

The below research gives an overview of rate of acquisition success amongst large conglomerates. An interesting note was “ out of the 78 proposed mergers from 2015 to 2019 in which the smaller firm was valued at more than $10 billion, the federal government attempted to block a grand total of only five on antitrust grounds and successfully stopped just three of them.”

congrats if you took the play. It’s now under 80 and the 80puts were selling for .23-.25 and are now sitting at .80. If it stays below 80, it will see 70.

I do not see this sitting at $70 by your expiry, what is your thesis for this? It will take a long time to bleed or MSFT has to come out and say they are reevaluating the deal. This has barely moved when markets are down big time. We may be seeing one of the largest one day drops in SPY since the start of COVID, but ATVI has barely moved 2%.

I still believe your thesis is wrong and recommend cashing out if your OTM puts are profitable. You can be wrong and make money, you can be right and lose money.

I’m playing the chart. The news would just be a bonus to the drop.

I have a suspicion that the only way this deal falls through is if regulators block it.

Just joined the forum, I played a 79P lotto for 0.40 on Wednesday for $ATVI because of the sentiment with closing below 79, (important level was 78.7) on the 1H candle and breaking 50MA. Cashed out today at 1.16. Now that it rallied EOD I myself wouldn’t consider buying puts until it closes below 78.7 next week.

congrats. Thats an amazing win